North Dakota Sample Letter transmitting Last Will and Testament of Decedent

Description

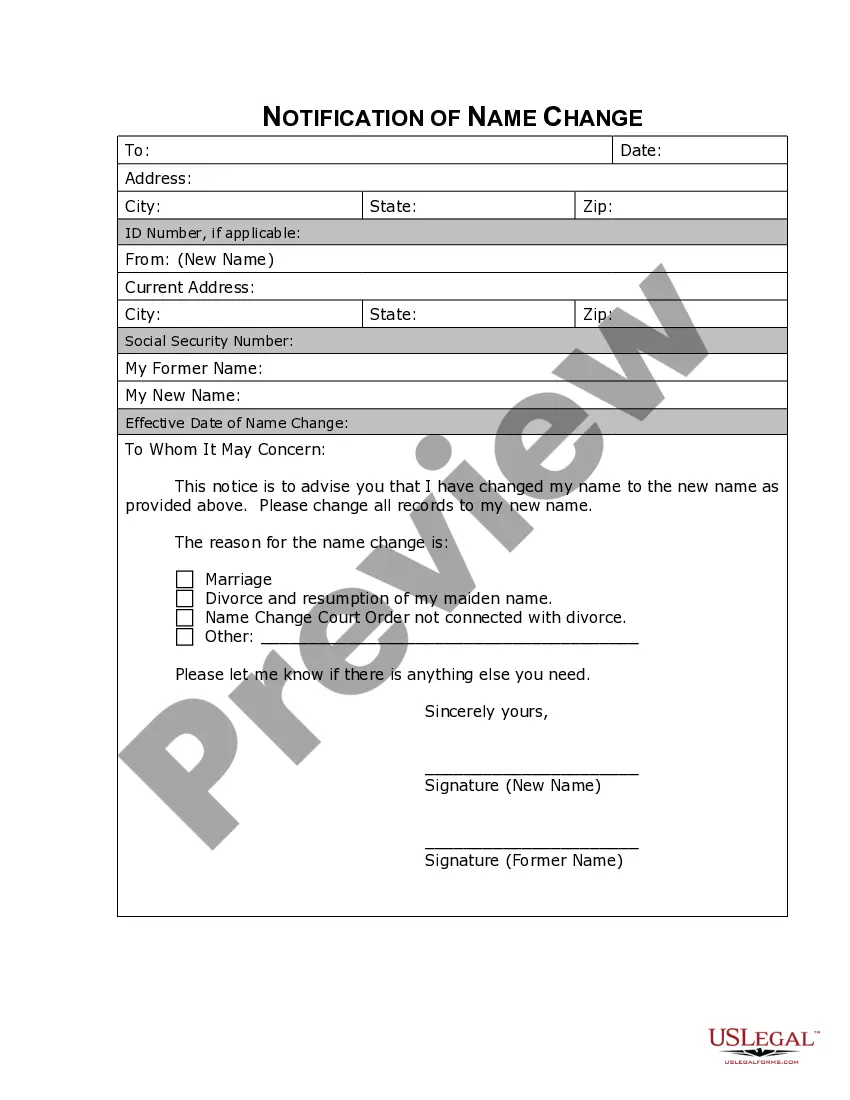

How to fill out Sample Letter Transmitting Last Will And Testament Of Decedent?

Locating the appropriate sanctioned document template can be somewhat of a challenge. Of course, there are plenty of designs available on the web, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform provides thousands of templates, including the North Dakota Sample Letter transmitting Last Will and Testament of Decedent, that can be utilized for both business and personal needs. All of the forms are vetted by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and then click the Acquire button to access the North Dakota Sample Letter transmitting Last Will and Testament of Decedent. Use your account to search through the legal forms you may have previously ordered. Visit the My documents tab of your account and obtain an additional copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and examine the form description to confirm it is the right fit for you. If the form does not meet your requirements, use the Search field to locate the appropriate form. Once you are certain the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction with your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired North Dakota Sample Letter transmitting Last Will and Testament of Decedent.

By following these guidelines, you can efficiently navigate through the US Legal Forms website and secure the necessary legal documentation with ease.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Utilize the service to download professionally crafted paperwork that adhere to state requirements.

- Ensure the document you choose is appropriate for your needs.

- Review all options available to find the best legal form.

- Follow the steps outlined to successfully obtain your documents.

- Access and manage your forms easily through your user account.

Form popularity

FAQ

The final letter to beneficiaries from the executor serves as a formal communication that outlines the completion of the estate administration. It typically details the distribution of assets and any remaining obligations or tax responsibilities. This letter provides clarity and assurance to beneficiaries about their inheritance. Utilizing the North Dakota Sample Letter transmitting Last Will and Testament of Decedent can help you draft this important correspondence effectively.

