North Dakota Receipt for Money Paid on Behalf of Another Person

Description

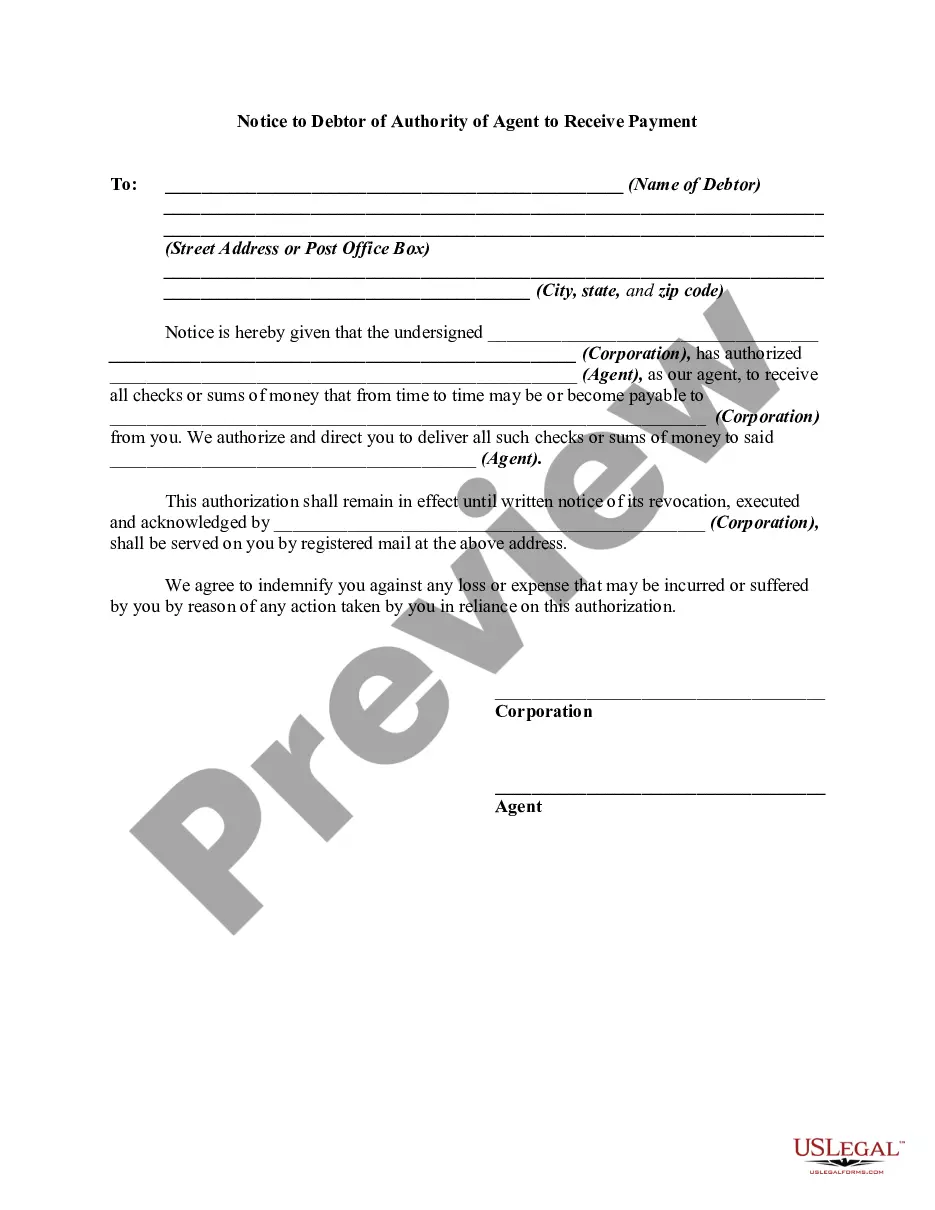

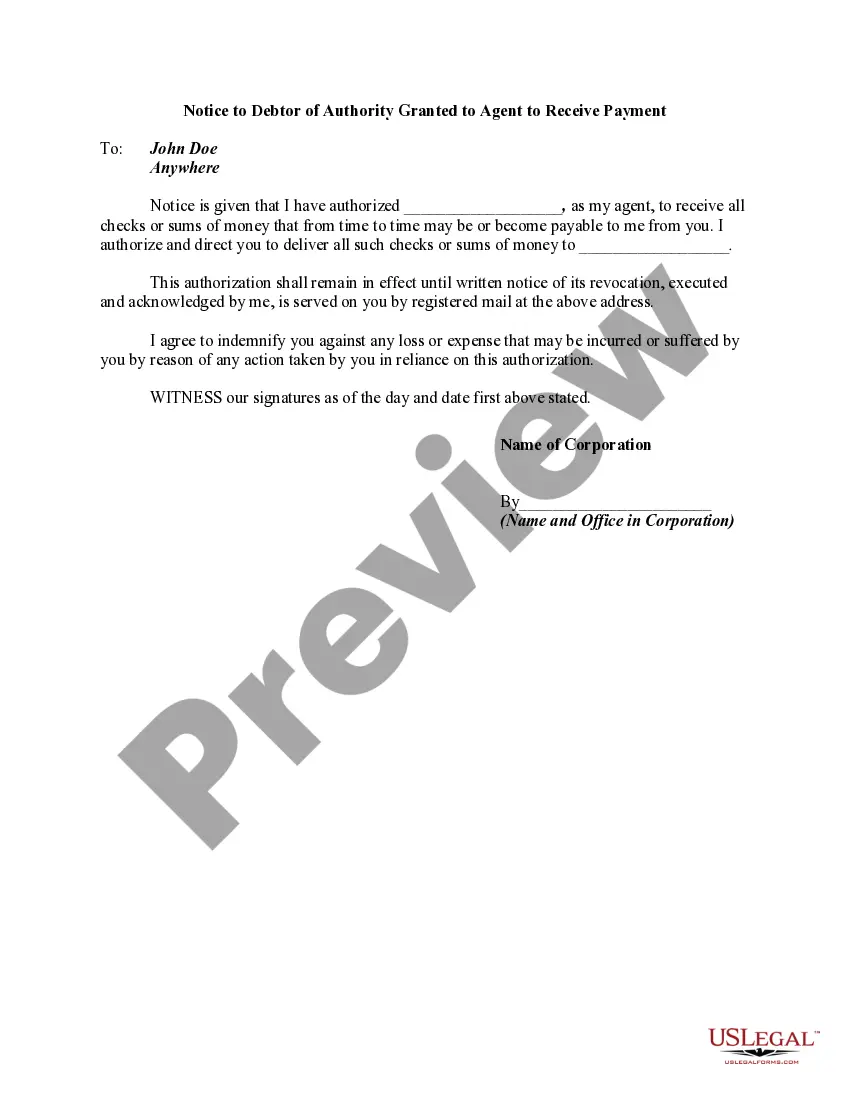

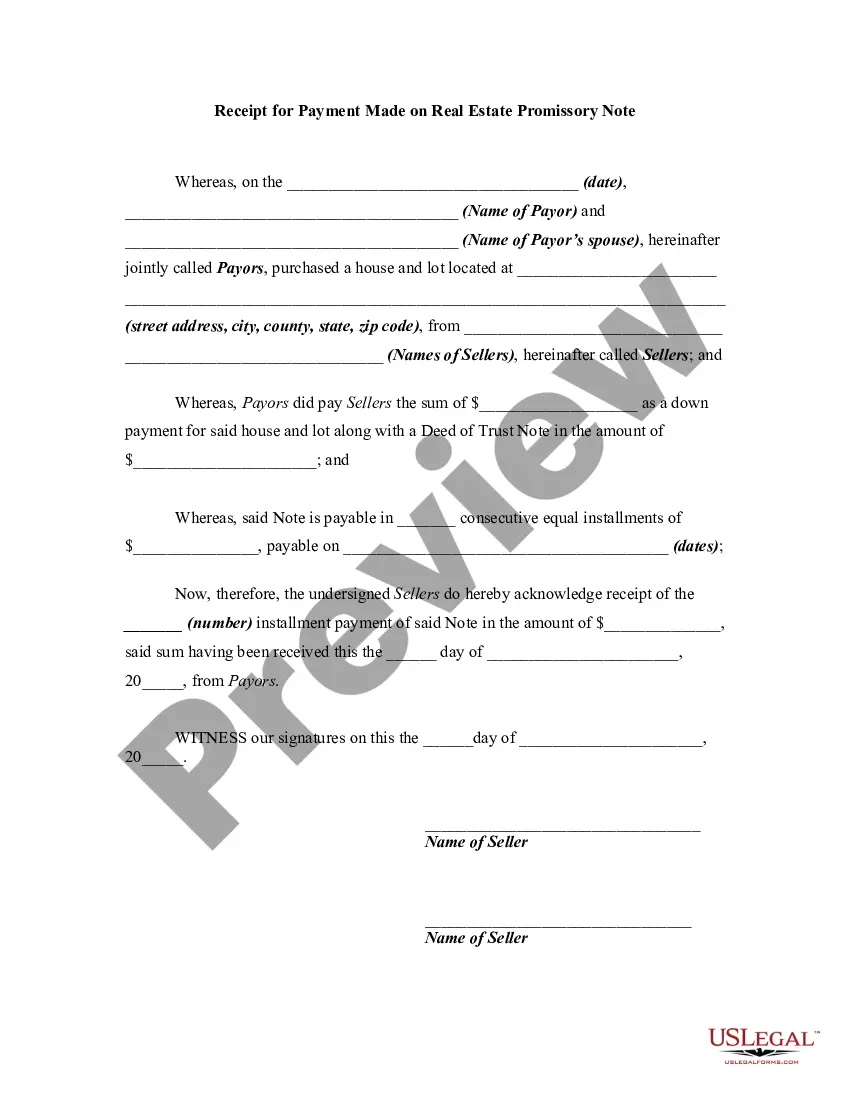

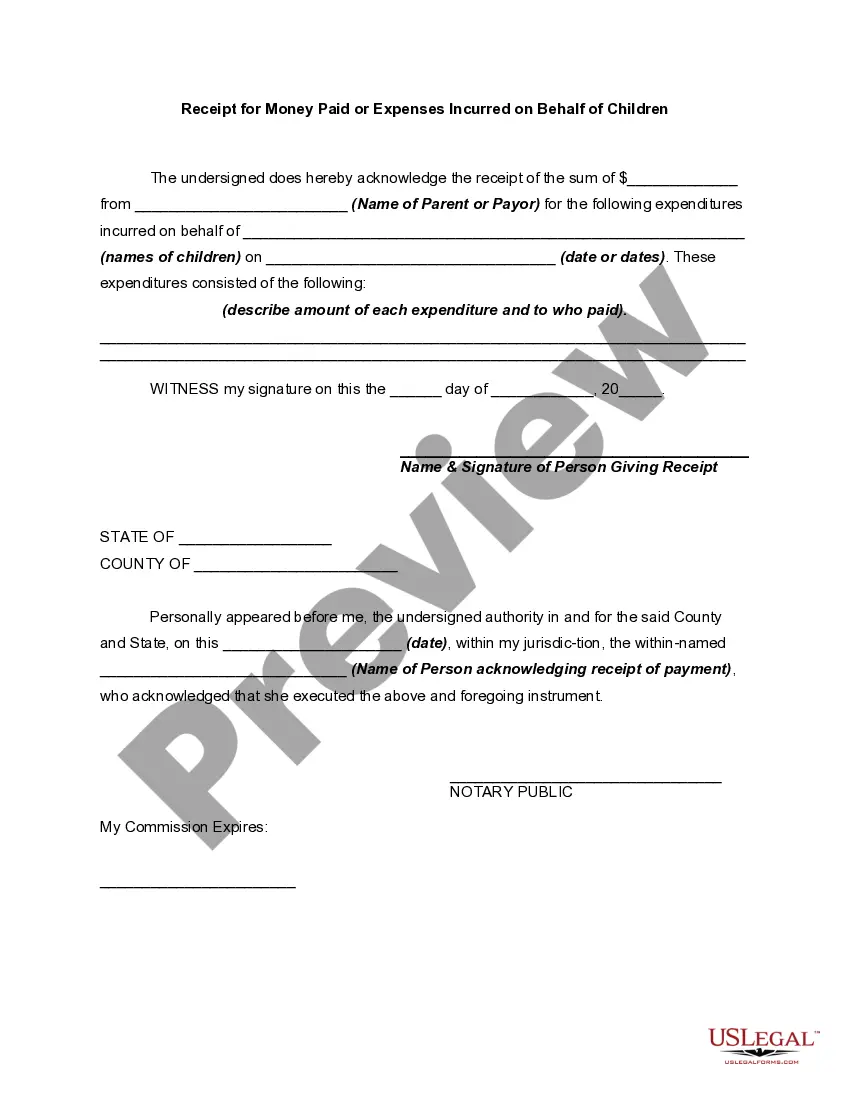

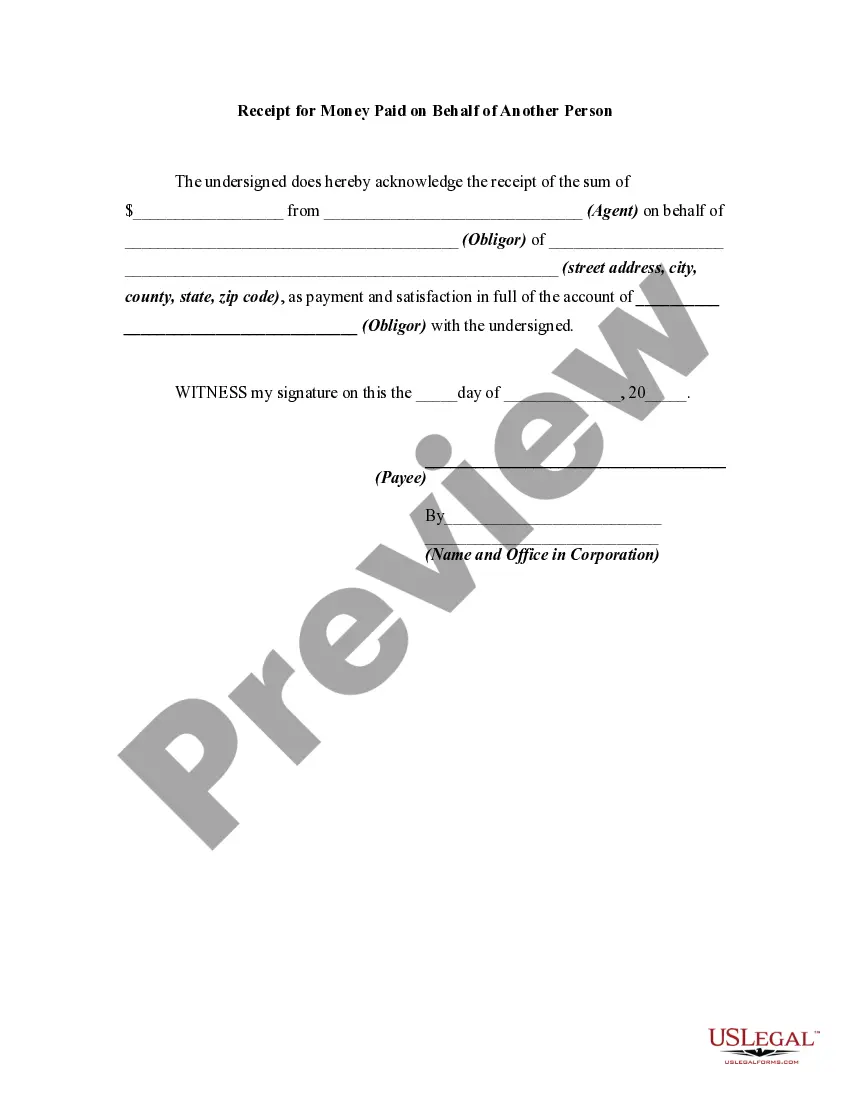

How to fill out Receipt For Money Paid On Behalf Of Another Person?

If you wish to be thorough, acquire, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the site’s straightforward and efficient search feature to find the documents you require.

Various templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to create an account.

- Utilize US Legal Forms to find the North Dakota Receipt for Money Paid on Behalf of Another Individual with a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the North Dakota Receipt for Money Paid on Behalf of Another Individual.

