North Dakota Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

If you need to extensive, acquire, or printing legal document templates, utilize US Legal Forms, the finest collection of legal forms, available online.

Take advantage of the site's simple and convenient search feature to obtain the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the North Dakota Notice of Public Sale of Collateral (Consumer Goods) upon Default within just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to get the North Dakota Notice of Public Sale of Collateral (Consumer Goods) on Default.

- You can also retrieve forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form relevant to the correct city/state.

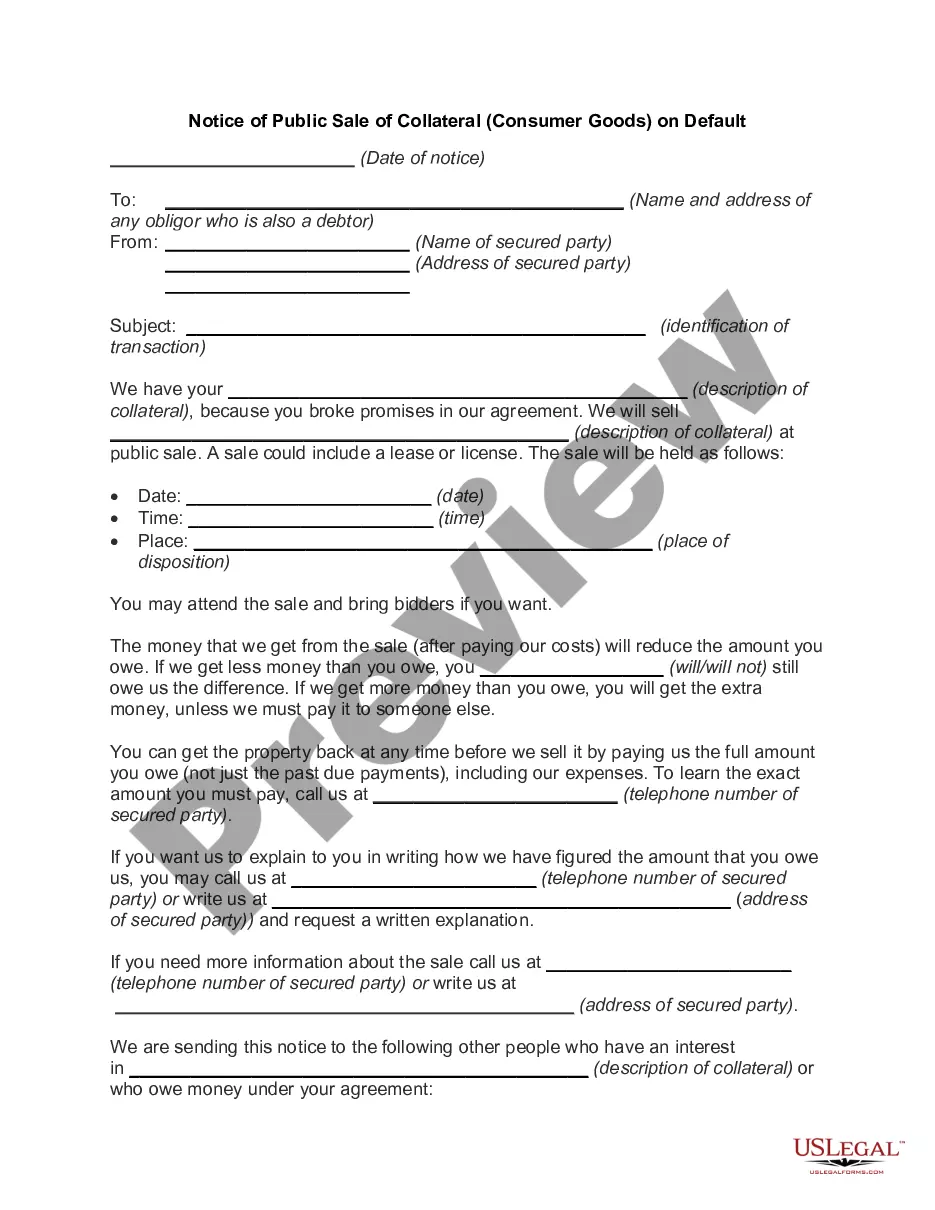

- Step 2. Use the Review option to examine the form's content. Make sure to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Revised Article 9 of the Uniform Commercial Code placed greater responsibility on secured parties to use the correct debtor name when preparing financing statements. RA9 provides that a financing statement is effective only if recorded under the correct name of the debtor.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

A PMSI is created in goods when a seller retains a security interest in the goods sold on credit by a security agreement. A debtor need not sign the financing statement. Attachment must occur in order to make a security interest enforceable against the debtor and against third parties.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

When the debtor sells collateral, he or she receives proceeds, something that is exchanged for collateral. The secured party automatically has an interest in the proceeds. If 2 parties provide a loan based on the same collateral, the party with the secured interest will have priority on the collateral.