North Dakota Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

Finding the appropriate legal document template can be a challenge.

Indeed, there are many templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the North Dakota Covenant Not to Sue by Widow of Deceased Stockholder, suitable for business and personal needs.

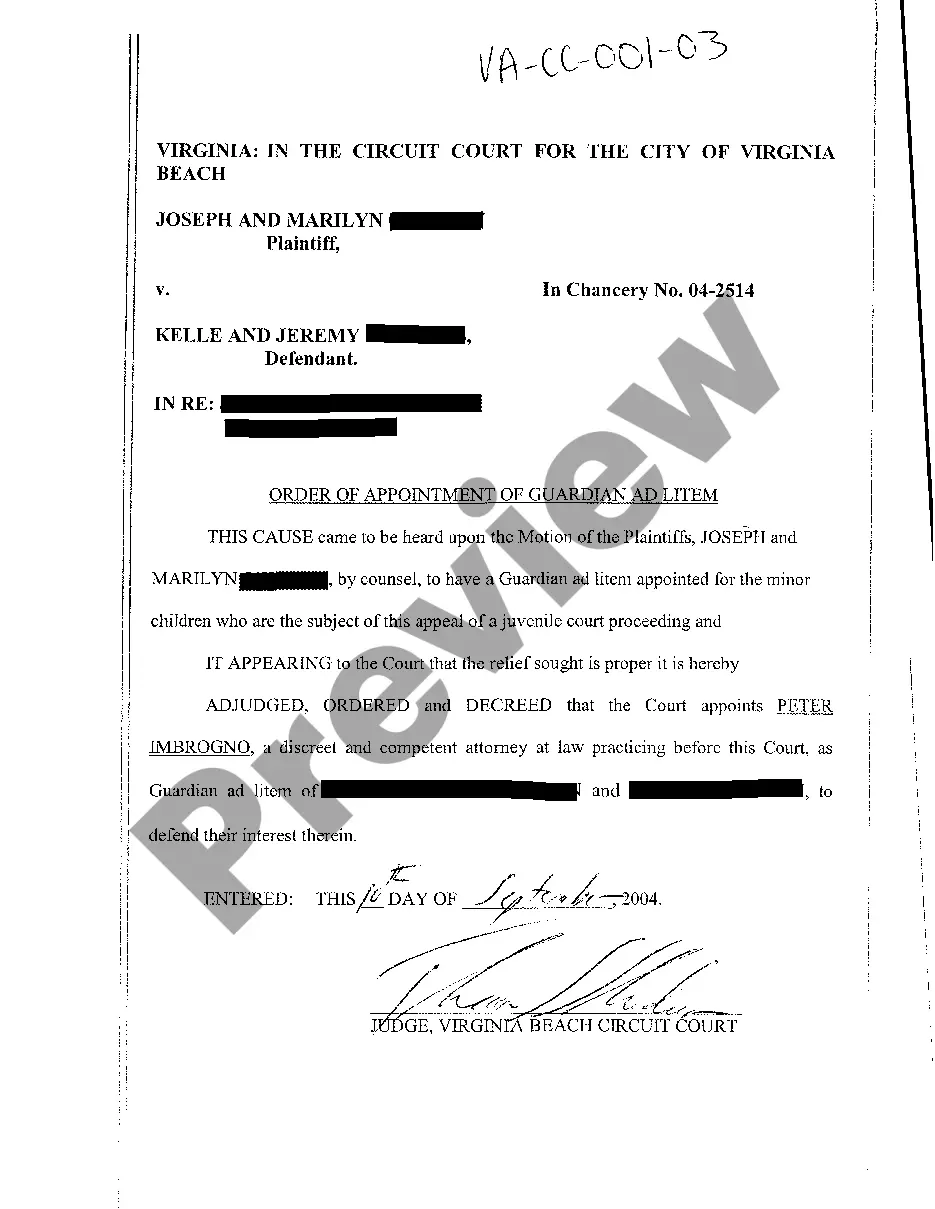

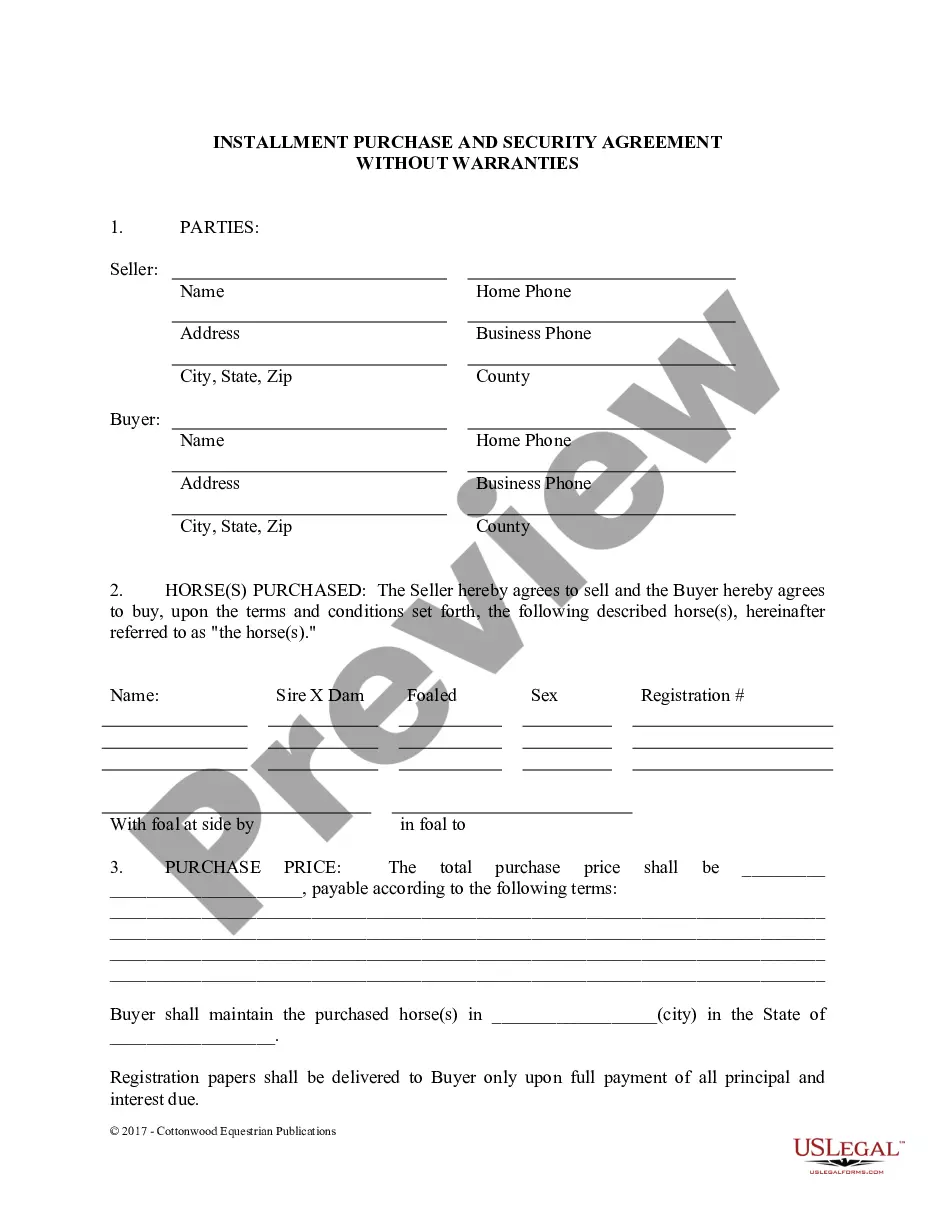

You can browse the form using the Preview button and read the form description to confirm it's the right one for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you're already registered, Log In to your account and click the Download button to obtain the North Dakota Covenant Not to Sue by Widow of Deceased Stockholder.

- Use your account to search through the legal forms you've previously ordered.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you're a new user of US Legal Forms, here are some easy steps to follow.

- First, ensure that you have selected the correct form for your locality.

Form popularity

FAQ

For navigating legal documents in North Dakota, platforms like USLegalForms can provide valuable templates and resources tailored to your needs. They simplify the process of creating necessary documents, including agreements related to a North Dakota Covenant Not to Sue by Widow of Deceased Stockholder. This ensures you stay compliant with local laws while saving time and minimizing potential legal issues.

The probate process in North Dakota typically takes six months to a year, although each case varies based on complexity. Several factors influence this timeline, including the size of the estate, outstanding debts, and the court's schedule. Incorporating strategies like the North Dakota Covenant Not to Sue by Widow of Deceased Stockholder can reduce delays, making the distribution of assets quicker and smoother for your heirs.