- You can also access forms you previously obtained under the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for your relevant city/state.

- Step 2. Use the Preview mode to review the form’s content. Don’t forget to read the description.

Form popularity

FAQ

Pay all or some of your North Dakota income taxes online via: NDTAP. Paying your ND taxes online on time will be considered a ND tax extension and you do not have to mail in Form ND-1EXT.

State Sales Tax The North Dakota sales tax rate is 5% for most retail sales.

2021 North Dakota State Tax PaymentsPay with Direct Debit. You can use this payment option when you e-file with us.Pay with a Credit Card. Visit the ND Taxpayer Access Point (TAP) website. Due by April 18, 2022.Pay by Mail. If mailing your tax return, mail in a check or money order with Form ND-1PRV.

North Dakota levies one of the lowest progressive state income taxes in the country, with rates ranging from 1.10% to 2.90%. This top rate is among the lowest of the states that have an income tax.

To register to collect and remit applicable sales and use tax in North Dakota ONLY, complete the online application on ND TAP. To register to collect sales tax in multiple states, use the Streamline Sales Tax Registration.

Purchases subject to sales tax in North Dakota generally include those of tangible personal property, magazines and other periodicals, and admission for recreational activities. Rentals and leases of tangible personal property, as well as that of hotel and similar accommodations, are also taxable.

North Dakota levies one of the lowest progressive state income taxes in the country, with rates ranging from 1.10% to 2.90%. This top rate is among the lowest of the states that have an income tax.

North Dakota is a somewhat tax-friendly destination for retirees. It recently became one of the states to stop taxing Social Security, though it still taxes most income from retirement accounts and pensions. That being said, income tax rates in North Dakota are quite low.

Goods that are subject to sales tax in North Dakota include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Gift Tax. North Dakota does not have a gift tax.