North Dakota Superior Improvement Form

Description

How to fill out Superior Improvement Form?

If you want to acquire, download, or print legal document templates, utilize US Legal Forms, the leading repository of legal templates available online.

Take advantage of the site's user-friendly and convenient search function to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the North Dakota Superior Improvement Form in just a few clicks.

Each legal document template you purchase is yours indefinitely. You’ll have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Compete and download, and print the North Dakota Superior Improvement Form with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the North Dakota Superior Improvement Form.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the instructions outlined below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the North Dakota Superior Improvement Form.

Form popularity

FAQ

Amending a North Dakota tax return involves completing the correct form, often based on changes in income or deductions. Be sure to review any sections relevant to the North Dakota Superior Improvement Form for accurate submissions. Once you have filled it out, send the amended return to the state to ensure they process your updates.

To amend your North Dakota tax return, fill out the appropriate amendment form for your situation. You may need to reference the North Dakota Superior Improvement Form, depending on your changes. After completing the form, submit it to the state tax department either electronically or via mail.

Anyone earning income in North Dakota as a nonresident is required to file a nonresident tax return. This includes individuals who may have businesses or income sources in the state. Ensure you reference specific forms, including those tied to the North Dakota Superior Improvement Form, to comply with state regulations.

Absolutely, you can amend just your state tax return without altering your federal return. This is particularly useful if you discover an error after filing your North Dakota tax return. Utilizing the right forms, like those associated with the North Dakota Superior Improvement Form, can streamline the process.

Yes, you can file North Dakota taxes online through several platforms, including uslegalforms. This option enables you to navigate tax forms efficiently, including the North Dakota Superior Improvement Form. Filing online usually offers a faster processing time and helps ensure that you don't miss crucial details.

Filing an amended tax return generally does not incur a penalty if you are due for a refund or correcting errors. However, if you owe additional taxes, North Dakota may impose penalties or interest. It's always a good idea to review how the North Dakota Superior Improvement Form interacts with your situation, as late payments could affect your total due.

To amend a tax return you already filed, you typically need to complete Form 1040-X for federal taxes. If you're focusing on state taxes, check the specific forms required by North Dakota, which may include elements relevant to the North Dakota Superior Improvement Form. You can file the amendment electronically or by mailing it, depending on your filing method.

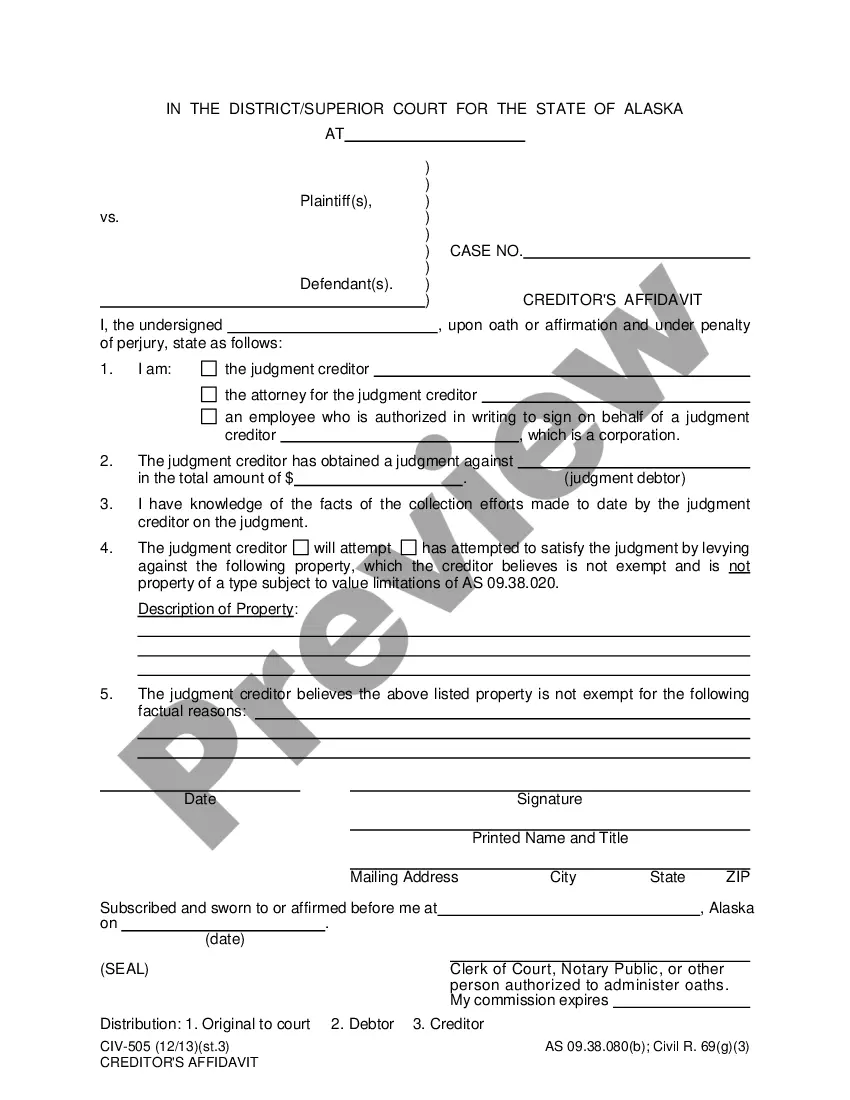

Rule 68 in North Dakota deals with offers of judgment and the implications of accepting or rejecting such offers. This rule encourages parties to settle disputes by outlining possible financial outcomes if a case goes to trial. Utilizing the North Dakota Superior Improvement Form may provide additional clarity during this negotiation process.

Filing a 960 in North Dakota involves submitting a motion for a default judgment when one party fails to respond to a legal complaint. The process typically requires filling out the appropriate documentation and paying any necessary fees. The North Dakota Superior Improvement Form might also be relevant in certain cases, helping you clearly submit your requests.

Rule 52 in North Dakota involves findings of fact and conclusions of law. It states that when a judge makes a ruling, they must provide a record of the factual and legal basis for their decision. When engaging with the North Dakota Superior Improvement Form, recognizing the implications of Rule 52 might help you navigate the judicial process more effectively.