North Dakota Corporate Resolution for Single Member LLC

Description

How to fill out Corporate Resolution For Single Member LLC?

If you wish to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Employ the site’s simple and convenient search to obtain the documents you need.

A variety of templates for business and personal purposes are grouped by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You will have access to all forms you downloaded in your account.

Visit the My documents section and select a form to print or download again.

- Utilize US Legal Forms to obtain the North Dakota Corporate Resolution for Single Member LLC with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Obtain option to get the North Dakota Corporate Resolution for Single Member LLC.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you've chosen the form for the correct city/state.

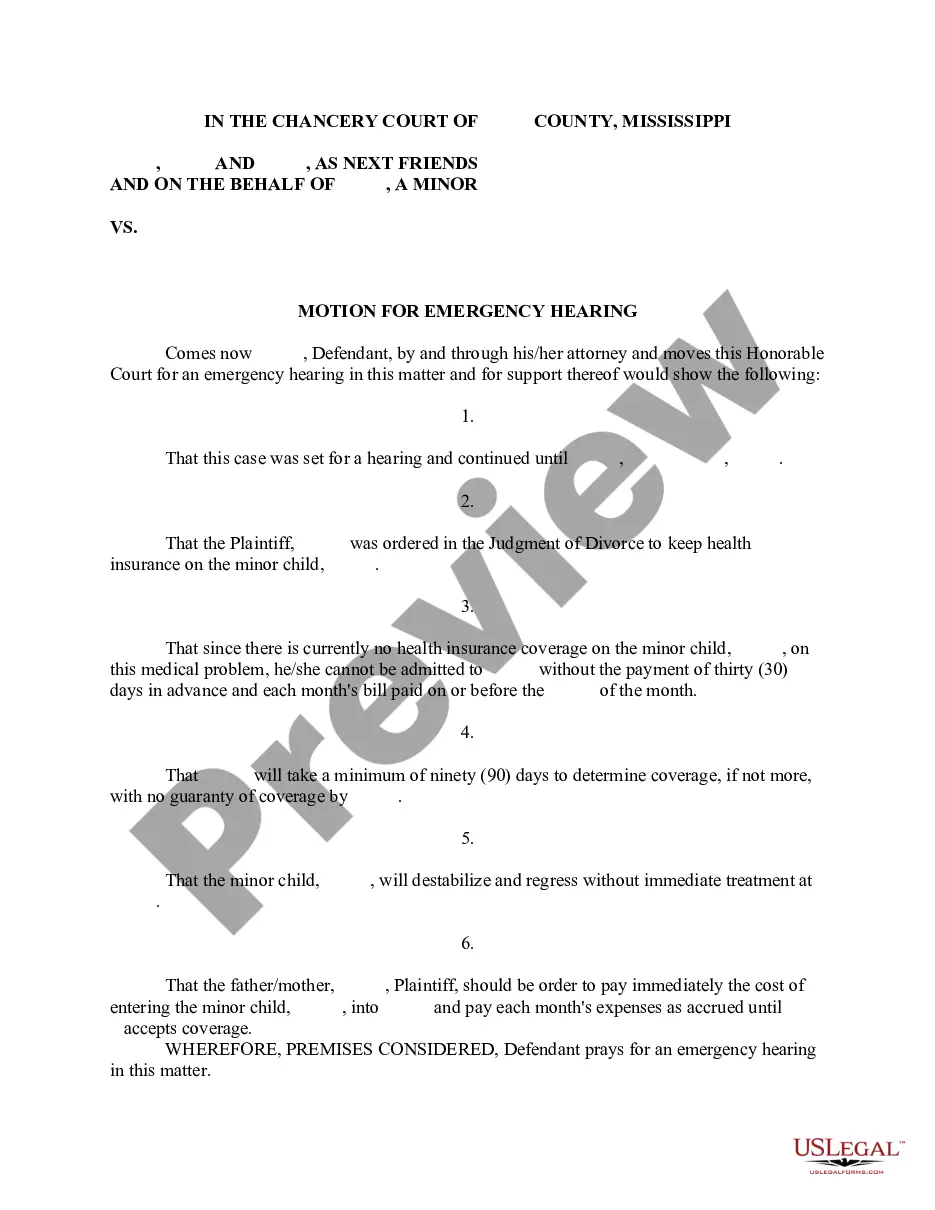

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you’ve located the form you need, click the Get now button. Choose the pricing option you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the North Dakota Corporate Resolution for Single Member LLC.

Form popularity

FAQ

Corporate Resolutions vs. Although articles of incorporation are an important part of corporate governance just like corporate resolutions, these are two very different legal documents.

Is an LLC a corporation? An LLC is not a type of corporation. In fact, an LLC is a unique hybrid entity that combines the simplicity of a sole proprietorship with the liability protections offered by starting a corporation.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

By default, a single-member LLC is considered a disregarded entity. Therefore, as with a sole proprietorship, business tax obligations flow through to the LLC owner.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

Less...Hold a Members meeting and record a resolution to Dissolve the North Dakota LLC.File a Notice of Dissolution with the ND Secretary of State.File all required Annual Reports with the North Dakota Secretary of State.Clear up any business debts.Pay all taxes and administrative fees owed by the North Dakota LLC.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

Option 1: Create or log into your account with the North Dakota Secretary of State. After logging in, select Forms from the left toolbar. Then, select Business Limited Liability Company Articles of Organization from the Limited Liability Companies section. Fill out the required fields and submit.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.