The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

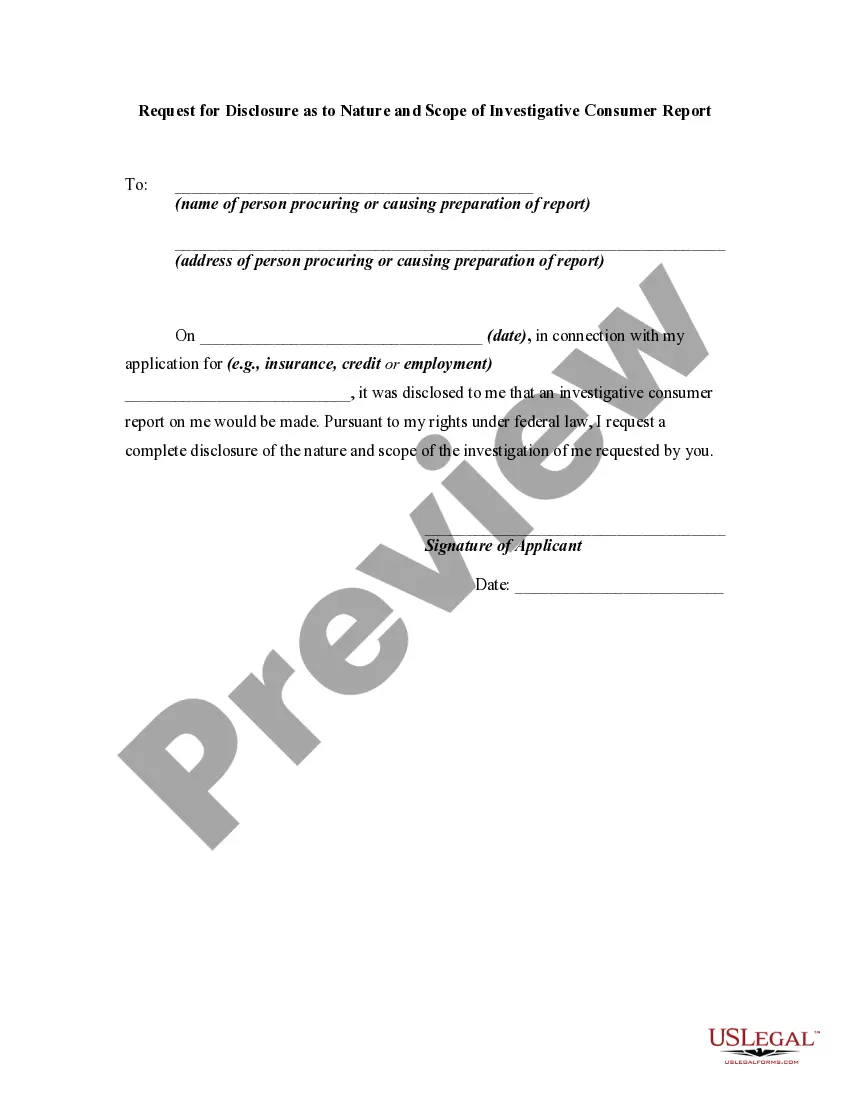

North Dakota Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Denial Of Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

If you need to comprehensive, acquire, or print lawful document layouts, use US Legal Forms, the biggest collection of lawful varieties, which can be found on-line. Make use of the site`s basic and handy look for to obtain the paperwork you will need. Various layouts for business and person purposes are categorized by groups and says, or keywords. Use US Legal Forms to obtain the North Dakota Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency in just a couple of click throughs.

When you are currently a US Legal Forms customer, log in to your bank account and click the Obtain button to get the North Dakota Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. You may also access varieties you in the past saved inside the My Forms tab of your own bank account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper area/country.

- Step 2. Take advantage of the Review option to look through the form`s content. Don`t neglect to see the explanation.

- Step 3. When you are unhappy together with the develop, utilize the Lookup area near the top of the monitor to discover other types of your lawful develop design.

- Step 4. After you have discovered the shape you will need, click on the Purchase now button. Choose the prices strategy you prefer and add your references to register on an bank account.

- Step 5. Process the transaction. You may use your charge card or PayPal bank account to finish the transaction.

- Step 6. Pick the format of your lawful develop and acquire it on the gadget.

- Step 7. Full, change and print or signal the North Dakota Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Each lawful document design you purchase is your own property permanently. You have acces to every single develop you saved with your acccount. Click on the My Forms section and decide on a develop to print or acquire once again.