Probate is always needed to deal with a property after the owner dies. However, other organisations such as the deceased's bank, insurer, or pension provider may also request to see a Grant of Probate before releasing any money held in the deceased's name.

North Dakota has adopted the Uniform Probate Code, which allows a person to informally probate a Will and have a personal representative appointed without the necessity of a court appearance or a court hearing, as long as the proper forms are filed and the correct procedures followed.

The best way to avoid probate in North Dakota is by placing the estate in a revocable living trust. This type of trust allows the owner to make changes and maintain control over the assets. The beneficiaries would receive the estate after that person is deceased.

North Dakota has adopted the Uniform Probate Code, which allows a person to informally probate a Will and have a personal representative appointed without the necessity of a court appearance or a court hearing, as long as the proper forms are filed and the correct procedures followed.

The Top Three Ways to Avoid ProbateWrite a Living Trust. The most straightforward way to avoid probate is simply to create a living trust.Name Beneficiaries on Your Retirement and Bank Accounts.Hold Property Jointly.

North Dakota has adopted the Uniform Probate Code, which allows a person to informally probate a Will and have a personal representative appointed without the necessity of a court appearance or a court hearing, as long as the proper forms are filed and the correct procedures followed.

This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate. If you have been named in a will as an executor, you don't have to act if you don't want to.

How long does Probate take? Probate will likely take at least 6 months after the initial court date to open the estate. A more realistic minimum time would be 9 to 12 months.