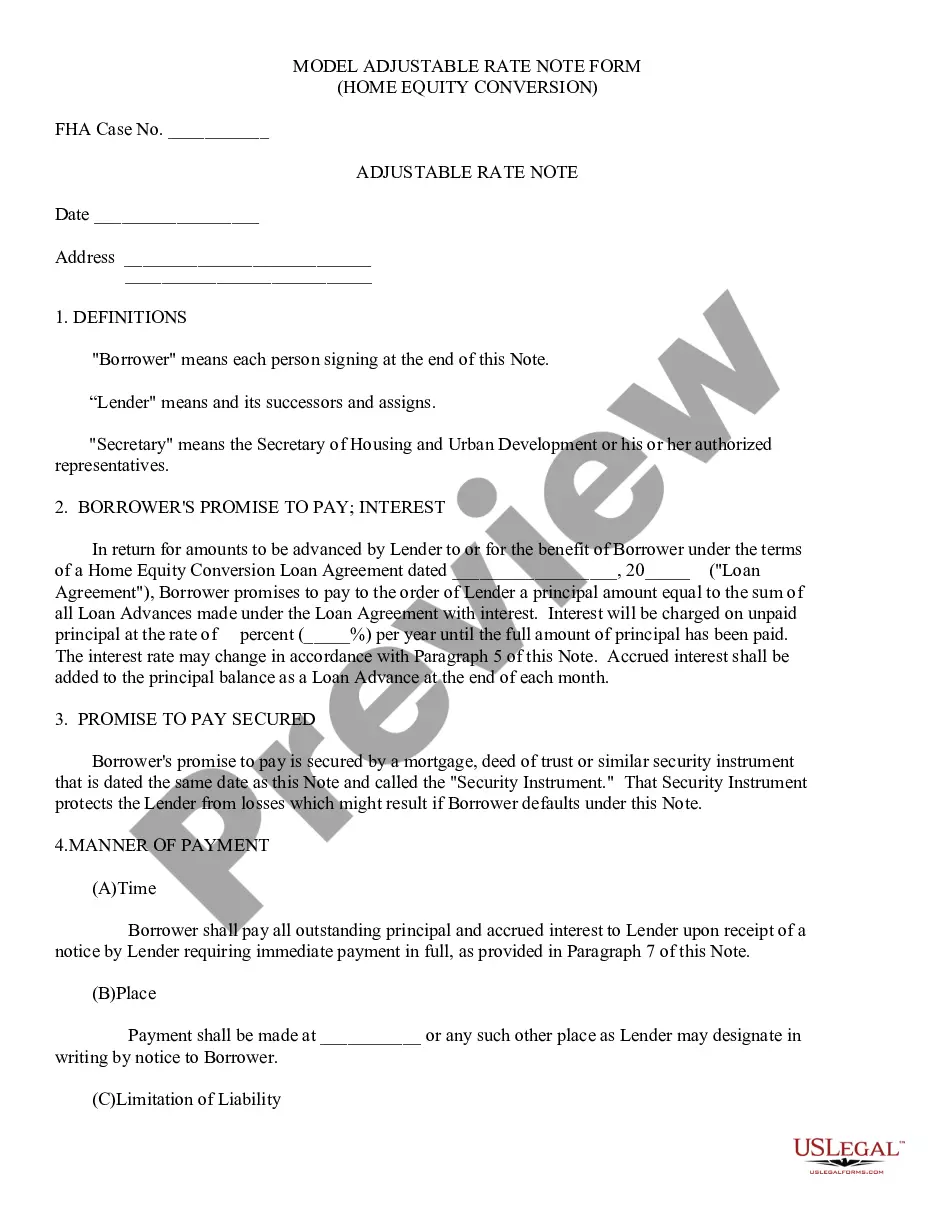

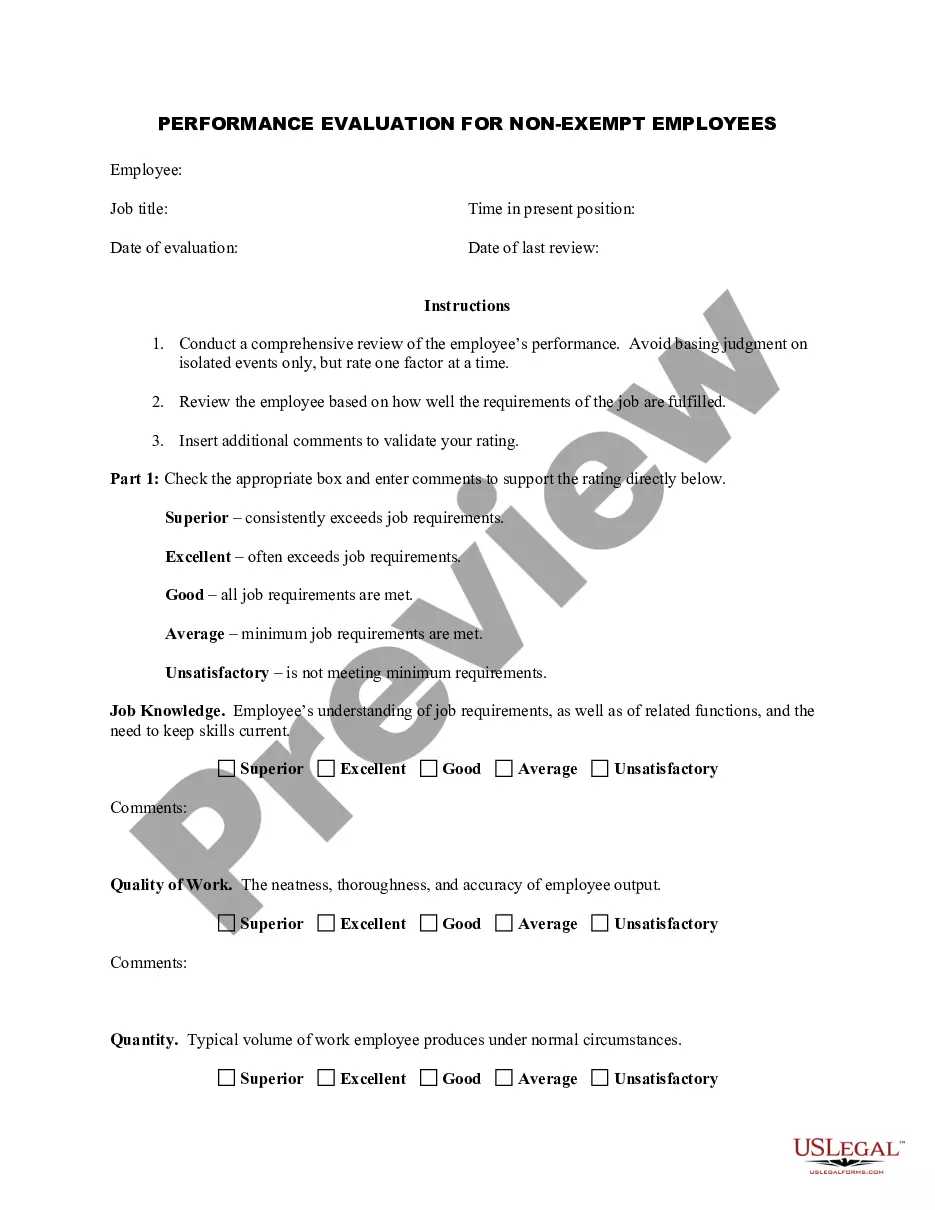

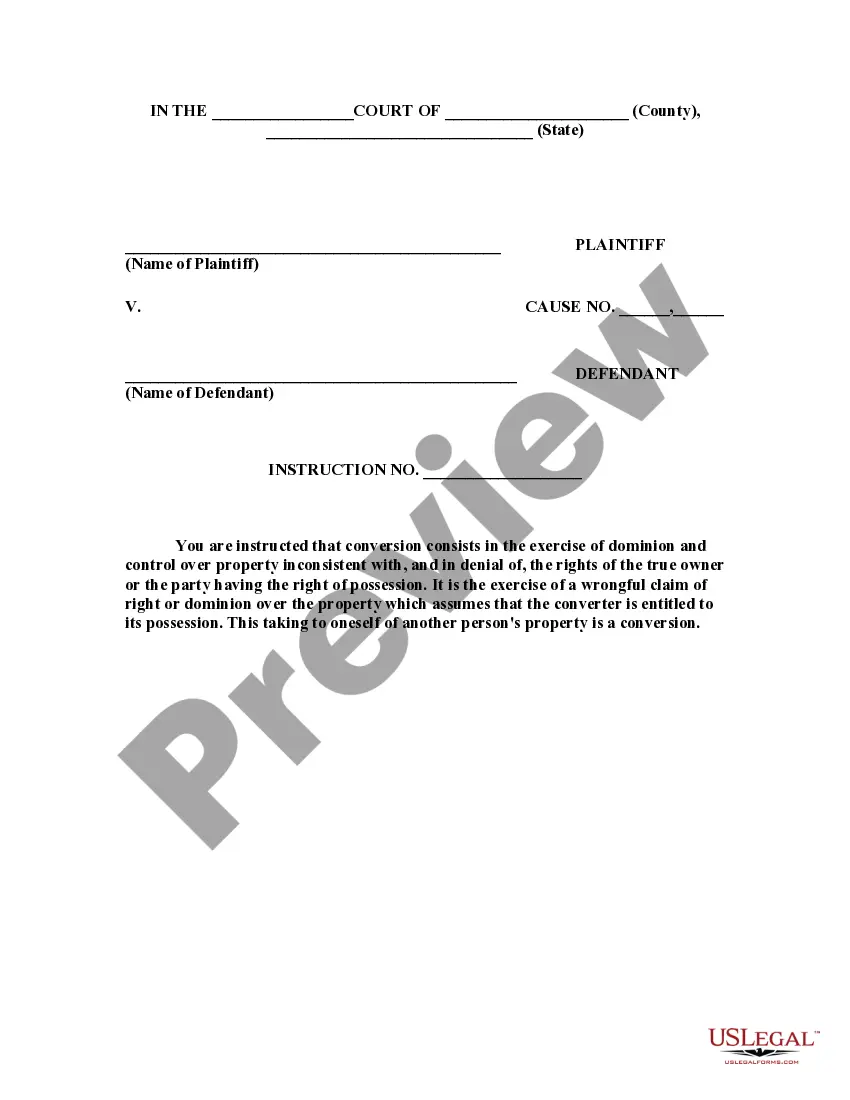

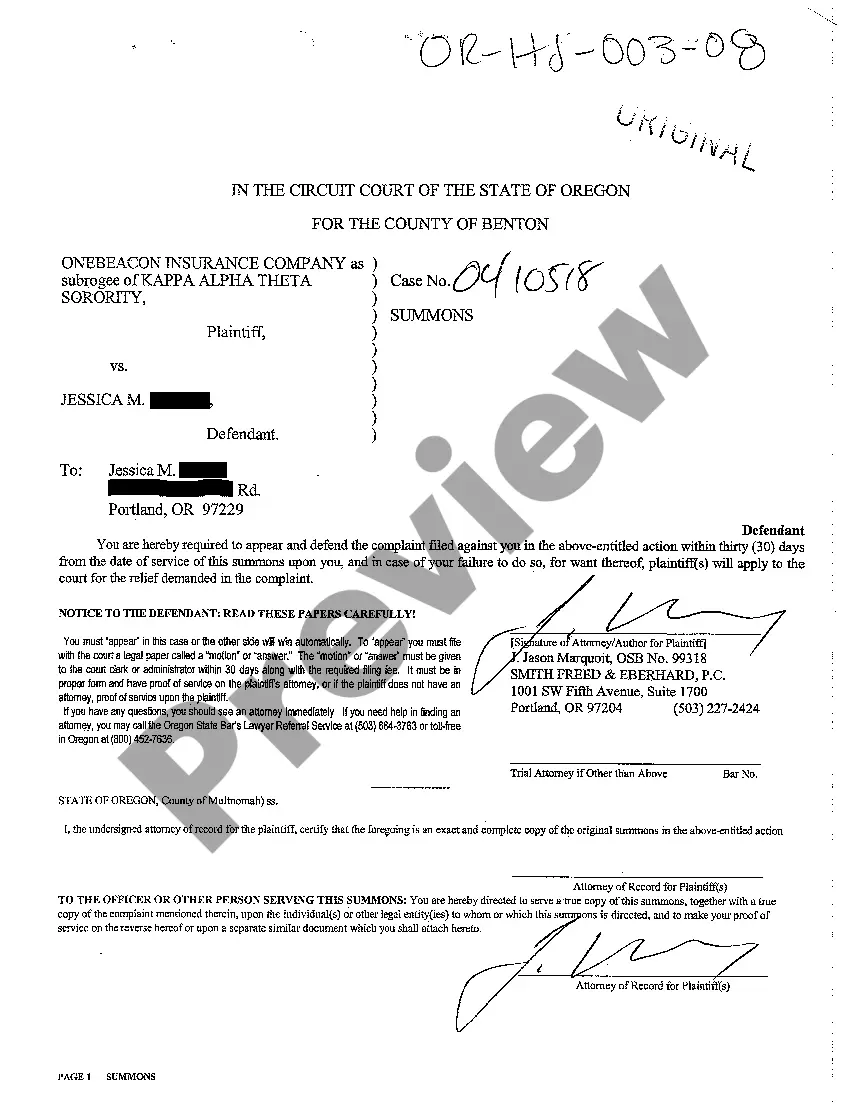

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Agreement to Extend Debt Payment Terms

Description

How to fill out Agreement To Extend Debt Payment Terms?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the site, you will have access to thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents like the North Dakota Agreement to Extend Debt Payment Terms in no time.

If the document does not meet your needs, use the Search field at the top of the page to find one that does.

Once you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your details to register for an account.

- If you already have a membership, Log In to download the North Dakota Agreement to Extend Debt Payment Terms from the US Legal Forms library.

- The Download button will be visible on each document you view.

- You can access all previously saved documents in the My documents section of your account.

- If you are new to US Legal Forms, here are some simple tips to help you get started.

- Make sure to select the correct document for your state/region.

