North Dakota Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

Are you presently in a circumstance where you require documents for both business or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of template forms, such as the North Dakota Sample Letter for Withheld Delivery, designed to comply with state and federal regulations.

When you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Dakota Sample Letter for Withheld Delivery template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

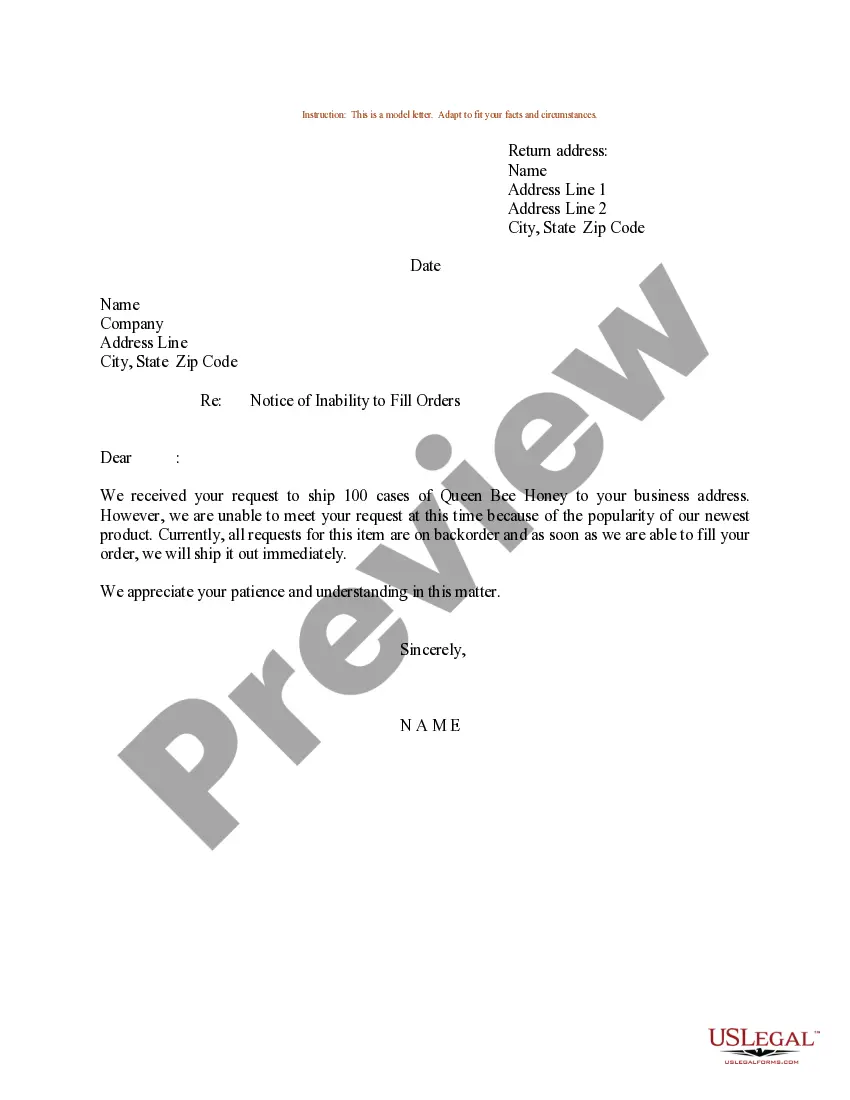

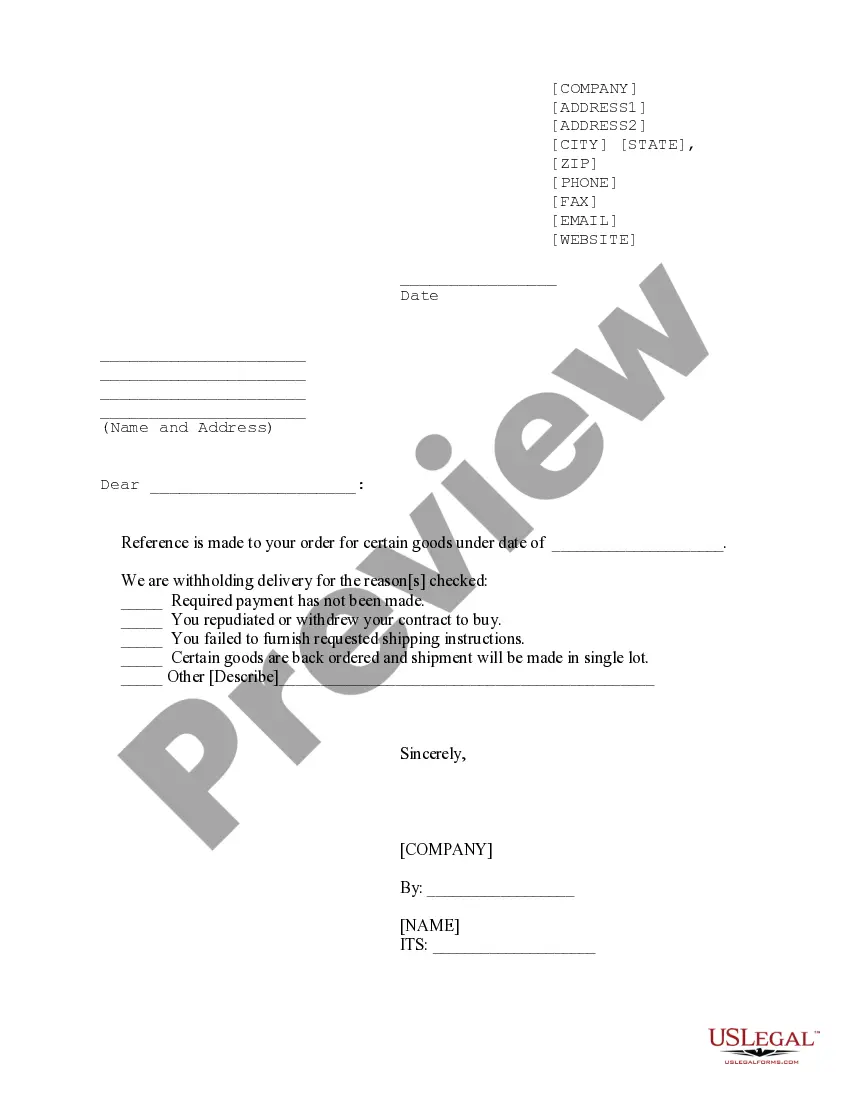

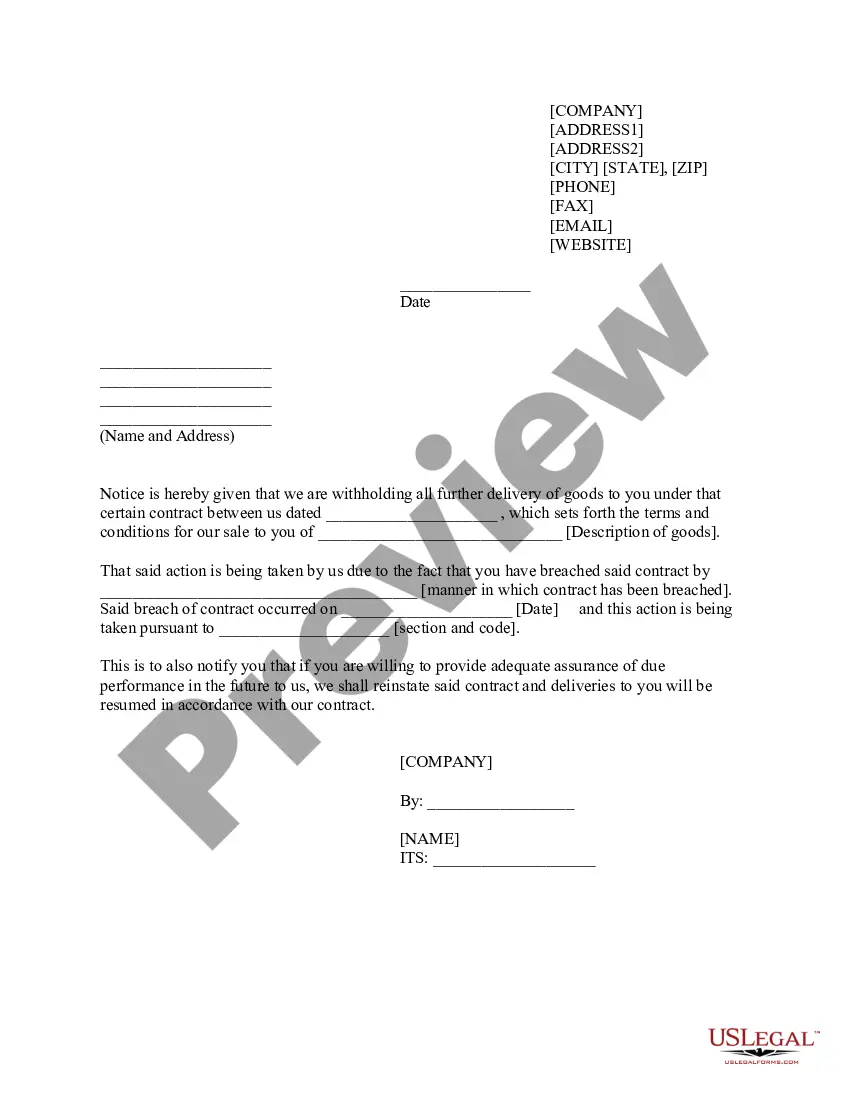

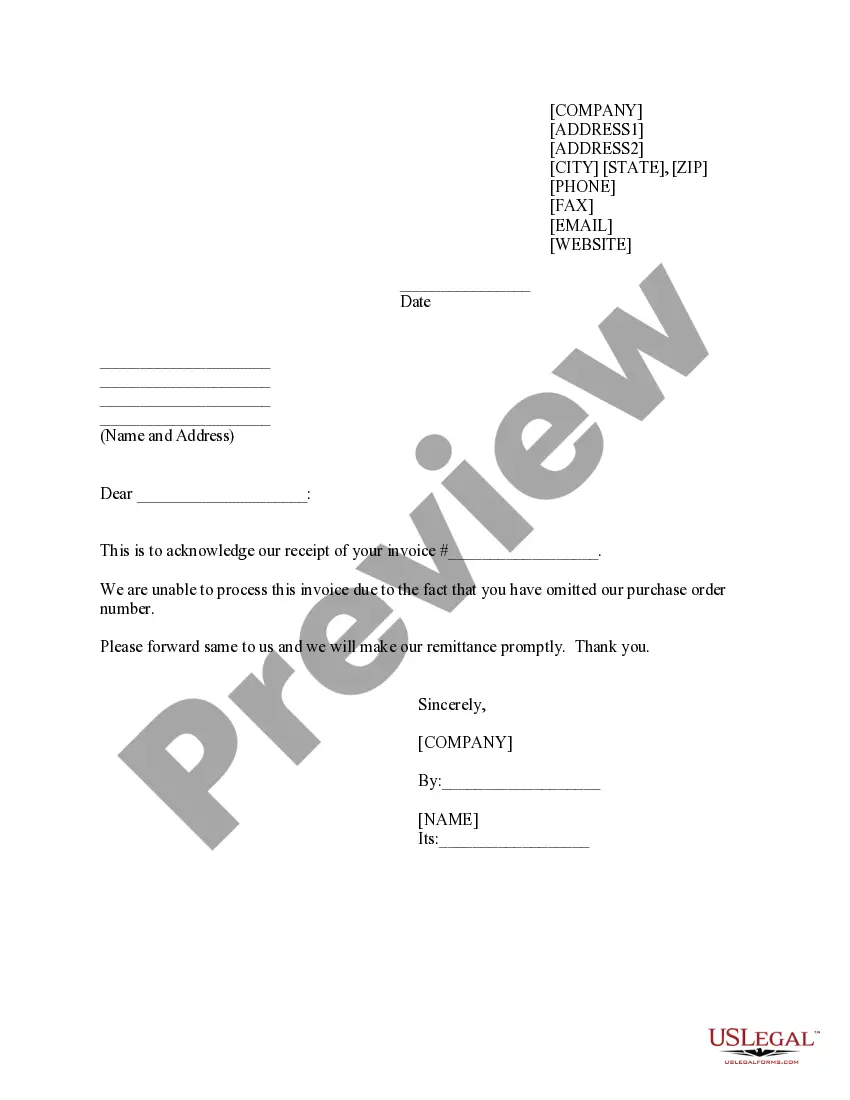

- Use the Review button to check the form.

- Review the description to verify that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, you can carry forward a net operating loss in North Dakota, which may provide you with potential tax relief in future years. Understanding the specifics of carryforwards is essential for maximizing your tax benefits. If you have concerns about how to manage such losses or need additional clarity, consider using the North Dakota Sample Letter for Withheld Delivery for effective communication with tax authorities.

