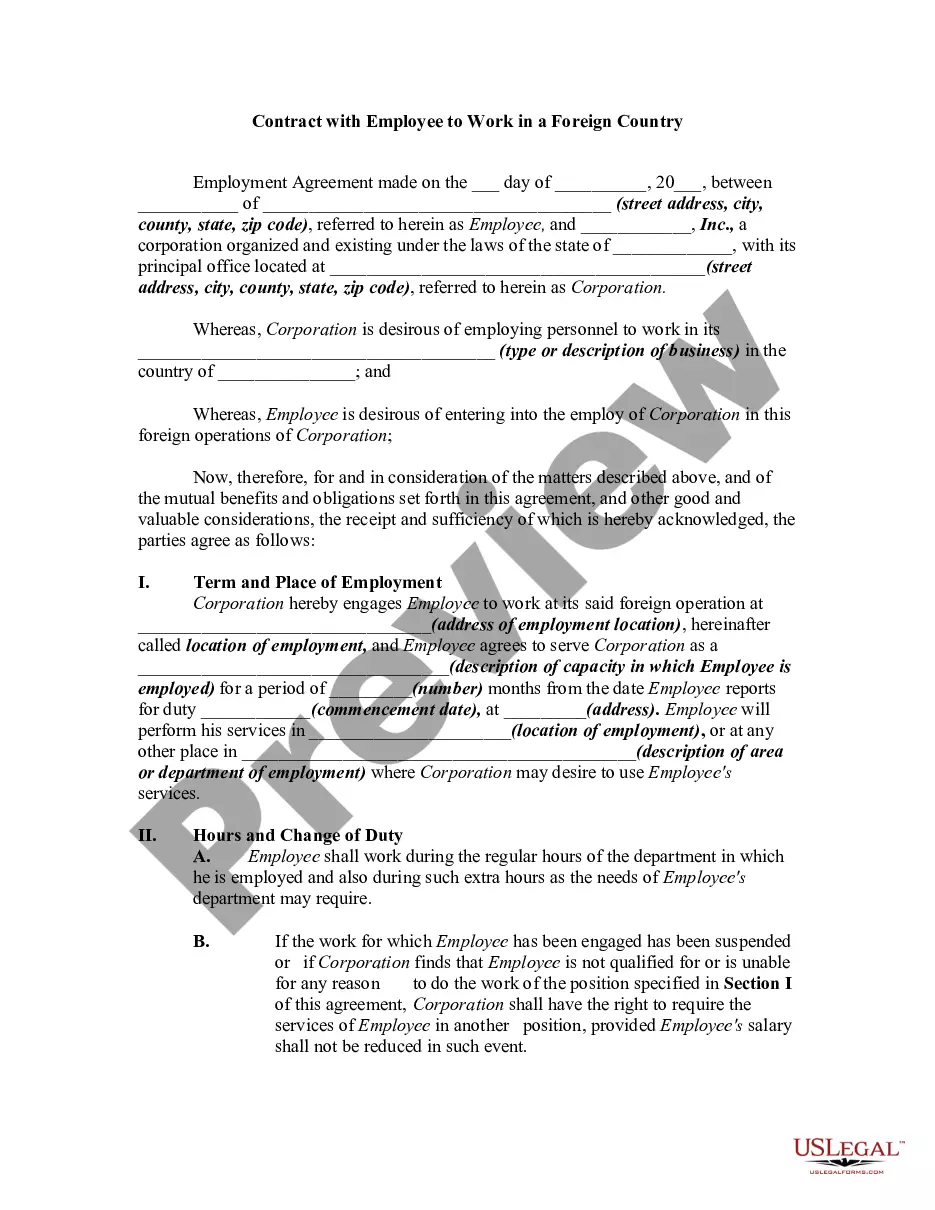

North Dakota Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest forms such as the North Dakota Contract with Employee to Work in a Foreign Country in just minutes.

Read the form description to confirm you have chosen the correct template.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already hold a membership, Log In to download the North Dakota Contract with Employee to Work in a Foreign Country from the US Legal Forms catalog.

- The Download button will be visible on every template you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To get started with US Legal Forms for the first time, here are easy instructions.

- Ensure you have selected the appropriate form for your city/county.

- Click the Review button to examine the form’s details.

