For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

North Dakota Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Are you currently in a circumstance where you require documents for either business or personal reasons nearly every day of the week.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast assortment of form templates, such as the North Dakota Multistate Promissory Note - Unsecured - Signature Loan, which can be customized to satisfy federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the North Dakota Multistate Promissory Note - Unsecured - Signature Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

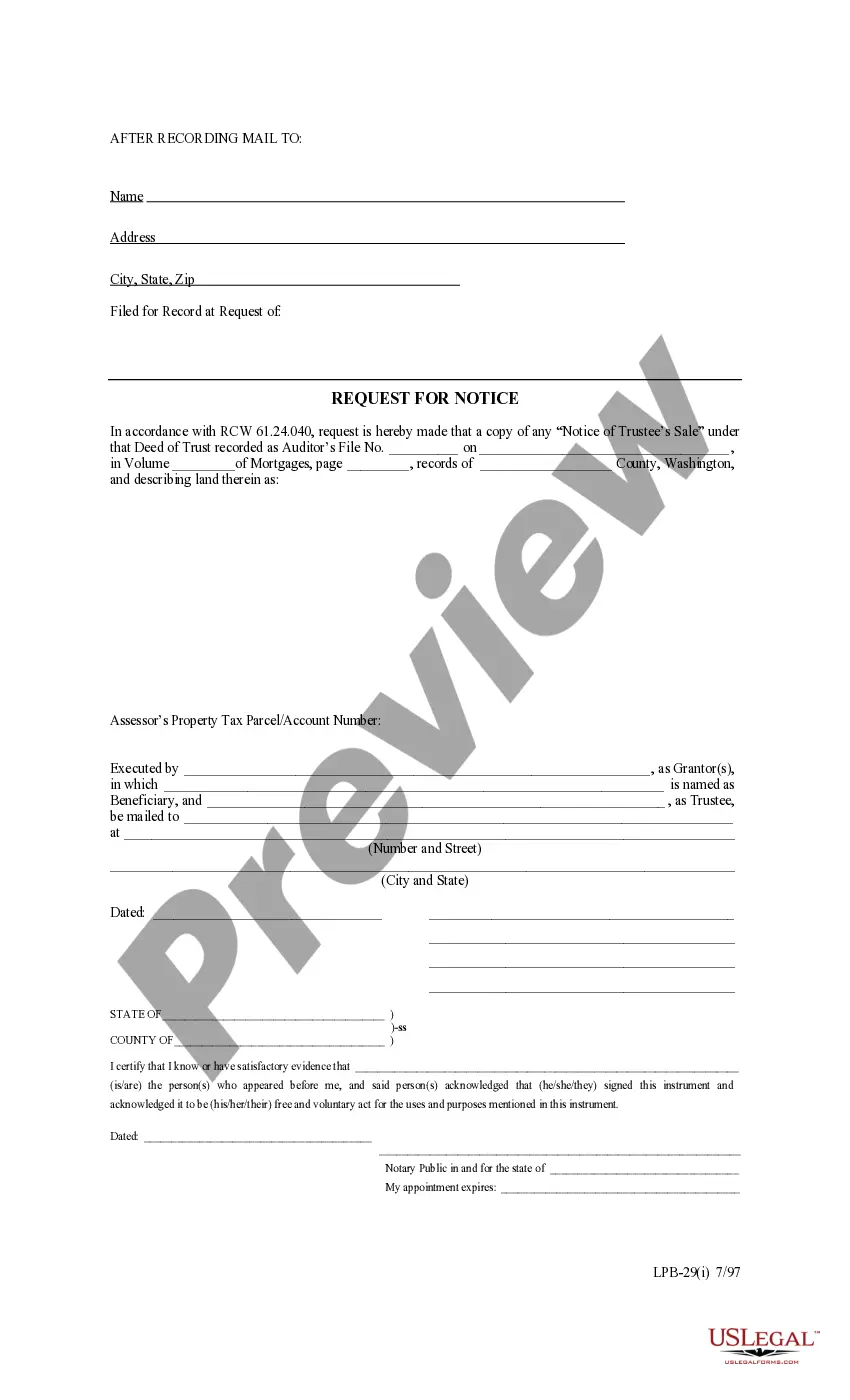

- Use the Review button to examine the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your requirements.

- Once you locate the appropriate form, click Get now.

- Select the pricing plan you wish, complete the necessary information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your version.

- Access all of the document templates you have purchased in the My documents section. You can obtain another copy of the North Dakota Multistate Promissory Note - Unsecured - Signature Loan at any time, if needed. Just go through the required form to download or print the document template.

Form popularity

FAQ

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

A Promissory Note only requires the signature of a borrower, whereas the Loan Agreement should include signatures from both parties. It should clearly state how borrower will make the payments. Like at the end of the term, regular periodic payment, regular payments towards interest only (or interest & principal).

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

Acceptance is not an essential requirement of a valid promissory note.

Only legal tender money is acceptable as promissory note. Rare currencies or coins wouldn't be taken as valid promissory notes. The amount to be paid should also be certain. It is not payable to bearer It is illegal to make promissory note payable to bearer under the provisions of the RBI Act.

Characteristics of promissory note:It is a written legal document. There must be a clear, point to point and unconditional promise of paying a certain amount to a specified person. It should be drawn and signed by the maker. It should be stamped properly. It specifically identifies the name of the maker and payee.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

An unsecured note is not backed by any collateral and thus presents more risk to lenders. Due to the higher risk involved, these notes' interest rates are higher than with secured notes. In contrast, a secured note is a loan backed by the borrower's assets, such as a mortgage or auto loan.