North Dakota Sales Commission Policy

Description

How to fill out Sales Commission Policy?

It is feasible to invest time online looking for the legal document template that aligns with the state and federal standards you need.

US Legal Forms provides thousands of legal forms that are assessed by specialists.

It is easy to download or print the North Dakota Sales Commission Policy from your platform.

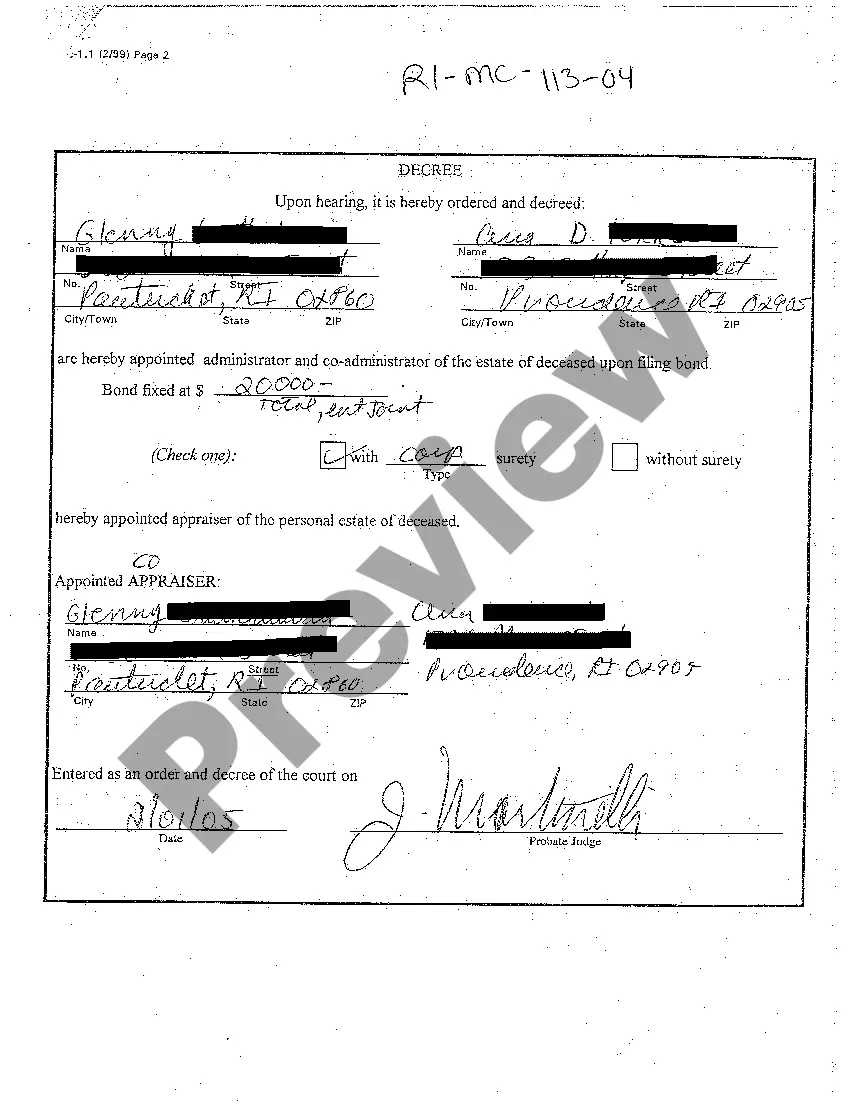

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, edit, print, or sign the North Dakota Sales Commission Policy.

- Every legal document template you purchase is yours permanently.

- To retrieve an additional copy of any downloaded form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Check the form details to confirm you have chosen the right form.

Form popularity

FAQ

Generally, labor is not subject to sales tax in North Dakota unless it relates to specific taxable services. Certain repairs, alterations, and installation services may incur sales tax, aligning with the North Dakota Sales Commission Policy. It's vital to identify what qualifies under these guidelines to ensure compliance. For clear and detailed explanations, the US Legal platform can be an invaluable resource.

Calculating sales tax in North Dakota involves taking the total sale amount and applying the state's sales tax rate, which is typically 5%. Including any local taxes is also necessary. Knowing how to accurately compute sales tax can prevent overcharging customers or underpayment to the government. Resources on the US Legal site can provide you with a step-by-step guide to this important calculation.

Several groups are exempt from sales tax in North Dakota, including non-profit organizations and certain government entities. Additionally, specific products like prescription drugs and certain food items may be exempt as well. Understanding who qualifies for these exemptions can simplify your tax compliance process. Utilize resources found on the US Legal platform to learn more about eligibility.

In North Dakota, labor costs for most services are not subject to sales tax. However, certain exceptions may apply to repairs or alterations of tangible personal property, which may fall under the North Dakota Sales Commission Policy. Always review the applicable guidelines to make sure you are following the correct procedures. US Legal offers tools to help clarify these nuances.

Delivery fees are generally subject to sales tax in North Dakota. According to the North Dakota Sales Commission Policy, if the delivery is part of the sale of taxable goods, then it will be taxed accordingly. It's important to understand this distinction to ensure compliance with local regulations. For specific scenarios and further clarification, consider exploring resources on the US Legal platform.

Yes, 100% commission jobs are legal under federal and state laws, including the North Dakota Sales Commission Policy. However, it is essential for job seekers to thoroughly understand the risks involved, as income can be unpredictable. Clear communication of the commission structure is essential for transparency between employers and employees in these roles.

The standard commission for sales often falls in the range of 10% to 15%. However, this can depend on factors like the type of product and the company’s specific commission policy. Familiarizing yourself with the North Dakota Sales Commission Policy can help sales professionals understand what to expect in their compensation plans.

A fair sales commission compensates sales representatives for their hard work while aligning with industry standards. Generally, a fair rate should motivate sales teams while being sustainable for the business. The North Dakota Sales Commission Policy encourages practices that ensure fairness in compensation to foster a positive work environment.

An acceptable sales commission typically ranges from 5% to 20%, depending on the industry and product sold. This percentage reflects the effort and skill required to close a sale. Under the North Dakota Sales Commission Policy, employers must clearly communicate their commission structures to their sales teams to avoid misunderstandings.

The sales commission policy outlines how sales representatives earn compensation based on their sales performance. This policy provides clarity on the percentage of sales that individuals can expect to receive as commission. Understanding the North Dakota Sales Commission Policy is crucial for both employers and employees to ensure fair and transparent transactions.