- Click the Review button to check the content of the document.

Form popularity

FAQ

Yes, North Dakota has a move over law that requires drivers to give way to emergency vehicles. While this law does not directly relate to the North Dakota Agreement to Extend Debt Payment Terms, abiding by road safety regulations is essential in everyday life. Familiarizing yourself with state laws, including laws on debt management, can help you navigate your financial responsibilities seamlessly.

North Dakota does not provide an automatic extension for debt payments. To take advantage of the North Dakota Agreement to Extend Debt Payment Terms, you must actively file for an extension. This proactive step allows you to extend your payment timeline responsibly and ensures that you remain compliant with local laws.

Yes, North Dakota accepts federal extensions, but this does not eliminate the need for a separate state extension. The North Dakota Agreement to Extend Debt Payment Terms offers flexibility, so you can navigate your payment responsibilities. It's important to understand that filing a federal extension helps at the national level, but state compliance is still a must.

When you file a federal extension, you will still need to submit a state extension in North Dakota. The North Dakota Agreement to Extend Debt Payment Terms allows you to manage your payments effectively, but state requirements differ from federal regulations. Therefore, it is essential to follow both processes to ensure compliance with state laws.

North Dakota does not automatically grant extensions for property tax payments. Property owners must apply for extensions in advance, demonstrating valid reasons for their request. A North Dakota Agreement to Extend Debt Payment Terms can also serve as a proactive solution to negotiate manageable payment plans and avoid penalties.

North Dakota does accept federal extensions for filing taxes, providing residents additional time to complete their returns. However, it's essential to stay informed about state-specific requirements and deadlines. If tax payments become burdensome, consider the North Dakota Agreement to Extend Debt Payment Terms for easing your financial obligations.

A warrant for unpaid property taxes is a legal mechanism that allows the government to recover delinquent taxes owed. When taxes remain unpaid for an extended period, the county may issue a warrant, leading to potential property seizure. Utilizing options like the North Dakota Agreement to Extend Debt Payment Terms can help resolve tax issues and avoid such legal actions.

North Dakota offers various forms of property tax relief designed to assist homeowners and prevent financial strain. This often includes exemptions or credits for qualifying individuals. If you are navigating financial difficulties, a North Dakota Agreement to Extend Debt Payment Terms can provide a structured path to manage your payments more effectively.

In North Dakota, property owners can stop paying property taxes when they reach the age of 65. However, to qualify for this exemption, you must meet specific income requirements. Additionally, you may want to consider utilizing a North Dakota Agreement to Extend Debt Payment Terms if you face challenges in meeting your tax obligations.

In North Dakota, the Fair Debt Collection Practices Act is enforced alongside state laws to protect consumers during debt collection efforts. Debt collectors must follow specific protocols to ensure they respect individuals’ rights. Knowing this can be crucial when negotiating a North Dakota Agreement to Extend Debt Payment Terms, ensuring you are treated fairly throughout the process.