North Dakota Community Property Disclaimer

Description

How to fill out Community Property Disclaimer?

You might spend hours online searching for the legal document format that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that have been evaluated by professionals.

It is easy to obtain or print the North Dakota Community Property Disclaimer from my service.

To find another version of the form, take advantage of the Search field to obtain the template that meets your needs and specifications. Once you have identified the format you need, click Buy now to proceed.

- If you already possess a US Legal Forms account, you may Log In and then select the Acquire option.

- Subsequently, you may complete, modify, print, or sign the North Dakota Community Property Disclaimer.

- Each legal document format you receive is yours forever.

- To obtain an additional copy of the acquired form, go to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document format for the state/region of your choice.

- Review the form description to make sure you have selected the appropriate document.

Form popularity

FAQ

In Minnesota, property you owned before marriage is typically considered non-marital property and remains yours after divorce. However, if your spouse contributed to the property's value or maintenance during the marriage, this may affect the outcome. Using insights from the North Dakota Community Property Disclaimer can help you understand how these principles may align or differ with those in North Dakota.

In non-community property states, assets are divided based on an equitable distribution model, which does not necessarily mean an equal split. Courts take various factors into account, like financial contributions, the length of the marriage, and individual circumstances. If you face these issues, consider visiting USLegalForms for comprehensive resources on the North Dakota Community Property Disclaimer to help clarify these matters.

Yes, North Dakota is a community property state, meaning that marital property is generally split 50/50 between spouses during a divorce. This approach aims to ensure that both partners receive an equal share of assets acquired during the marriage. Being informed about the North Dakota Community Property Disclaimer is essential, as it helps clarify what is subject to division.

Minnesota is not strictly a 50/50 state for divorce, as it emphasizes equitable distribution of assets. Courts assess various factors, such as each spouse's financial situation, contributions, and the duration of the marriage, to determine fair division. Considering the North Dakota Community Property Disclaimer may offer useful perspectives on asset division if you have ties to North Dakota.

In Minnesota, you do not need to be married for a specific duration to qualify for asset division. Instead, all marital property is subject to division, regardless of the length of the marriage. Understanding these guidelines can help you navigate divorce proceedings effectively, and integrating insights from the North Dakota Community Property Disclaimer can provide additional clarity.

Minnesota is not a community property state; it follows an equitable division approach. This means that assets may be divided fairly, but not necessarily equally. Couples should consider the North Dakota Community Property Disclaimer when planning their financial future, especially if they have connections to North Dakota or own property there.

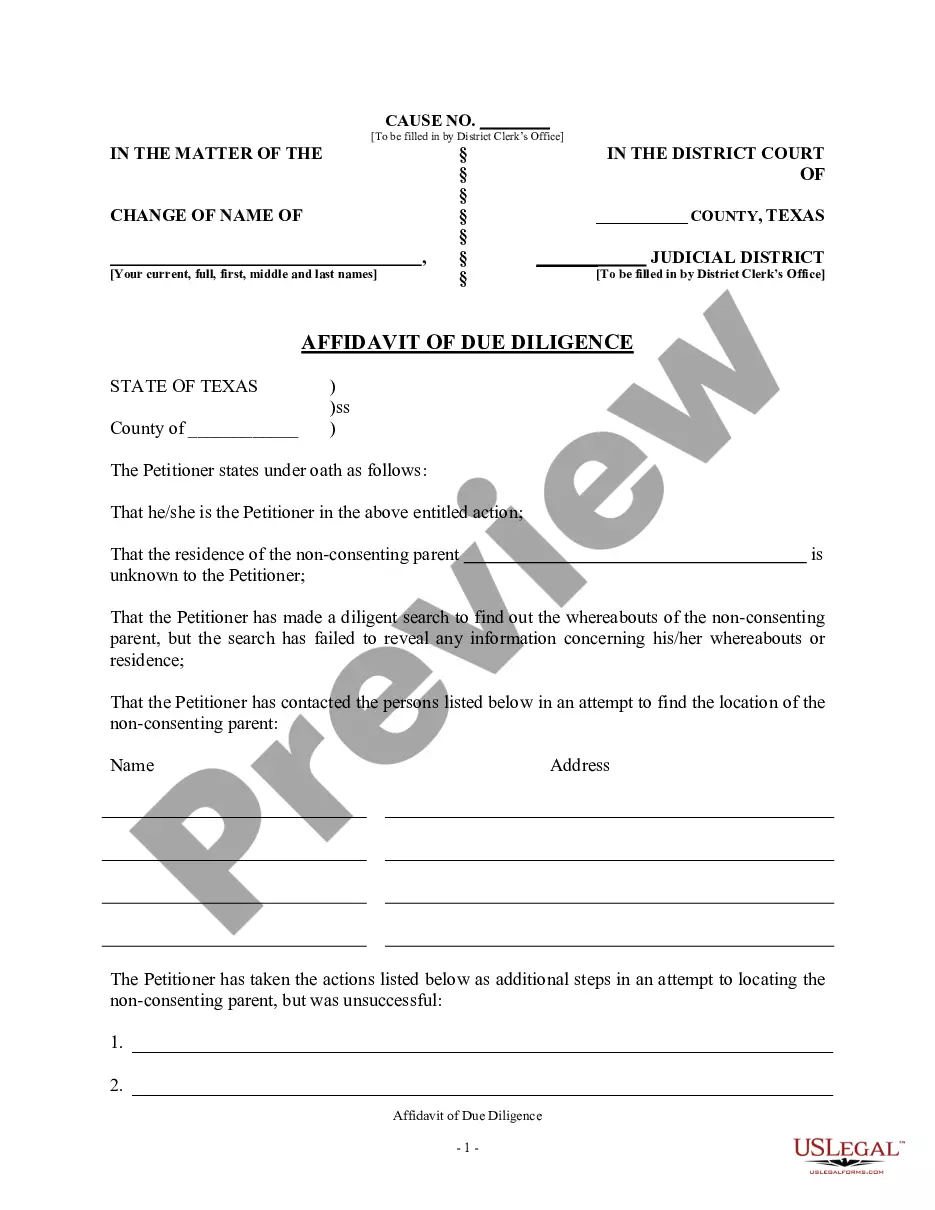

A property disclaimer is a legal document that allows a person to renounce their interest in a property or asset. In the context of North Dakota Community Property Disclaimer, it serves to clarify ownership and avoid future disputes among heirs. Essentially, it provides a formal way to communicate your decision not to accept property that may be entitled to you. For easier navigation, consider using the tailored disclaimers found on USLegalForms.

Filing a disclaimer involves a few straightforward steps. First, you will need to create a North Dakota Community Property Disclaimer document that expresses your choice to decline any ownership rights. Second, ensure you sign the document and file it with the county clerk where the property is located. If you're unsure about the process, USLegalForms can assist you with easy-to-follow templates and instructions.

An example of a disclaimer would be a statement in which an individual formally rejects their claim to a shared property. For instance, if you inherit a house along with your spouse, you can use a North Dakota Community Property Disclaimer to officially waive your rights to that property. This helps clarify ownership and simplifies the estate management process. Utilizing resources from USLegalForms can provide you with a clear template to guide you.

A beneficiary may wish to disclaim property for various reasons, including tax considerations or personal preferences. For instance, they might believe that accepting the property could lead to unforeseen financial liabilities, or they simply may not want the item in question. Using a North Dakota Community Property Disclaimer can help facilitate this process, ensuring that their rights are formally recognized. It ultimately allows the beneficiary to direct the property towards someone else who may benefit more.