North Dakota Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

Are you in a circumstance where you require documentation for either commercial or particular purposes almost every day? There are numerous authentic form templates accessible online, but finding versions you can rely on is not straightforward.

US Legal Forms offers an extensive range of form templates, such as the North Dakota Sample Letter for Corrections to Credit Report, that are crafted to comply with federal and state standards.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the North Dakota Sample Letter for Corrections to Credit Report template.

- Locate the form you require and ensure it is appropriate for your specific city/state.

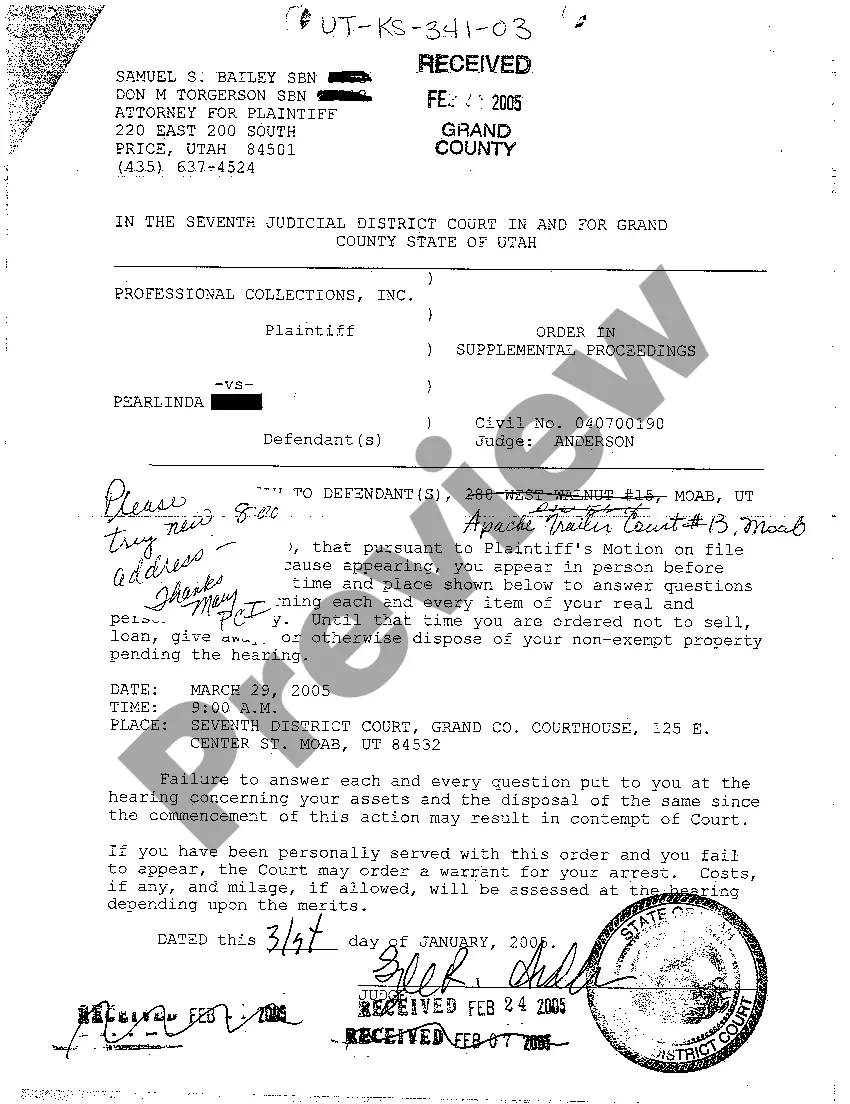

- Utilize the Review button to assess the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you identify the correct form, click on Get now.

- Select the payment plan you prefer, fill out the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To effectively dispute a credit report and increase your chances of success, gather your documentation and clearly outline the inaccuracies. Following the structure found in a North Dakota Sample Letter for Corrections to Credit Report can enhance the clarity of your dispute. Submit your letter to the credit bureau along with any supporting evidence to boost your case. Persistence and organization are key to winning credit disputes.

Writing a letter to dispute a credit report involves outlining the specific errors and providing evidence for your claims. Always include your identifying information, such as your name and account number. A North Dakota Sample Letter for Corrections to Credit Report can serve as a valuable template to ensure you cover all necessary points. This approach can help streamline the dispute process.

To write a good credit dispute letter, start by clearly stating the inaccuracies in your credit report. Include relevant personal details and any supporting documents. Use a North Dakota Sample Letter for Corrections to Credit Report as a reference to structure your letter effectively. Remember, be concise and assertive to enhance your chances of a prompt resolution.

Making corrections on a credit report is straightforward but requires some steps. First, examine your report for inaccuracies, then write to the reporting agency, using your North Dakota Sample Letter for Corrections to Credit Report to articulate your concerns clearly. Make sure to include any necessary documentation to support your request for corrections.

To make corrections to your credit report, you should identify the errors and gather supporting documentation. Following this, contact the credit bureau to initiate a dispute, using your North Dakota Sample Letter for Corrections to Credit Report as a formal request. Usually, the bureau will investigate and respond within 30 days.

Writing a letter to dispute an item on your credit report requires clarity and detail. Start by stating your identification and the inaccuracies you wish to challenge. Then, attach your North Dakota Sample Letter for Corrections to Credit Report along with any evidence that supports your claim, and send it to the appropriate credit bureau.

Adding a notice of correction to your credit report involves writing to the credit reporting agency and requesting the notice. Include clear details about the correction along with your North Dakota Sample Letter for Corrections to Credit Report. This notice helps creditors understand your situation better and can improve your chances of obtaining credit.

To make changes to your credit report, you should first gather any supporting documents that prove your case. Next, contact the credit reporting agency with the inaccuracies, and provide them with a detailed explanation along with your North Dakota Sample Letter for Corrections to Credit Report. It's essential to keep a record of all communications and follow up if you don't receive a response within 30 days.

Creating a credit report dispute letter involves several key steps. Start by addressing the letter to the correct credit bureau, then clearly state the inaccuracies you have identified. It's also helpful to reference specific details and include attached documents to support your dispute. Utilizing a North Dakota Sample Letter for Corrections to Credit Report can simplify the process and provide a solid template for your needs.

To correct your credit report, you should first identify the inaccuracies present in your report. Next, gather relevant documentation as evidence of your claim. Then, either send a dispute letter directly to the credit bureau or use a North Dakota Sample Letter for Corrections to Credit Report to ensure you present your case clearly and convincingly.