Form popularity

FAQ

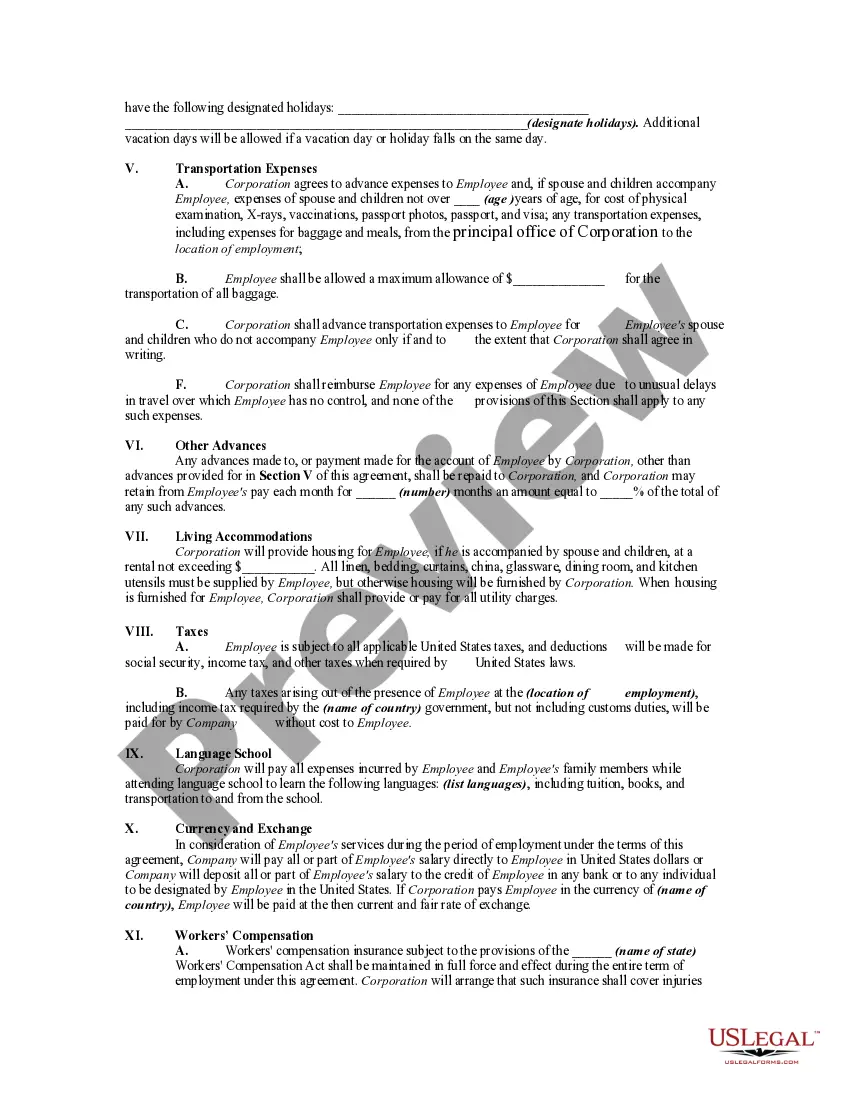

The withholding rate for a nonresident partner in North Dakota is typically based on the partner's share of income effectively connected to the state. This is important to understand if partnerships engage nonresident individuals. When working under a North Dakota Contract with Employee to Work in a Foreign Country, appropriate withholding can alleviate future tax burdens. Consulting with a tax professional can ensure you meet all necessary requirements.

Nonresident withholding tax in the US refers to the tax withheld from payments made to foreign individuals or entities earning income in the country. Each state, including North Dakota, imposes its own rules regarding withholding for nonresidents. If you’re navigating a North Dakota Contract with Employee to Work in a Foreign Country, grasping these tax implications is key to ensuring compliance and avoiding unexpected liabilities.

To be considered a resident of North Dakota, you generally need to live in the state for more than 183 days during the year. This timeframe includes maintaining a permanent home and establishing ties to the state. If you hold a North Dakota Contract with Employee to Work in a Foreign Country, understanding residency rules can influence your tax returns and obligations, so it’s valuable to get informed.

