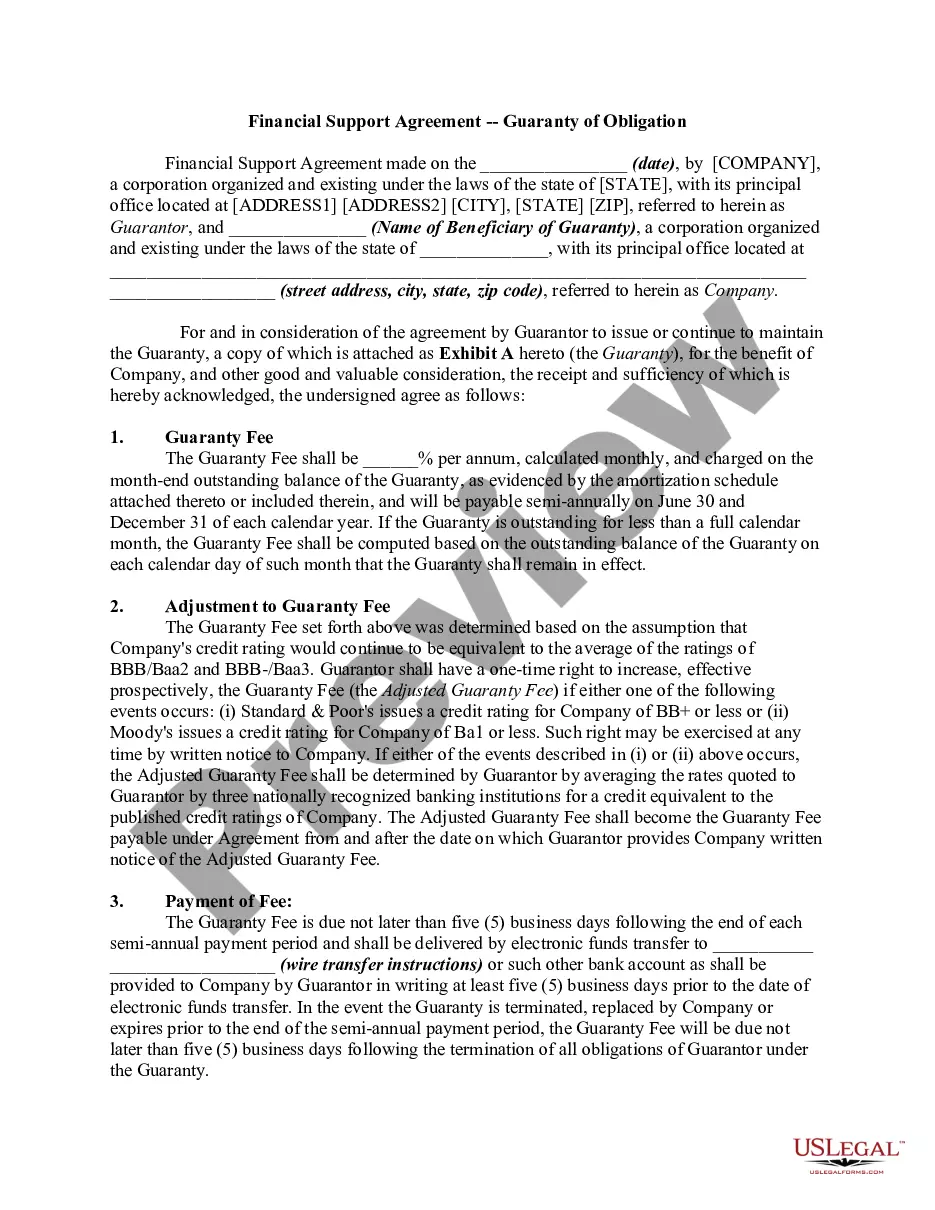

In this agreement, one corporation (the Guarantor) is providing financial assistance to another Corporation (the Corporation) by guaranteeing certain indebtedness for the Company in exchange for a guaranty fee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.