North Dakota Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

Are you currently in the placement in which you need to have documents for possibly business or individual purposes almost every day? There are a lot of lawful papers templates available on the Internet, but discovering versions you can rely isn`t easy. US Legal Forms offers thousands of develop templates, like the North Dakota Subordination Agreement Subordinating Existing Mortgage to New Mortgage, which can be created to satisfy federal and state demands.

When you are presently knowledgeable about US Legal Forms site and get a free account, simply log in. Following that, you may download the North Dakota Subordination Agreement Subordinating Existing Mortgage to New Mortgage design.

Should you not come with an account and want to start using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for the correct city/county.

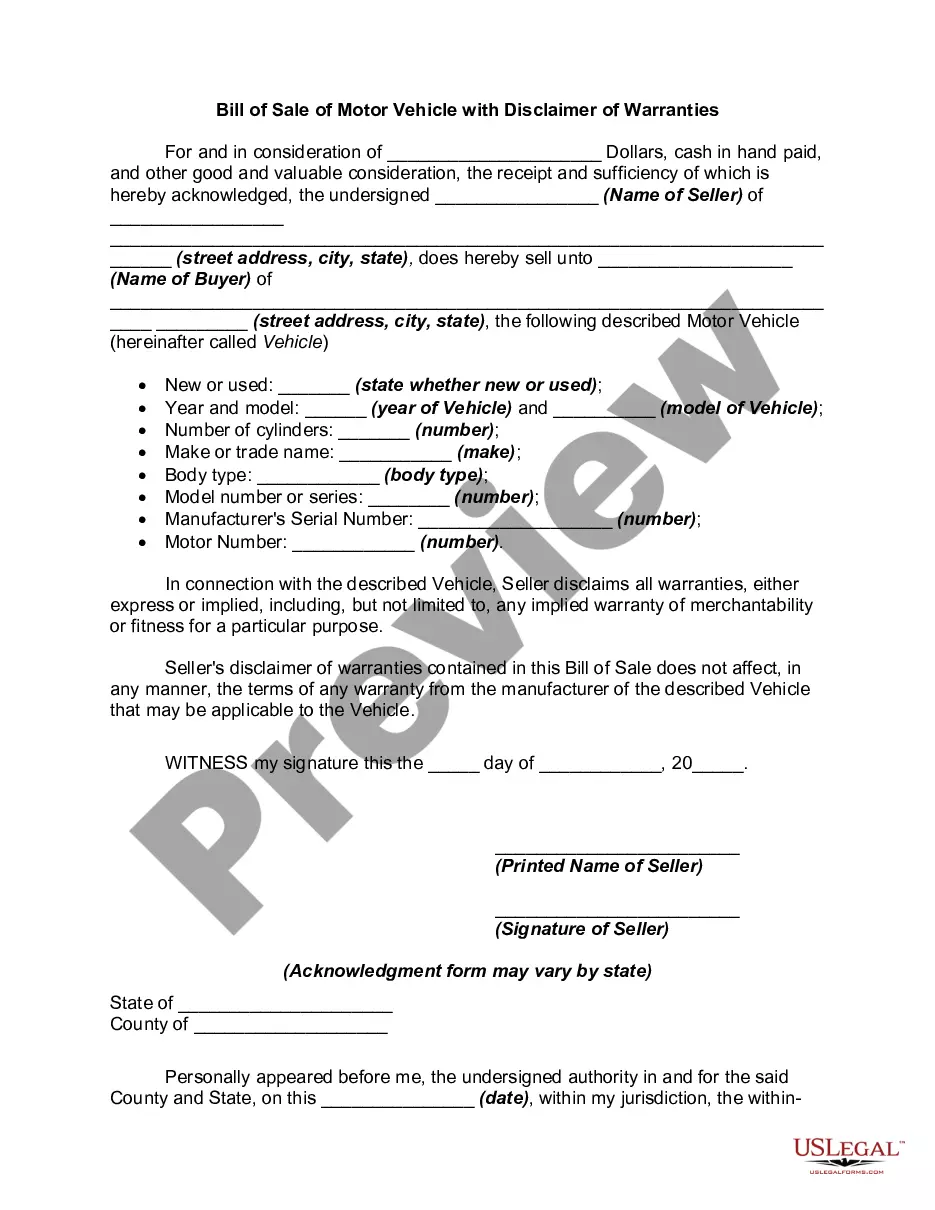

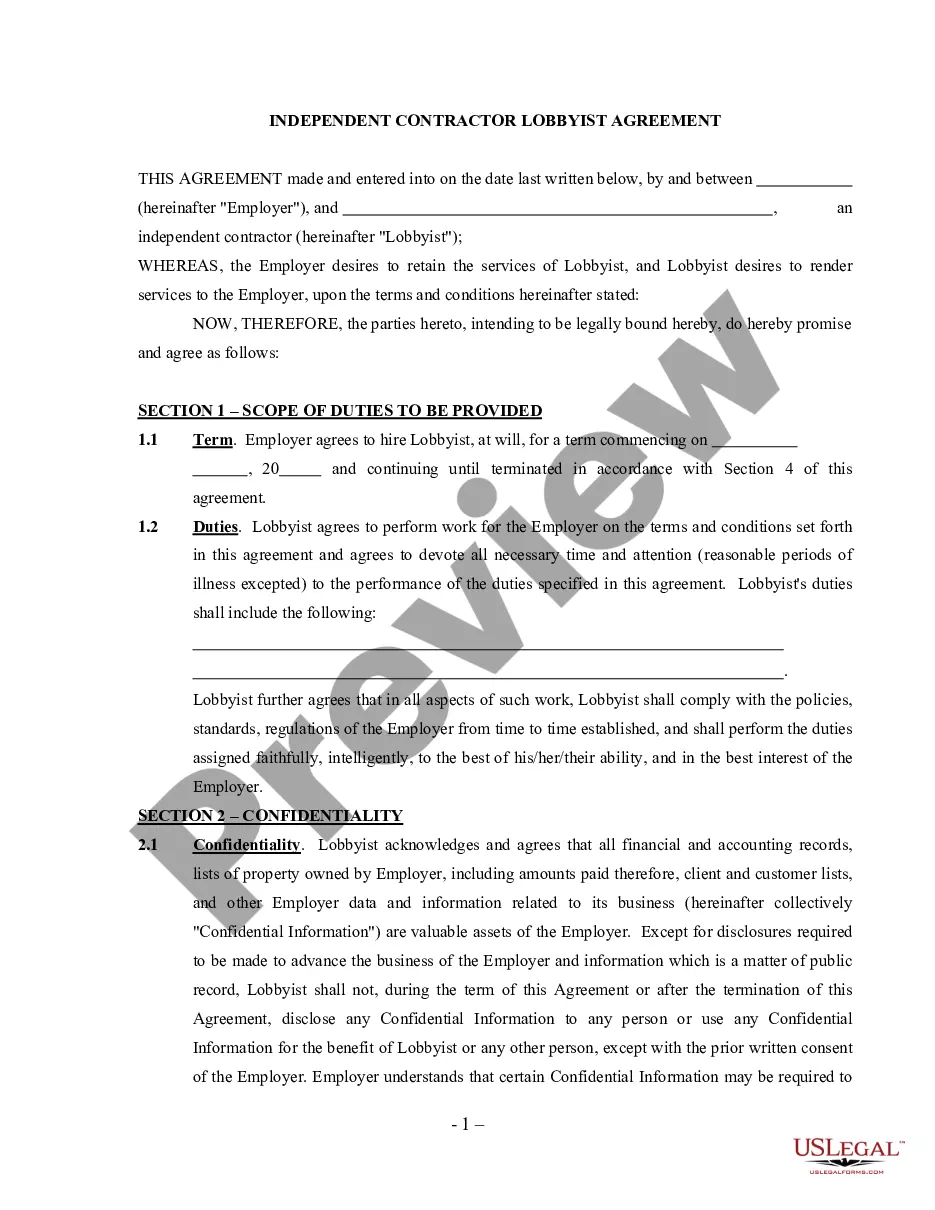

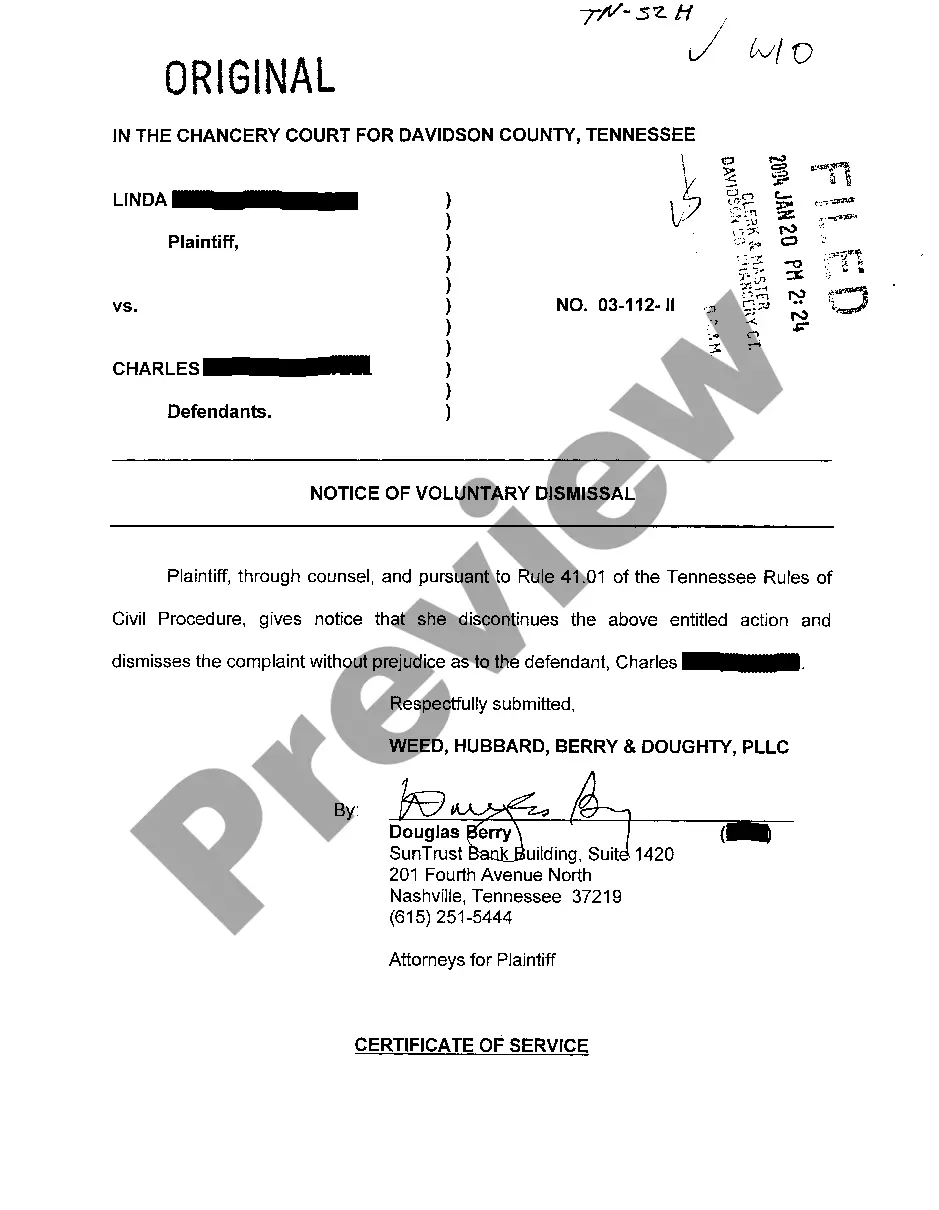

- Take advantage of the Review key to review the shape.

- Look at the information to ensure that you have selected the appropriate develop.

