North Dakota Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Have you found yourself in a circumstance where you require documentation for both business or personal purposes almost every day.

There is a multitude of legal document templates accessible online, but locating versions you can rely on is challenging.

US Legal Forms provides an extensive array of template documents, including the North Dakota Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, designed to comply with state and federal regulations.

Once you obtain the correct document, click Purchase now.

Select the pricing plan you want, complete the necessary information to create your account, and proceed to purchase your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the North Dakota Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you require and ensure it is for the correct jurisdiction/region.

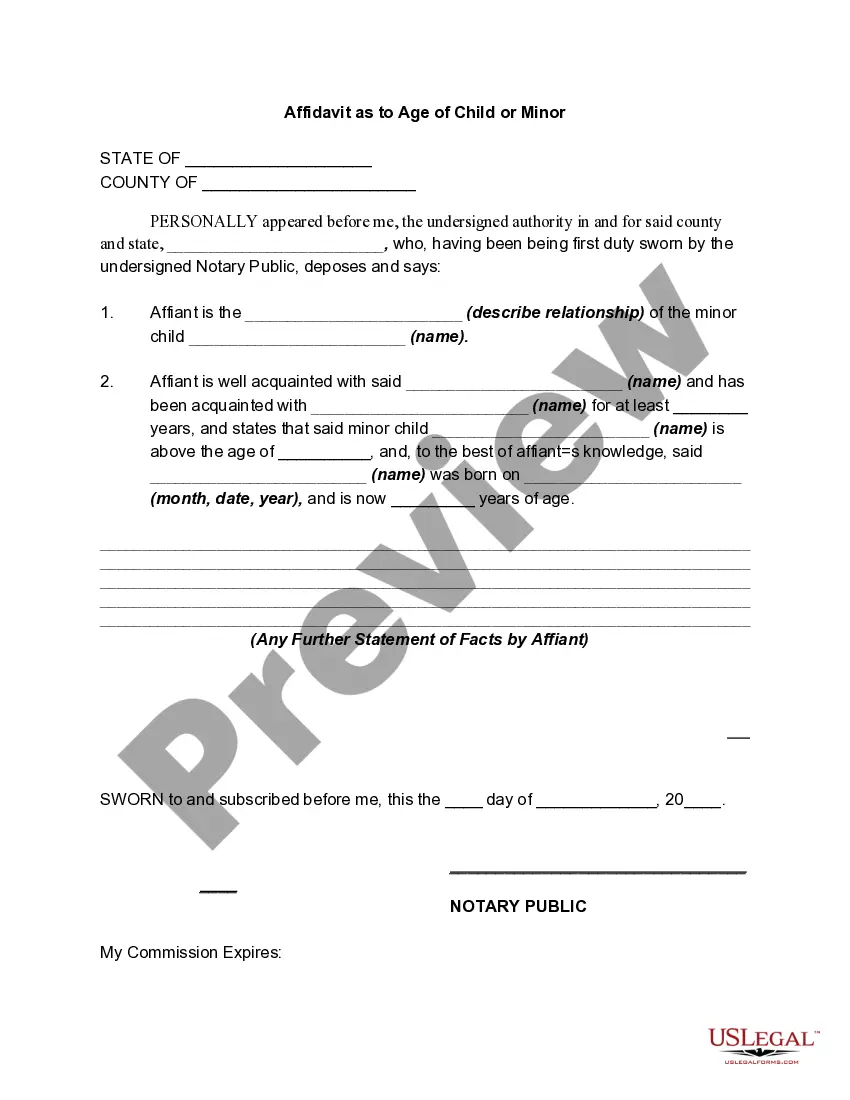

