This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

US Legal Forms - one of the largest libraries of authorized types in the USA - provides a variety of authorized record layouts you are able to download or print. Making use of the website, you can find thousands of types for enterprise and person uses, categorized by groups, says, or keywords.You can get the most up-to-date models of types such as the North Dakota Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement in seconds.

If you already have a subscription, log in and download North Dakota Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement in the US Legal Forms library. The Obtain switch can look on each and every develop you look at. You get access to all formerly delivered electronically types in the My Forms tab of your profile.

If you wish to use US Legal Forms initially, listed below are straightforward directions to get you started:

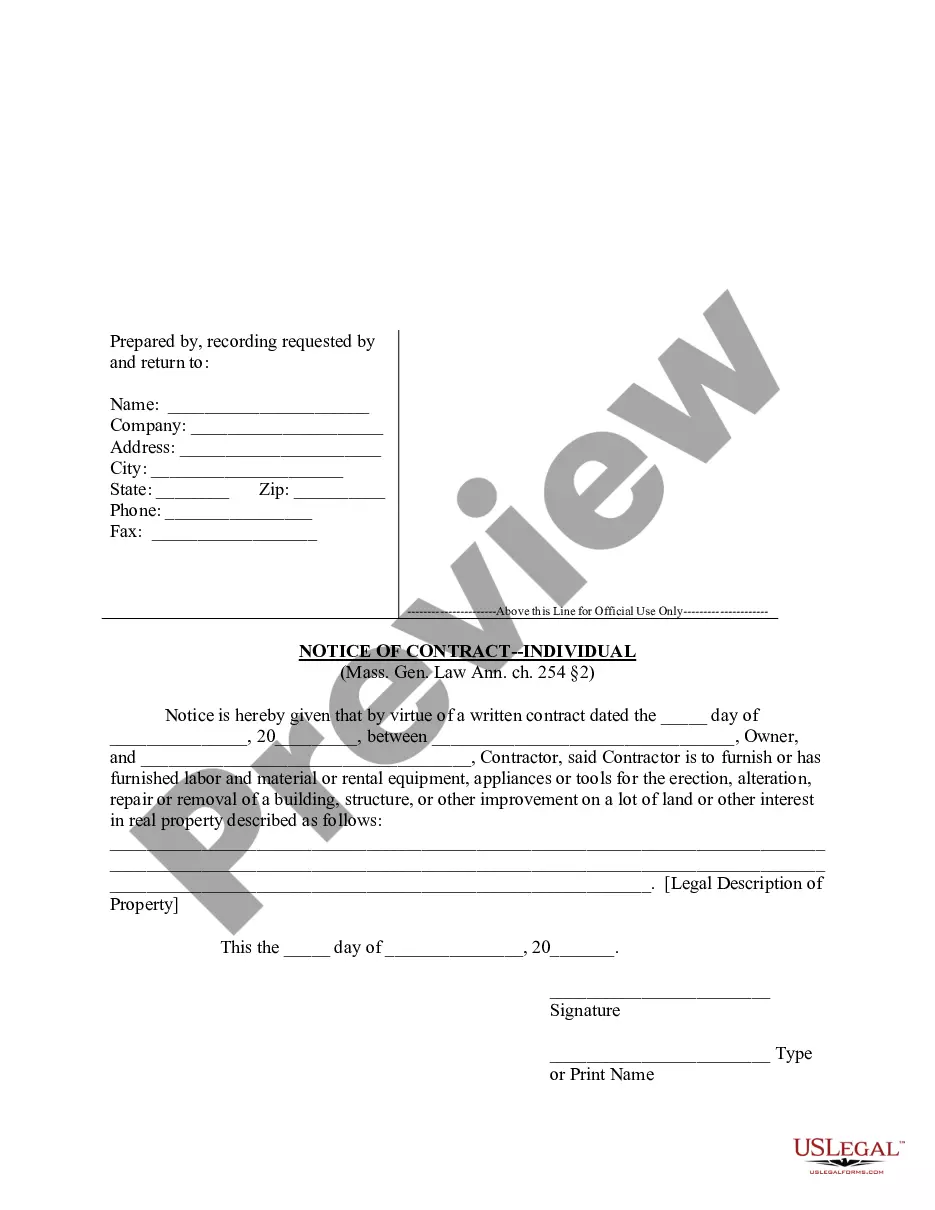

- Be sure to have picked the proper develop for the town/county. Click the Preview switch to analyze the form`s content. Look at the develop description to actually have selected the appropriate develop.

- In case the develop doesn`t suit your needs, take advantage of the Research area near the top of the display to discover the the one that does.

- If you are satisfied with the form, validate your selection by clicking on the Get now switch. Then, select the prices plan you prefer and supply your credentials to sign up to have an profile.

- Approach the purchase. Utilize your bank card or PayPal profile to complete the purchase.

- Choose the formatting and download the form on your own system.

- Make changes. Complete, revise and print and indicator the delivered electronically North Dakota Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement.

Every single format you put into your money does not have an expiry particular date and it is your own forever. So, if you would like download or print one more version, just proceed to the My Forms segment and then click on the develop you require.

Gain access to the North Dakota Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement with US Legal Forms, one of the most considerable library of authorized record layouts. Use thousands of expert and condition-particular layouts that meet your small business or person requirements and needs.

Form popularity

FAQ

An agreement to sell is an executory contract of sale. Under the Sale of Goods Act 1979, s 2 (5): where under a contract of sale the transfer of the property in the goods is to take place at a future time, or subject to some condition later to be fulfilled, the contract is called an agreement to sell.

Unlike a sale involving a mortgage, there is no transfer of the principal from buyer to seller. Instead, the agreement is that the buyer will repay that sum over time. This alternative to traditional financing can be useful in certain situations or in places where mortgages are hard to get.

Buyer Benefits Alternative to traditional loans: For low-income or first-time buyers who might not qualify for traditional loans, seller financing is a more attainable option. Faster closing: By avoiding the traditional mortgage process, buyers are able to move into their new home faster.

Contract for Deed. - After, a contract for deed has been signed by the parties, the vendor retains the legal title to the land until the vendee has fully performed the terms of the contract. However, the law regards the vendee, as the owner of the property for most purposes, since the vendee ordinarily gets the.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.

Disadvantages Of Seller Financing Fewer regulations that protect home buyers. Buyers still vulnerable to foreclosure if seller doesn't make mortgage payments to senior financing. No home inspection/PMI may result in buyer paying too much for the property. Higher interest rates and bigger down payment required.

Average length of note: Five years, but it varies from three to seven years. Average down payment: Usually 50%, but it varies from 30% to 80%. All cash deals: Less than 10% of businesses sell for all cash.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.