North Dakota Joint Marketing Agreement between Realtor and Lender

Description

How to fill out Joint Marketing Agreement Between Realtor And Lender?

Are you currently in a situation where you require documents for either business or personal purposes almost constantly.

There are many trustworthy document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms offers a vast array of form templates, such as the North Dakota Joint Marketing Agreement between Realtor and Lender, which can be customized to meet federal and state regulations.

Once you find the right form, click Buy now.

Select the payment plan you desire, fill in the required information to create your account, and complete your order using PayPal or Visa or MasterCard.

- If you are already aware of the US Legal Forms site and have an account, simply Log In.

- Then, you can download the North Dakota Joint Marketing Agreement between Realtor and Lender template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct area/region.

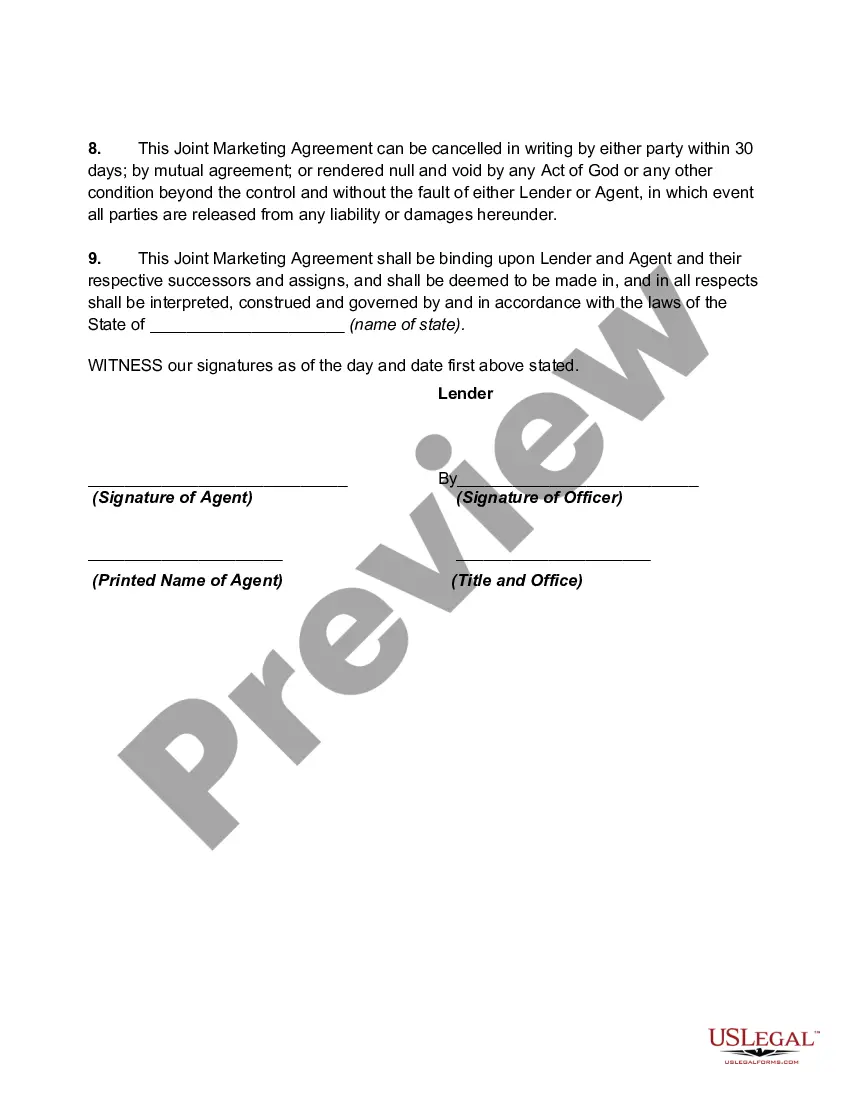

- Utilize the Preview button to examine the form.

- Read the description to verify that you have selected the right form.

- If the form is not what you need, use the Search section to locate the form that suits your needs.

Form popularity

FAQ

Yes, it is possible to be a realtor and a lender. Holding both licenses allows you to provide comprehensive services to clients, making their real estate transactions smoother. If you consider establishing a North Dakota Joint Marketing Agreement between Realtor and Lender, ensure you adhere to all legal requirements to foster a trustworthy relationship with your clients.

A joint marketing agreement involves collaboration between two parties, often a realtor and a lender, to promote their services together. This mutual effort not only helps to reach a broader audience but also enhances credibility and trust. When forming a North Dakota Joint Marketing Agreement between Realtor and Lender, both parties should outline their roles and contributions to ensure a successful partnership.

You can absolutely be a realtor while holding another job. Many professionals manage real estate careers alongside other roles, which can enhance their skills and viewpoints. If you decide to create a North Dakota Joint Marketing Agreement between Realtor and Lender, juggling these responsibilities effectively might require careful planning, but it’s completely doable.

Yes, you can be both a lender and a realtor simultaneously. This dual role can provide a unique advantage by streamlining the process for your clients. When establishing a North Dakota Joint Marketing Agreement between Realtor and Lender, transparency and compliance with local regulations remain vital to maintain trust and credibility.

The Real Estate Settlement Procedures Act (RESPA) section 8 does address co-advertising. It provides guidelines on how realtors and lenders can engage in joint marketing efforts without violating regulations. For a North Dakota Joint Marketing Agreement between Realtor and Lender, it’s crucial to understand these guidelines to ensure compliance while effectively promoting your services.

Mortgage brokers and realtors collaborate closely to ensure a smooth home buying experience for clients. They share information and resources, often guided by frameworks like the North Dakota Joint Marketing Agreement between Realtor and Lender, to provide valuable insights. This partnership helps streamline the process, making it easier for clients to secure financing and find their ideal property.

The Real Estate Settlement Procedures Act (RESPA) prohibits kickbacks and unearned fees in real estate transactions. It aims to protect consumers from unfair practices. Understanding how the North Dakota Joint Marketing Agreement between Realtor and Lender fits within RESPA's guidelines can help you navigate these regulations while collaborating effectively with mortgage professionals.

Every advertisement posted by a broker must include certain key details to ensure compliance with regulations. This typically includes the broker's name, contact information, and the North Dakota Joint Marketing Agreement between Realtor and Lender if applicable. Being transparent in your marketing helps build trust with potential clients and showcases your professionalism in the real estate industry.

Yes, it is possible to be both a real estate agent and a mortgage broker, but you must comply with state regulations. The North Dakota Joint Marketing Agreement between Realtor and Lender can provide guidance on how to effectively collaborate without conflicts of interest. Balancing these two roles can enhance your services, as it allows you to offer comprehensive support to your clients throughout the buying process.

Profit sharing in a real estate partnership is typically determined in advance based on the contributions of each partner. Common arrangements may involve equal sharing or percentages based on time, resources, and effort invested. A North Dakota Joint Marketing Agreement between Realtor and Lender can also include stipulations for profit distribution from joint marketing efforts.