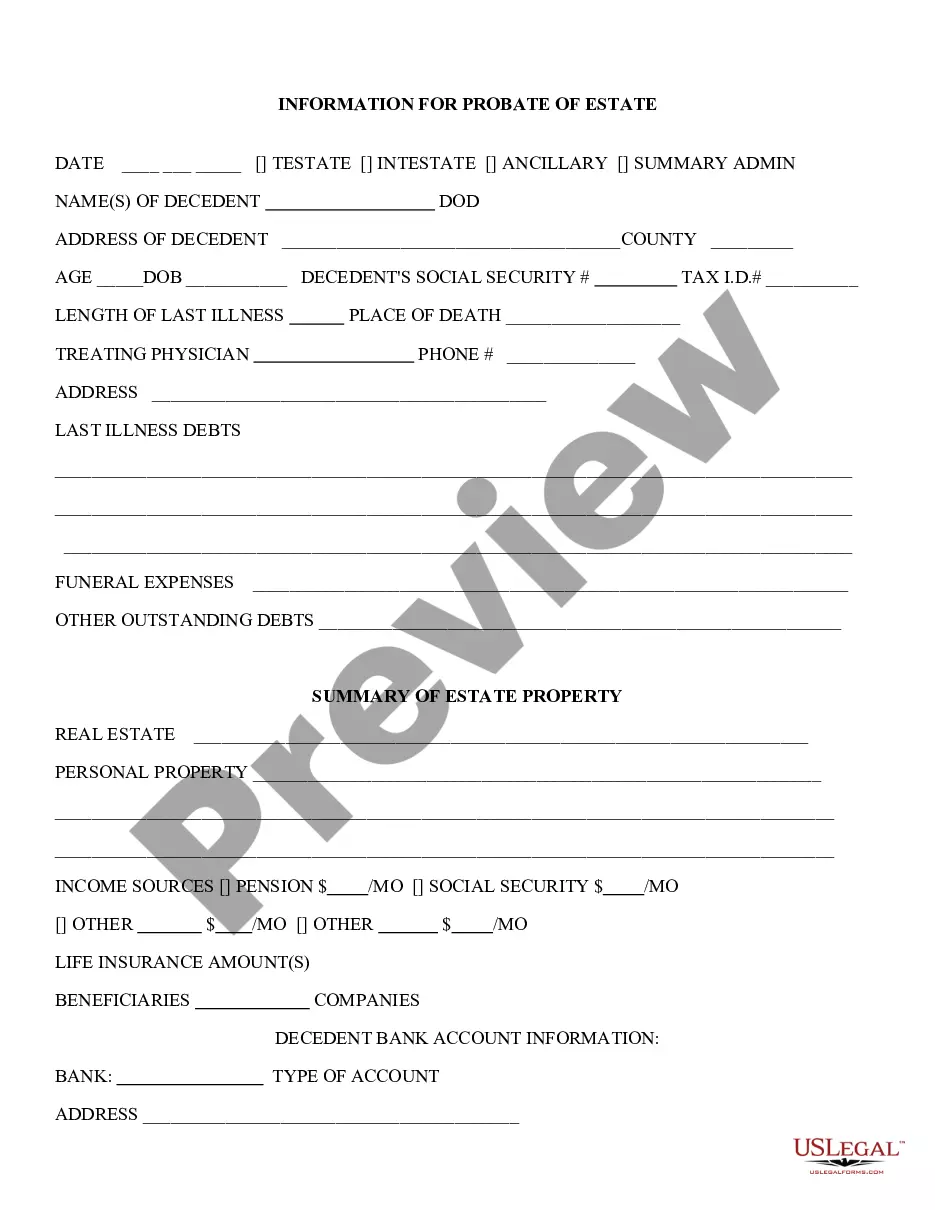

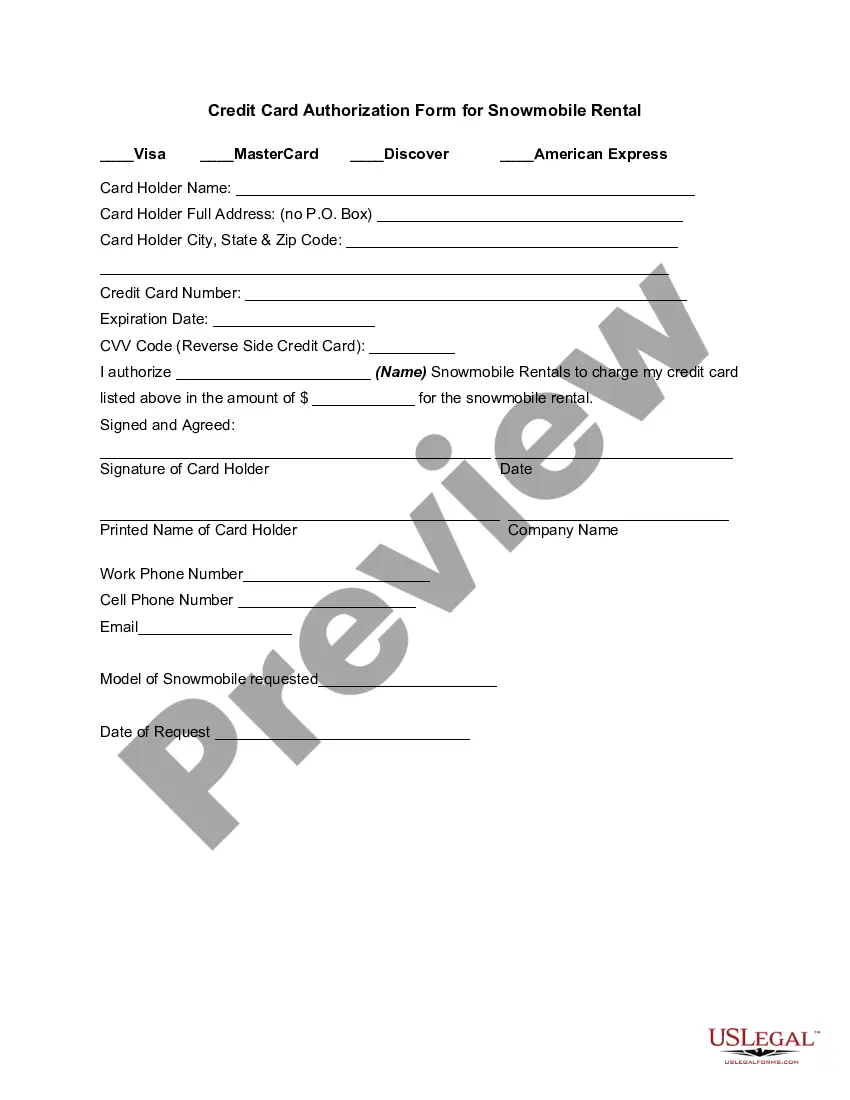

- Utilize the Preview button to review the form.

- Read the details to confirm you have selected the appropriate document.

- If the document is not what you are looking for, use the Search field to find the template that suits your requirements.

Form popularity

FAQ

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The trust must pay taxes on any interest income it holds and does not distribute past year-end. The interest income the trust distributes is taxable for the beneficiary who receives it. The amount distributed to the beneficiary is considered to be from the current-year income first, then from the accumulated principal.

The IRS requires that any gifts be made out of a trust be under the beneficiary's full control immediately. This present interest rule means that if a gift is made with conditions and the beneficiary does not have control over it at the time its made then it doesn't qualify for the annual exclusion amount.

After the grantor of an irrevocable trust dies, the trust continues to exist until the successor trustee distributes all the assets. The successor trustee is also responsible for managing the assets left to a minor, with the assets going into the child's sub-trust.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

Irrevocable trusts are primarily set up for estate and tax considerations. That's because it removes all incidents of ownership, removing the trust's assets from the grantor's taxable estate. It also relieves the grantor of the tax liability on the income generated by the assets.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

When you receive a distribution of principal from irrevocable trust funds, you will be required to report this income on your standard IRS Form 1040 tax form, as this money will almost always be taxed at normal income tax rates.