North Dakota Receipt Template for Cash Payment

Description

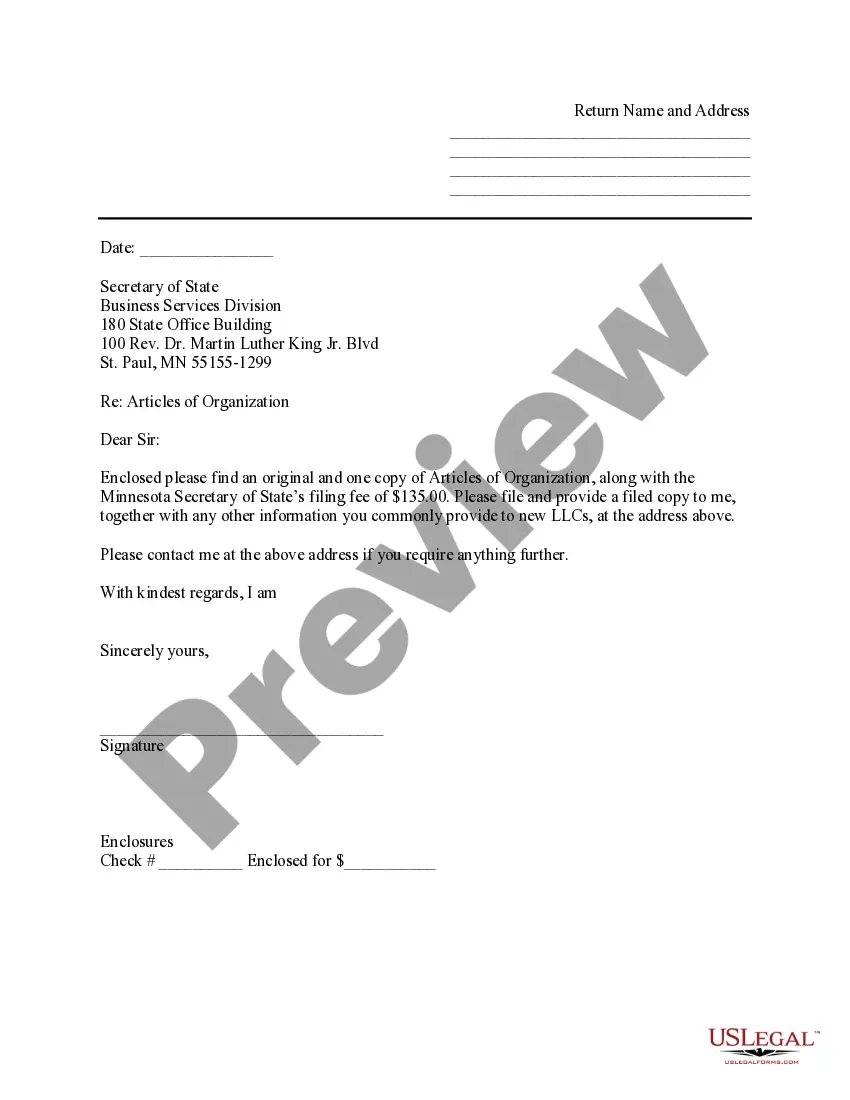

How to fill out Receipt Template For Cash Payment?

If you want to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site's easy and user-friendly search function to locate the documents you require.

A variety of templates for business and personal purposes are categorized by sections and suggestions, or keywords. Use US Legal Forms to quickly find the North Dakota Receipt Template for Cash Payment with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the North Dakota Receipt Template for Cash Payment. You can also access forms you previously downloaded in the My documents tab of your account.

Every legal document template you download is yours indefinitely. You will have access to each form you've downloaded in your account. Review the My documents section and select a document to print or download again.

Compete and acquire, and print the North Dakota Receipt Template for Cash Payment using US Legal Forms. There are countless professional and state-specific forms you can utilize for your personal or business needs.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Preview option to examine the form's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other variations of the legal template.

- Step 4. Once you have located the form you want, click the Acquire now button. Choose your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the North Dakota Receipt Template for Cash Payment.

Form popularity

FAQ

This is the information that should be included on a receipt: Your company's details including name, address, telephone number, and/or e-mail address. The date the transaction took place. List of products/services with a brief description of each along with the quantity delivered.

How to Write a ReceiptDate;Receipt Number;Amount Received ($);Transaction Details (what was purchased?);Received by (seller);Received from (buyer);Payment Method (cash, check, credit card, etc.);Check Number (if applicable); and.More items...?

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

Common proofs of payment include a check or credit card statement showing that the bill was paid. Other forms of proof may be a store receipt, credit card receipt, or paid invoice.

Format of Cash ReceiptThe date on which the transaction happened.The unique number assigned to the document for identification.The name of the customer.The amount of cash received.The method of payment, i.e., by cash, cheque, etc.;The signature of the vendor.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

Generally, paying wages in cash is as legal as a paycheck or direct deposit as long as the employer adheres to federal and SALT compliance laws. An employee should expect a stub or statement along with the cash payment indicating that all withholding payments are being deducted.

Cash receipts procedureRecord Checks and Cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.Forward Payments.Apply Cash to Invoices.Record Other Cash (Optional)Deposit Cash.Match to Bank Receipt.

Regardless of what you're paying for, if it's a legitimate transaction, you should be entitled to a receipt of some kind. This is especially true in the case of rent payments. If your landlord accepts rent payments in cash, you must get a receipt for each payment you make.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.