North Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

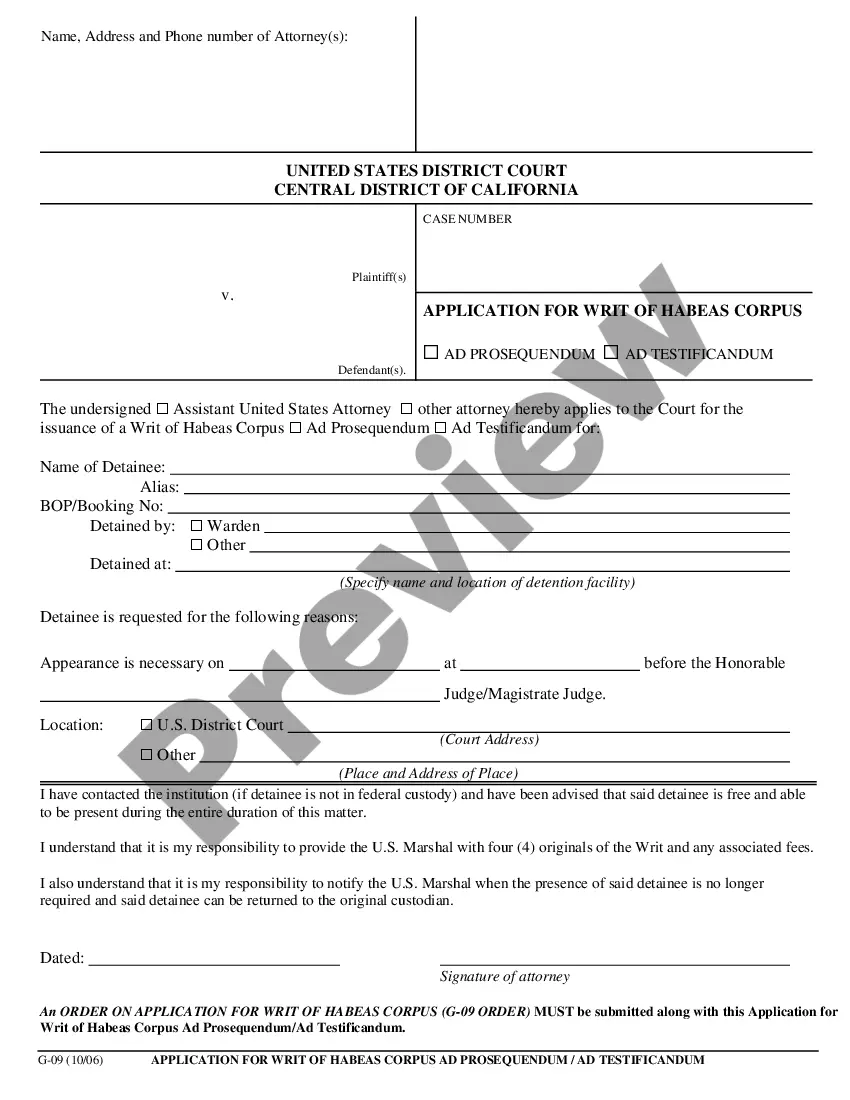

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you wish to finish, secure, or produce authentic document templates, utilize US Legal Forms, the largest collection of legitimate forms available online.

Utilize the site’s straightforward and user-friendly search feature to acquire the documents you require.

Various templates for corporate and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the North Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to get the North Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In a public corporation, anyone can buy shares of stock as long as they meet the brokerage requirements. The shares are listed on an exchange, making them accessible to investors. However, private corporations use different strategies, such as the North Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, to control who may buy or sell stock.

While a buy-sell agreement provides structure and clarity, it may also impose restrictions on share transfers that some shareholders might find limiting. The North Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions requires careful consideration of its terms to avoid conflicts. Additionally, it's vital to ensure that valuations of shares are fair to all parties involved.

A buyout agreement is a contract between the shareholders of a company. The agreement determines whether a company must buyout a departing shareholder or whether a company has the right to buyout a shareholder when a certain event, such as a shareholder's death, occurs.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

5 easy steps to file share purchase agreementReview of the share purchase agreement by both the parties.Signature by both the parties.Copies should be made for a purchaser, seller and the company.Giving the certificate after the payment.It can register if you meet certain criteria.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Events Covered Under a Buyout Agreementa divorce settlement in which a partner's ex-spouse stands to receive a partnership interest in the company. the foreclosure of a debt secured by a partnership interest. the personal bankruptcy of a partner, or. the disability, death, or incapacity of a partner.

An agreement between two parties in which the seller agrees to sell the stated number of shares to the buyer at a particular price.

Stock Purchase Agreement: Everything You Need to KnowName of company.Purchaser's name.Par value of shares.Number of shares being sold.When/where the transaction takes place.Representations and warranties made by purchaser and seller.Potential employee issues, such as bonuses and benefits.More items...?

Step 1: Decide on the issues the agreement should coverCommon problem areas include the following:Directors -v- members.Transfer of shares.Approving a change in business direction.Managing changes in the roles shareholders play.Injection of debt.Competition.Exit.More items...