North Dakota Agreement between Physicians to Share Offices without Forming Partnership

Description

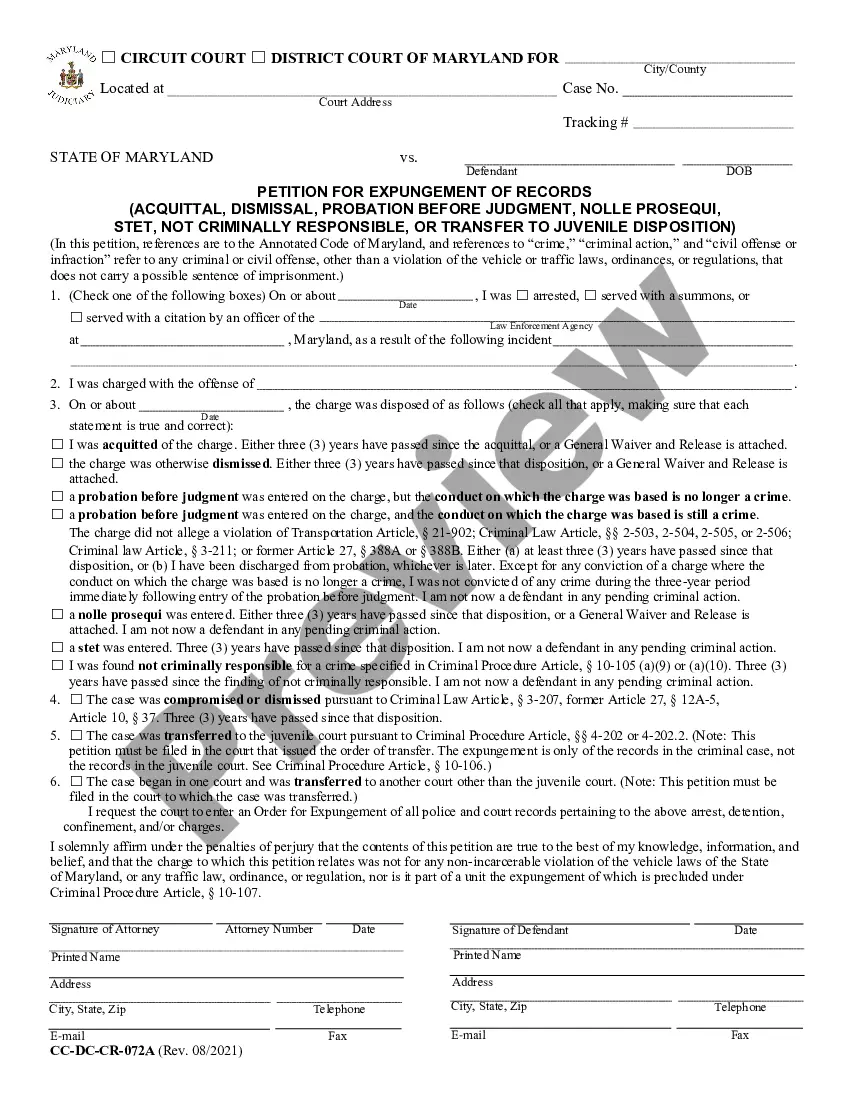

How to fill out Agreement Between Physicians To Share Offices Without Forming Partnership?

You might dedicate numerous hours online attempting to locate the authentic document template that satisfies the national and state demands you need.

US Legal Forms offers a vast array of valid forms that have been reviewed by professionals.

It is easy to obtain or print the North Dakota Agreement between Physicians to Share Offices without Forming Partnership from my service.

If you wish to obtain another version of the form, utilize the Search field to locate the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, amend, print, or sign the North Dakota Agreement between Physicians to Share Offices without Forming Partnership.

- Each legal document template you purchase is yours indefinitely.

- To retrieve an additional copy of any purchased form, go to the My documents section and click the relevant button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the region/area that you choose.

- Review the form details to confirm you have chosen the accurate type.

Form popularity

FAQ

Doctor partnerships generally involve sharing decision-making, income, and liabilities. Each partner contributes to operations and shares in the risks and rewards. However, with a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, physicians can avoid these complexities. This agreement allows them to collaborate effectively while keeping their practices distinct, simplifying management and enhancing patient care.

An example of a healthcare partnership would be two or more doctors forming a formal legal partnership to share profits, liabilities, and responsibilities. However, a North Dakota Agreement between Physicians to Share Offices without Forming Partnership allows doctors to work together without these obligations. This can help them reduce overhead costs while keeping their practices separate. Such an agreement is advantageous for both patient care and practice management.

Doctors' offices are not always structured as partnerships. In fact, a North Dakota Agreement between Physicians to Share Offices without Forming Partnership allows physicians to collaborate in an office setting without merging their practices. This arrangement provides a way to share resources while maintaining independence. It helps physicians meet patient needs more effectively.

For partnerships, non-resident withholding in North Dakota is set at 2.9% of the income allocated to the non-resident partner. This withholding ensures non-residents fulfill their state tax obligations on income generated within North Dakota. In scenarios involving a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, staying updated on these withholdings is essential for sound financial planning. It's wise to consult a tax professional to clarify obligations.

Yes, North Dakota taxes non-residents on income sourced within the state. This means that if you earn income as part of a professional agreement in North Dakota, such as a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, you need to comply with state tax laws. Remaining informed about your tax duties as a non-resident can help streamline your tax experience. Utilize reliable resources to ensure compliance.

Yes, North Dakota allows for an automatic extension for filing state income tax returns. However, this extension does not apply to partnership income where tax is owed, making it crucial to understand your obligations. If you are operating under a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, keep this in mind when planning your tax deadlines. Being aware of the rules can enhance your financial planning.

The withholding tax for foreign partners in North Dakota mirrors that of non-residents, with a rate of 2.9% applied. This ensures that foreign partners also meet their tax obligations on income sourced from North Dakota. When navigating a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, it's critical to integrate tax considerations effectively. Properly managing these aspects can help avoid unexpected liabilities.

North Dakota does not impose a specific pass-through entity tax. Instead, income typically passes through to the owners, including non-residents, who report it on their individual tax returns. When structuring a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, understanding how income flows is essential. This structure can further simplify tax reporting for partners.

In North Dakota, the withholding for a non-resident partner typically stands at 2.9% of the partner's share of income. This withholding aims to ensure that non-resident partners meet their tax obligations in the state. When engaging in activities under a North Dakota Agreement between Physicians to Share Offices without Forming Partnership, it is crucial to identify these withholding requirements early. Ensuring compliance can simplify your partnership taxes.