Individuals who earn income from North Dakota sources and do not live in the state need to file a North Dakota nonresident tax return. This often includes income from jobs, businesses, or rental properties located in North Dakota. Filing can feel complicated, but using tools like the North Dakota Sample Letter for Withheld Delivery can help you clarify your obligations while ensuring compliance.

ND Form 307 is a North Dakota document used for notifying agencies about the delivery of certain items that have been withheld. This form may come in handy if you're dealing with a situation related to deliveries not reaching their intended destination. By understanding how to fill out the ND Form 307, you can streamline your communication process and effectively utilize the North Dakota Sample Letter for Withheld Delivery for your needs.

Yes, North Dakota provides a state tax withholding form for employers to fulfill their tax obligations. Utilizing this form helps to ensure that you are withholding the correct amounts for employee salaries. It’s important to keep updated with any changes in these forms. For clarity on filling it out, refer to the North Dakota Sample Letter for Withheld Delivery.

North Dakota does offer a specific state withholding form for employers to use. This form is crucial for reporting the income tax amounts withheld from employee wages. Employing the correct form ensures compliance with state regulations. For assistance with this process, consider the North Dakota Sample Letter for Withheld Delivery.

Your North Dakota withholding account number is assigned by the state when you register for withholding taxes. This number is essential for accurately reporting and remitting taxes. If you have questions regarding your account number, reaching out to the state's tax office is advisable. You may also find guidance through a North Dakota Sample Letter for Withheld Delivery.

The total loss threshold in North Dakota refers to the amount one must reach before certain tax benefits can be claimed. It helps define how losses can offset income for tax purposes. Understanding this threshold can lead to better financial planning. For more details, consult a North Dakota Sample Letter for Withheld Delivery.

Yes, North Dakota has its own state income tax form that residents must file annually. This form collects information on your income and is used to calculate your tax liability. Familiarizing yourself with the state income tax form is essential for compliance. To simplify the process, consider a North Dakota Sample Letter for Withheld Delivery.

The Nexus threshold in North Dakota varies based on factors such as sales volume and physical presence. If your business exceeds certain sales figures or has a brick-and-mortar location in the state, it likely has nexus. Understanding this threshold will help you comply with state tax laws efficiently. For more information, utilize the North Dakota Sample Letter for Withheld Delivery.

Nexus refers to the level of connection a business has with North Dakota, which determines tax obligations. If a business has a physical presence, employees, or significant sales in the state, it establishes nexus and must consider state tax laws. Keeping compliant with these regulations is vital. If you need assistance, a North Dakota Sample Letter for Withheld Delivery can help clarify your obligations.