Individuals who earn income from North Dakota sources must file a nonresident tax return, including those with foreign contracts. If you've signed a North Dakota Contract with Employee to Work in a Foreign Country and receive payment for your work, filing is necessary. This process helps in accurately reporting and paying your taxes, thus avoiding any potential issues with the state.

Yes, North Dakota has an AW-4 form, which is used for withholding allowances for non-resident employees. This form allows employees to indicate their number of allowances for state income tax withholding purposes. If you are dealing with a North Dakota Contract with Employee to Work in a Foreign Country, utilizing the AW-4 form correctly can help ensure the right amount of tax is withheld from your paycheck.

Nonresidents who earn income from sources within North Dakota must file a North Dakota nonresident tax return. This includes individuals who have a contract, such as a North Dakota Contract with Employee to Work in a Foreign Country, and earn income from work performed in the state. Failing to file can result in penalties, so it’s essential to ensure compliance with your tax obligations.

Partnership withholding for nonresidents in North Dakota refers to the tax that partnerships must withhold from payments made to partners who do not reside in the state. This withholding is important for ensuring compliance with North Dakota tax laws. If you have a North Dakota Contract with Employee to Work in a Foreign Country, it’s crucial to understand these withholding obligations. Proper guidance can help you manage tax liabilities effectively.

Foreign exchange contracts, often referred to as FX contracts, involve agreements to exchange currency at a fixed rate at a future date. While not directly related to a North Dakota Contract with Employee to Work in a Foreign Country, understanding FX contracts can be crucial for companies hiring employees abroad. These agreements help mitigate risks related to currency fluctuations, allowing businesses to budget effectively. For insights and structured templates, consider using resources available at US Legal Forms.