Be competitive and acquire, and print the North Dakota Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency with US Legal Forms. There are millions of skilled and condition-certain varieties you can utilize to your business or person needs.

Form popularity

FAQ

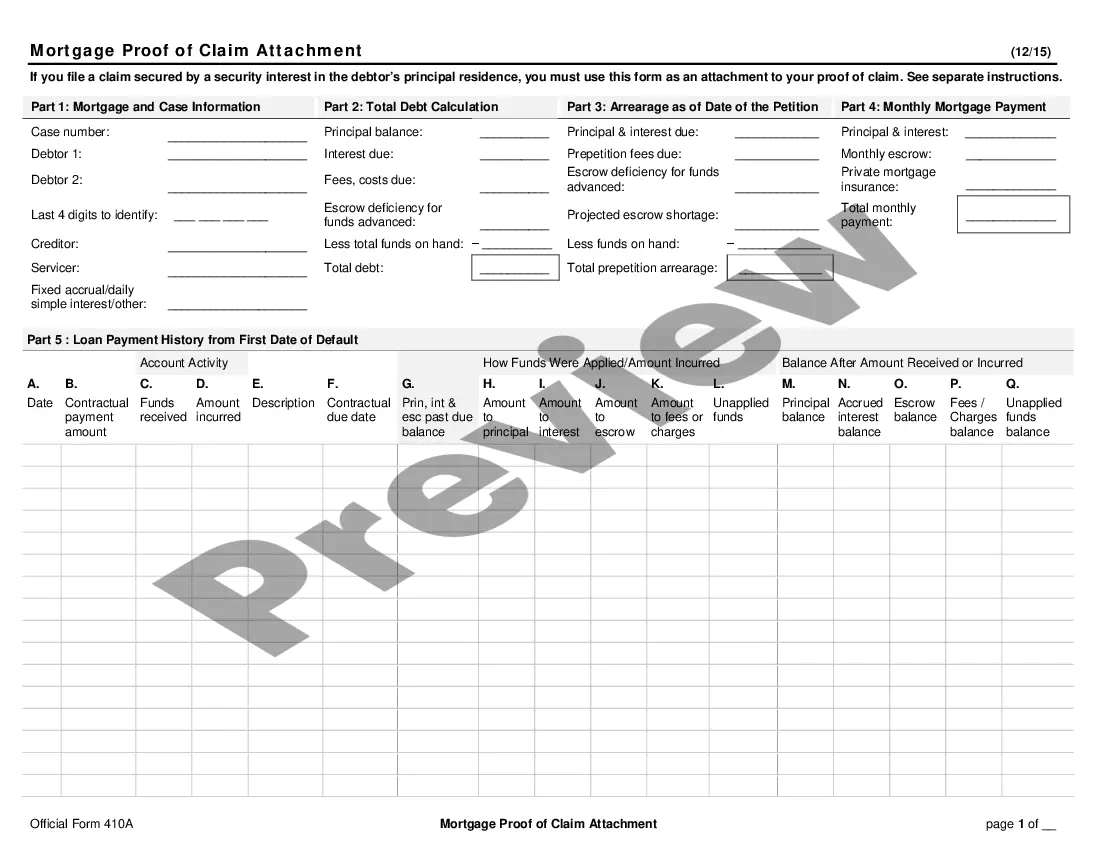

If you deny a consumer credit based on information in a consumer report, you must provide an ?adverse action? notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a ?risk-based pricing? notice.

A statement of action taken by the creditor. Either a statement of the specific reasons for the action taken or a disclosure of the applicant's right to a statement of specific reasons and the name, address, and telephone number of the person or office from which this information can be obtained.

How do you respond to an adverse action notice? If you get an adverse action notice, you don't have to respond in any way. But if you disagree with the action and want to dispute or appeal the decision, you may have an opportunity to do so.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

A creditor must disclose the principal reasons for denying an application or taking other adverse action. The regulation does not mandate that a specific number of reasons be disclosed, but disclosure of more than four reasons is not likely to be helpful to the applicant.

A written statement of actual and specific reasons for the adverse action or, if not providing the specific reason within the written notice, a statement that the applicant has a right to receive the specific reason for adverse action if requested within 60 days of the notification.

The notice must either disclose the applicant's right to a statement of specific reasons within 30 days, or give the primary reasons each creditor relied upon in taking the adverse action - clearly indicating which reasons relate to which creditor.

Numerous options exist on adverse action notices for reasons for the action taken. In providing documentation to the applicant, provide the reasons in the order of prominence to the action taken. Provide all the main reasons for the action; however, providing more than four reasons should generally be avoided.