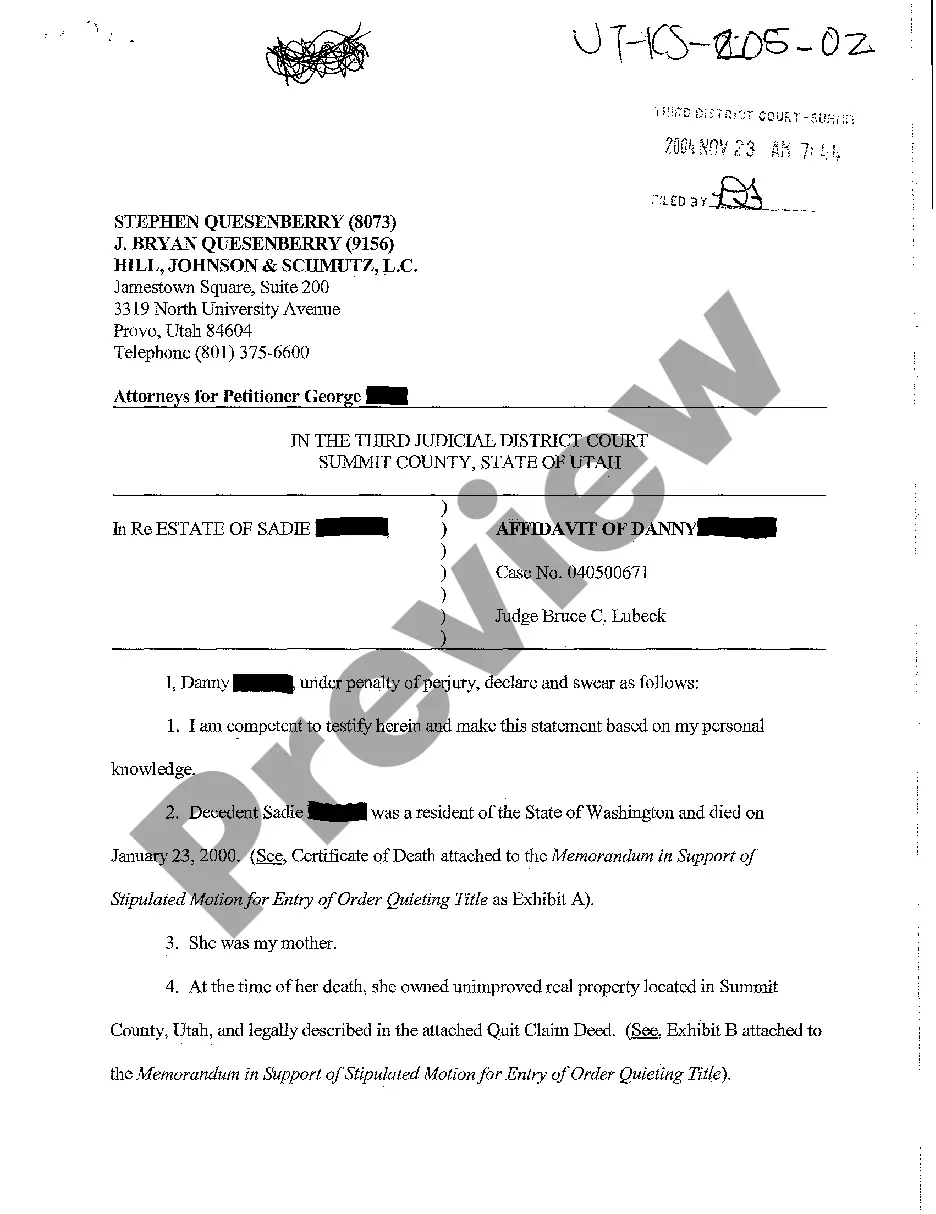

Rule 32 in North Dakota outlines the procedures for the probate of a will and the administration of an estate. This rule specifies the responsibilities of executors and the necessary documentation required for the probate process. Understanding Rule 32 can help ensure that you comply with state laws during estate administration. Resources like the North Dakota Sample Letter transmitting Last Will and Testament of Decedent can be beneficial in navigating these legalities.

An example of a letter to a beneficiary of a will includes a formal notification outlining the terms of their inheritance as stated in the Last Will and Testament. This letter typically includes details such as the type of assets being distributed and any actions the beneficiary needs to take. By using a template like the North Dakota Sample Letter transmitting Last Will and Testament of Decedent, you can create a professional and clear communication.

Final distribution refers to the last stage in the probate process where the executor distributes the remaining assets of the estate to the beneficiaries. This step occurs after all debts and taxes have been settled, ensuring that the estate is closed properly. Final distribution marks the conclusion of the executor's responsibilities. For clarity, consider using the North Dakota Sample Letter transmitting Last Will and Testament of Decedent during this phase.

The final estate distribution letter is a document that summarizes the distribution of an estate's assets to the beneficiaries. It serves as confirmation that the executor has completed their duties and provides details on how assets were allocated. This letter can help beneficiaries understand their inheritance and any tax implications. Using the North Dakota Sample Letter transmitting Last Will and Testament of Decedent can simplify crafting this important document.

Estate distribution refers to the process of distributing a decedent's assets to the rightful beneficiaries as specified in their Last Will and Testament. This process ensures that the wishes of the deceased are honored, and assets are allocated fairly. Proper estate distribution often requires legal documentation to validate the transfer of assets. The North Dakota Sample Letter transmitting Last Will and Testament of Decedent can assist in clarifying this process.

In North Dakota, obtaining a letter of testamentary typically requires court involvement. This document is essential for the executor to manage the estate according to the decedent's wishes outlined in the Last Will and Testament. However, you may explore alternatives if the estate is small or if there are no disputes among beneficiaries. Utilizing resources like the North Dakota Sample Letter transmitting Last Will and Testament of Decedent can help streamline this process.