North Dakota Unrestricted Charitable Contribution of Cash

Description

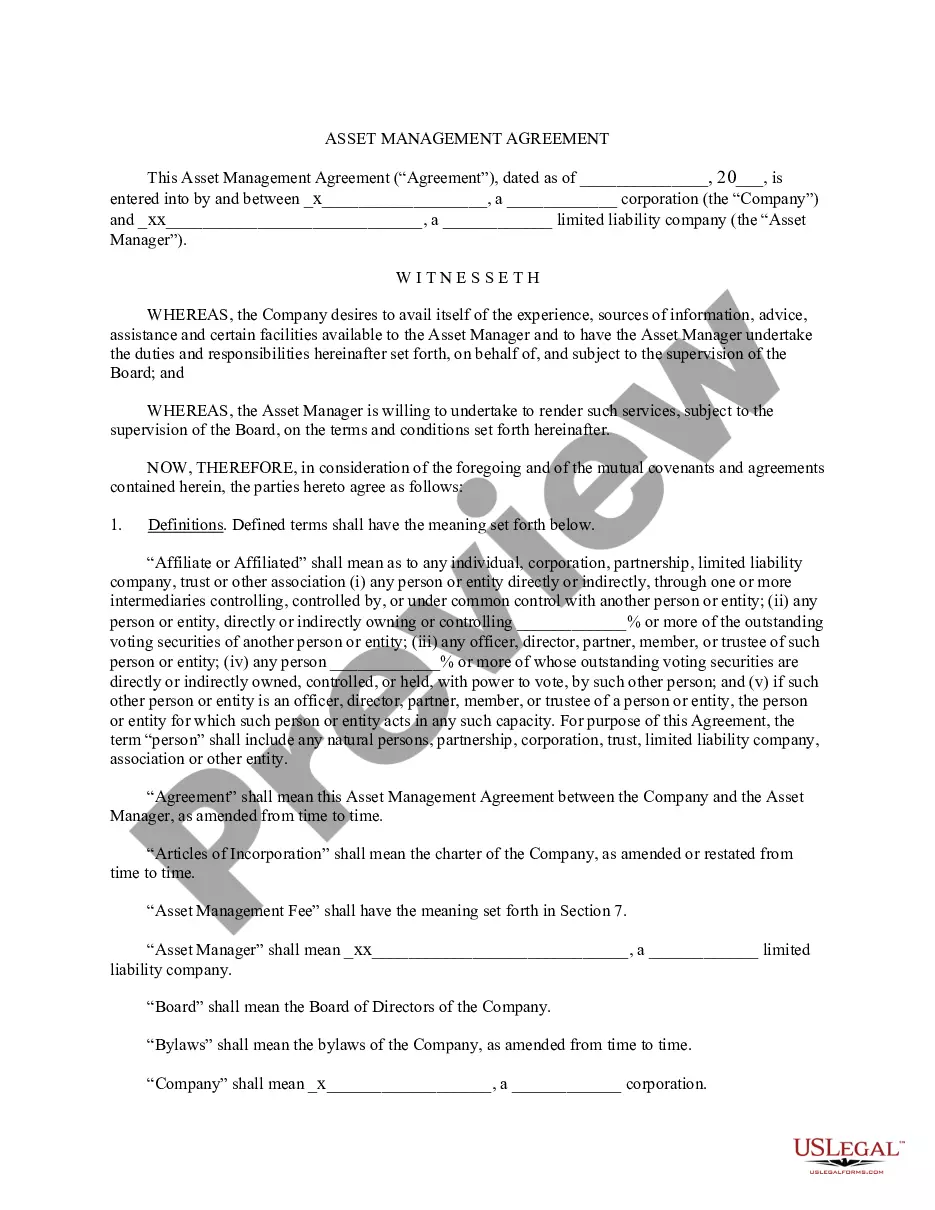

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you presently inside a place that you require papers for both business or person functions almost every day time? There are a lot of lawful papers web templates available on the Internet, but discovering types you can rely on isn`t effortless. US Legal Forms offers a large number of develop web templates, such as the North Dakota Unrestricted Charitable Contribution of Cash, that happen to be created to fulfill federal and state specifications.

In case you are currently knowledgeable about US Legal Forms internet site and get a merchant account, basically log in. Afterward, you can acquire the North Dakota Unrestricted Charitable Contribution of Cash template.

Should you not offer an accounts and want to begin using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your right metropolis/state.

- Take advantage of the Preview button to check the form.

- Browse the description to actually have selected the right develop.

- In case the develop isn`t what you are searching for, utilize the Look for discipline to discover the develop that meets your needs and specifications.

- If you discover the right develop, click Acquire now.

- Choose the costs strategy you desire, fill in the necessary information and facts to create your account, and pay for your order utilizing your PayPal or bank card.

- Pick a convenient document file format and acquire your duplicate.

Find all the papers web templates you possess purchased in the My Forms menus. You may get a more duplicate of North Dakota Unrestricted Charitable Contribution of Cash anytime, if necessary. Just go through the essential develop to acquire or printing the papers template.

Use US Legal Forms, one of the most substantial collection of lawful types, to save lots of time as well as prevent faults. The support offers appropriately manufactured lawful papers web templates which you can use for a selection of functions. Generate a merchant account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

One of the most common method by which gifts are made to foreign organizations is indirectly, through a Canadian registered charity. Normally, these will be ?friends of?? organizations or simply be organizations which have interests in common with the American or other foreign charity.

Some examples of how charitable donations reduce taxes DonationOntarioQuebec$200$40.10$70$500$160.58$229$1,000$361.38$494$5,000$1,967.78$2,6141 more row ?

If you make charitable donations to registered charities, the federal government of Canada allows you to claim a non-refundable charitable tax credits. A tax credit is a reduction in the taxes you owe to the Canadian federal and provincial governments.

No, if you take the standard deduction you do not need to itemize your donation deduction. However, if you want your deductible charitable contributions you must itemize your donation deduction on Form 1040, Schedule A: Itemized Deductions.

State Tax Credit for Planned or Deferred Gifts The North Dakota Community Foundation and all of its component funds are considered qualified charities. The tax credit is 40% of the charitable deduction allowed by the IRS up to a maximum of $10,000 per year per taxpayer or $20,000 per year per couple filing jointly.

Gifts made to certain organizations outside of Canada, which are considered ?qualified donees? from the CRA's perspective, can be claimed on your tax return similar to a Canadian charitable gift.

More In Help Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions.

If you normally complete a Self Assessment tax return, tell HMRC about your gifts to charity ? and claim any tax relief ? by completing the appropriate section on your tax return. If you do not complete a tax return, you can contact HMRC to give them the details.