This document is a checklist for a venture capital term sheet. It addresses each component of a venture capital term sheet and discusses the requirements of each. Among the topics covered are: type of securities to be issued, dividends and distributions, liquidation preference, conversion features, and redemption features.

North Carolina Venture Capital Term Sheet Guidelines Checklist

Description

How to fill out Venture Capital Term Sheet Guidelines Checklist?

Are you in a situation the place you need paperwork for possibly organization or personal purposes virtually every working day? There are tons of legal file web templates available on the net, but finding types you can depend on isn`t straightforward. US Legal Forms offers 1000s of form web templates, like the North Carolina Venture Capital Term Sheet Guidelines Checklist, that are published in order to meet state and federal demands.

Should you be presently knowledgeable about US Legal Forms web site and have a free account, simply log in. Next, you may down load the North Carolina Venture Capital Term Sheet Guidelines Checklist web template.

Should you not have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is to the correct metropolis/region.

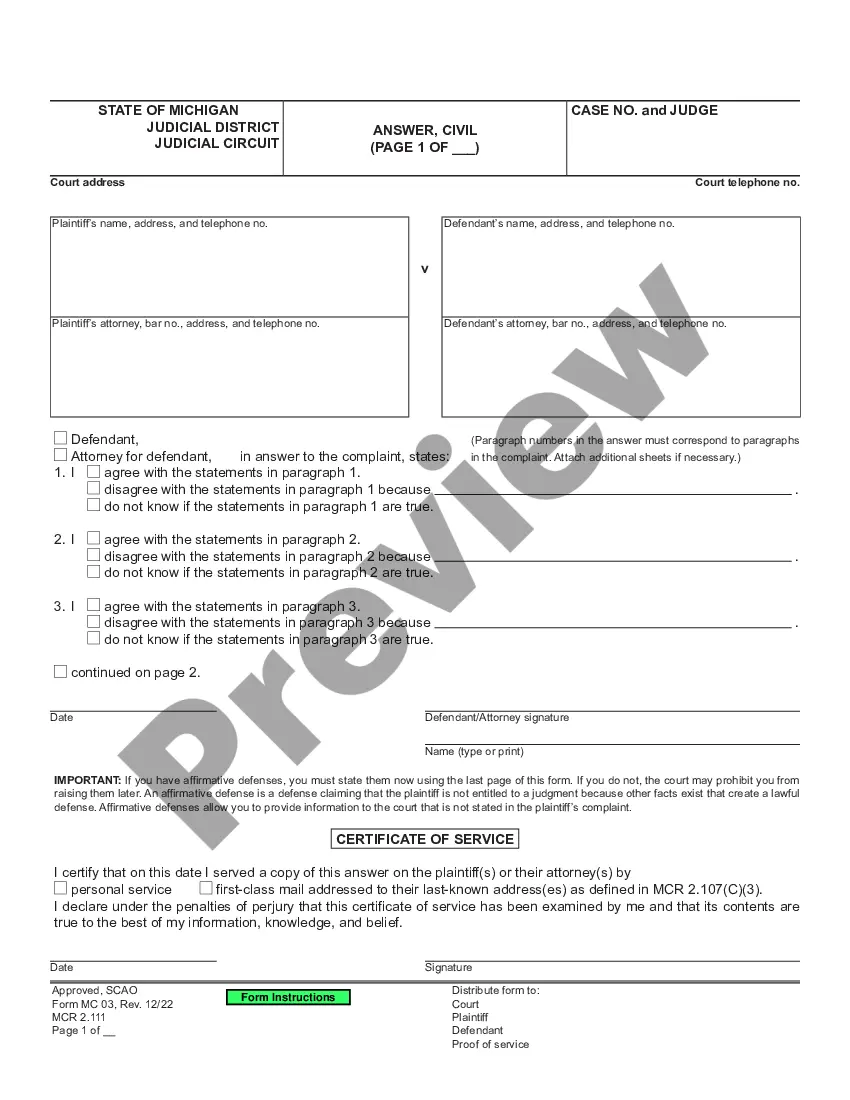

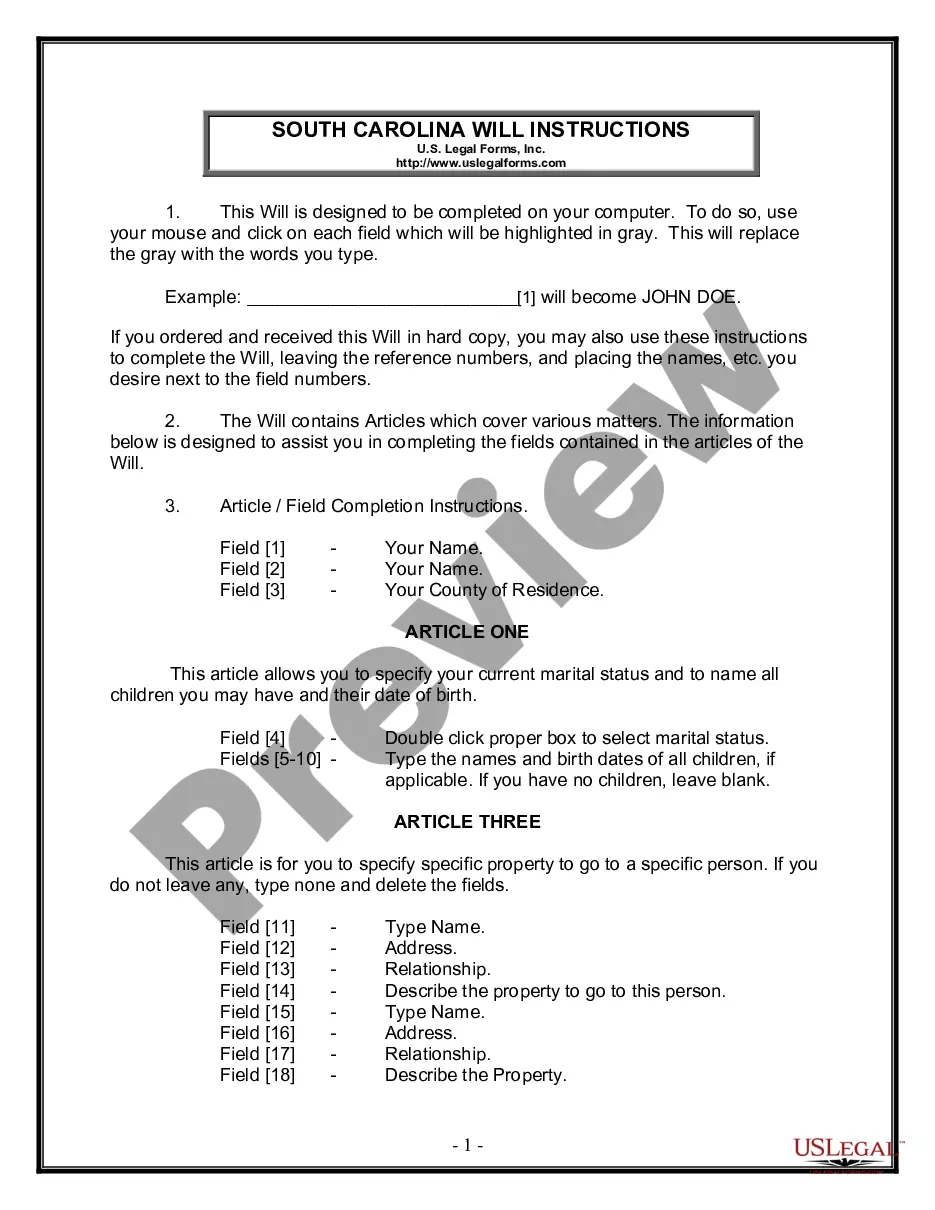

- Utilize the Review button to check the form.

- See the information to ensure that you have selected the proper form.

- In case the form isn`t what you`re seeking, use the Research discipline to discover the form that fits your needs and demands.

- When you get the correct form, click Buy now.

- Choose the costs strategy you need, complete the desired details to produce your account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free file formatting and down load your copy.

Locate all the file web templates you possess bought in the My Forms food list. You can get a further copy of North Carolina Venture Capital Term Sheet Guidelines Checklist at any time, if needed. Just click on the necessary form to down load or print out the file web template.

Use US Legal Forms, one of the most comprehensive assortment of legal forms, to save efforts and avoid mistakes. The support offers expertly manufactured legal file web templates that can be used for a variety of purposes. Create a free account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

My simple advice when you raise capital: assume you have to return a liquidity event (sale or IPO) of at least 10x the amount you raise for raising venture capital to be worth it. Valuations change from round to round. Later stage investors will expect lower ROI, seed investors will be looking for a lot more.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

A term sheet is a document that outlines the key terms and conditions of a potential investment, such as valuation, equity, voting rights, and exit options. It is not a legally binding contract, but it serves as a basis for negotiation and due diligence.

A venture capital fund is usually structured in the form of a partnership, where the venture capital firm (and its principals) serve as the general partners and the investors as the limited partners.