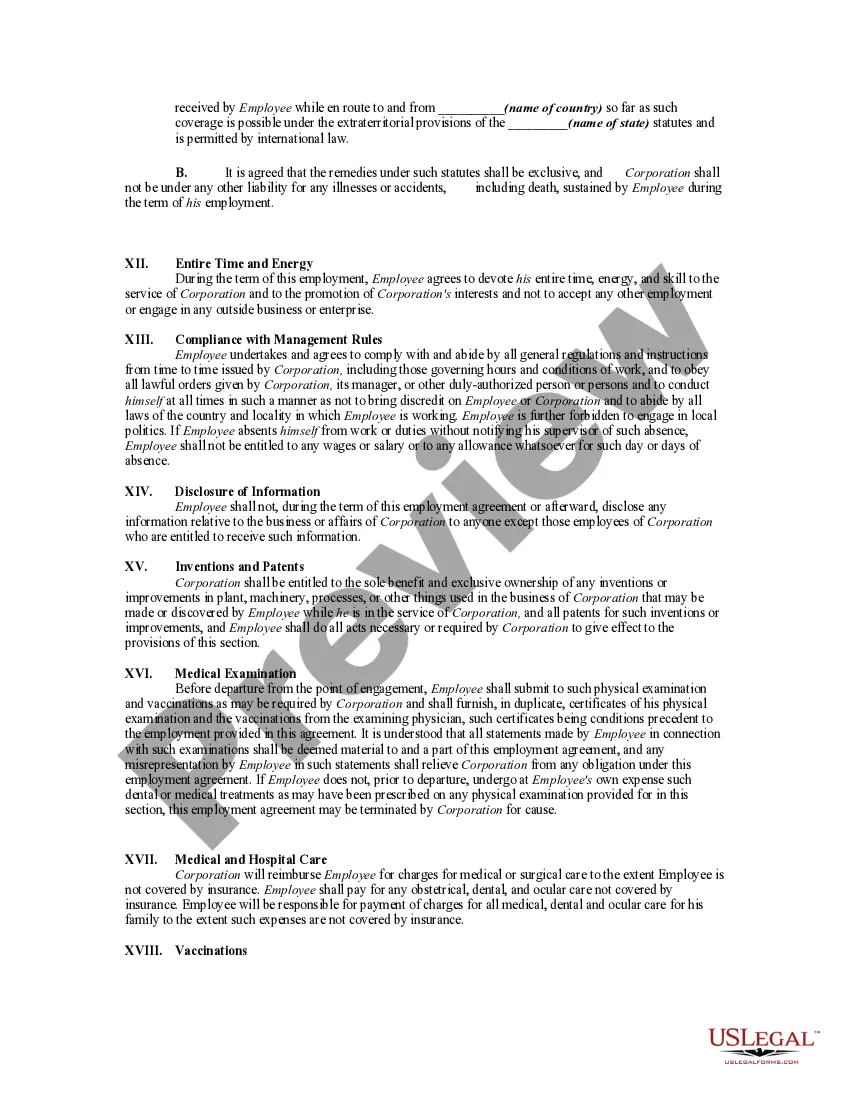

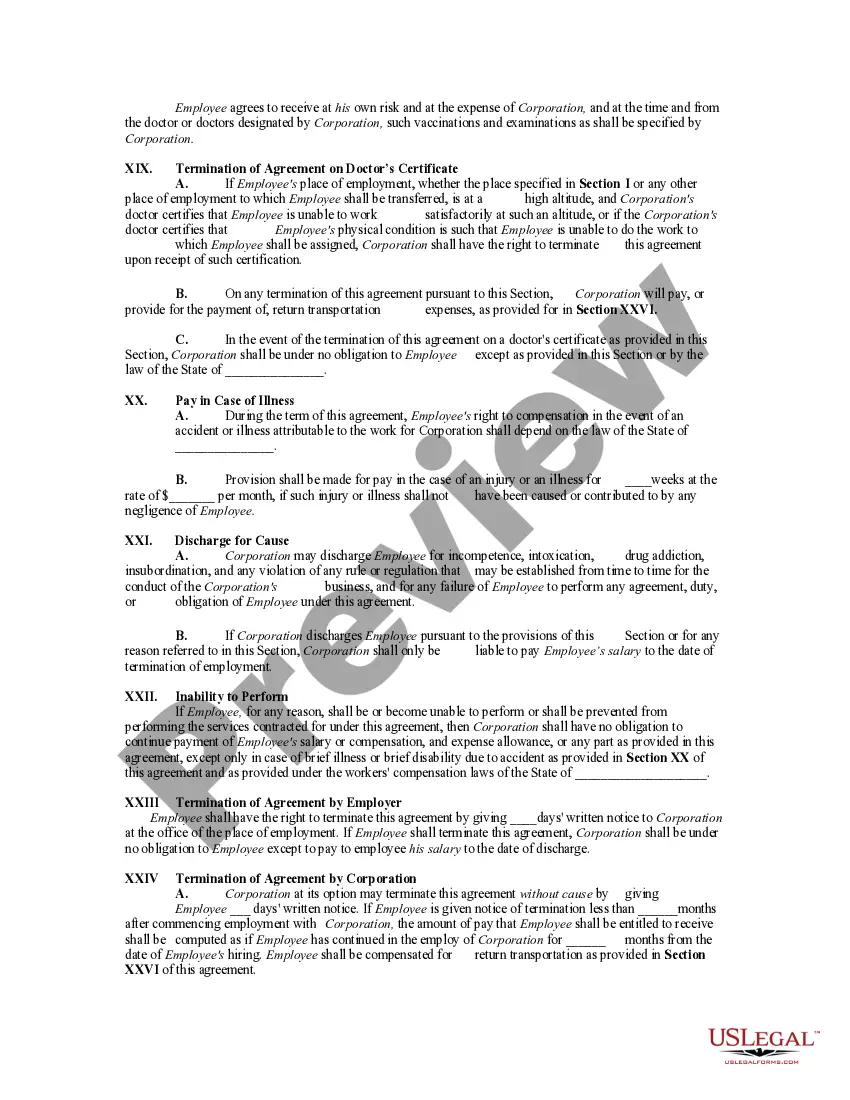

A foreign contract employee is typically an individual hired by a company to work outside the employee's home country under a defined contract. This may involve using a North Dakota Contract with Employee to Work in a Foreign Country that outlines specific job roles, compensation, and legal responsibilities. Such arrangements can offer flexibility for companies looking to expand their workforce globally. Proper documentation and clear agreements are essential to ensure compliance.

To secure a government contract job overseas, start by identifying potential opportunities available through federal agencies. You may need to create a comprehensive application that includes a North Dakota Contract with Employee to Work in a Foreign Country as part of your proposal. Additionally, networking and leveraging platforms that specialize in government contracts can enhance your chances. Consider exploring US Legal Forms for templates that may support your application efforts.