- In case the develop isn`t what you`re trying to find, make use of the Look for area to obtain the develop that fits your needs and demands.

- When you find the correct develop, just click Purchase now.

- Select the costs plan you desire, fill in the required information to create your money, and pay money for your order making use of your PayPal or Visa or Mastercard.

- Select a convenient file formatting and download your duplicate.

Find each of the papers templates you have bought in the My Forms food list. You can aquire a more duplicate of North Dakota Subordination Agreement Subordinating Existing Mortgage to New Mortgage any time, if required. Just go through the necessary develop to download or printing the papers design.

Use US Legal Forms, one of the most substantial assortment of lawful varieties, to save efforts and steer clear of faults. The support offers expertly produced lawful papers templates that can be used for a selection of purposes. Generate a free account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, the second mortgage can take its place as the primary loan.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Subordination clauses are most commonly found in mortgage refinancing agreements. Consider a homeowner with a primary mortgage and a second mortgage. If the homeowner refinances his primary mortgage, this in effect means canceling the first mortgage and reissuing a new one.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

A subordinated loan is debt that's only paid off after all primary loans are paid off, if there's any money left. It's also known as subordinated debt, junior debt or a junior security, while primary loans are also known as senior or unsubordinated debt.

Again, if you're refinancing your first mortgage and the property also has a subordinate mortgage, the refinancing lender will usually handle the process of getting the necessary subordination agreement. But you need to ensure that the required subordination agreement is completed before the new loan's closing date.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Any subsequent loan that is taken out after your initial purchase loan is considered to be a junior-lien or subordinate mortgage. Therefore, subordinate financing is the use of two or more mortgages to finance the purchase of real estate or using your home's equity for liquid cash.