North Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

Are you in the place where you need documents for both enterprise or personal functions almost every day time? There are a lot of legitimate document templates available online, but getting ones you can trust isn`t straightforward. US Legal Forms provides thousands of kind templates, much like the North Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries, that are published to meet federal and state needs.

When you are already knowledgeable about US Legal Forms website and get a merchant account, basically log in. After that, you may down load the North Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries format.

Should you not offer an account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for your appropriate metropolis/state.

- Utilize the Review key to examine the shape.

- Read the information to actually have selected the right kind.

- In case the kind isn`t what you are trying to find, take advantage of the Research industry to get the kind that suits you and needs.

- Once you get the appropriate kind, just click Get now.

- Opt for the costs plan you desire, submit the required info to produce your account, and pay for the order with your PayPal or bank card.

- Select a handy file structure and down load your version.

Find all of the document templates you might have purchased in the My Forms food list. You can obtain a further version of North Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries at any time, if needed. Just select the required kind to down load or printing the document format.

Use US Legal Forms, the most comprehensive collection of legitimate kinds, in order to save efforts and stay away from blunders. The service provides professionally produced legitimate document templates which can be used for a variety of functions. Make a merchant account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

In North Carolina, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. Avoiding Probate in North Carolina - Nolo nolo.com ? legal-encyclopedia ? north-carol... nolo.com ? legal-encyclopedia ? north-carol...

$1,000 to $3,000 The cost of creating a trust in North Carolina varies, but a basic Revocable Living Trust generally ranges from $1,000 to $3,000. The cost may be higher for more complex trusts or if you require the assistance of an attorney. Online legal services can offer more affordable alternatives for creating trusts. North Carolina: Make A Revocable Trust Online in 12 Minutes | Snug getsnug.com ? north-carolina-trusts getsnug.com ? north-carolina-trusts

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles. What Assets Cannot Be Placed in a Trust? - SmithTaire Legal smithtaire.com ? blog ? what-assets-cannot-be-pla... smithtaire.com ? blog ? what-assets-cannot-be-pla...

In North Carolina, the trustee named in a deed of trust holds legal title to the real property granted therein as security for the note obligation. Once the debt is paid off, the deed of trust is cancelled and title reverts to the borrower.

Testamentary trust example ing to the trust terms you laid out, after your death, your best friend will manage the trust funds and make decisions in your child's best interest until they reach the age of 25. At that point, the trust will terminate, and your child will receive the money.

A grantor can appoint someone a trustee as long as the individual is at least 18 years old and is not likely to become bankrupt or mentally incompetent. Grantors can also be the trustee themselves, as long as the trust is a revocable living trust. This means the trust can be changed during the grantor's lifetime.

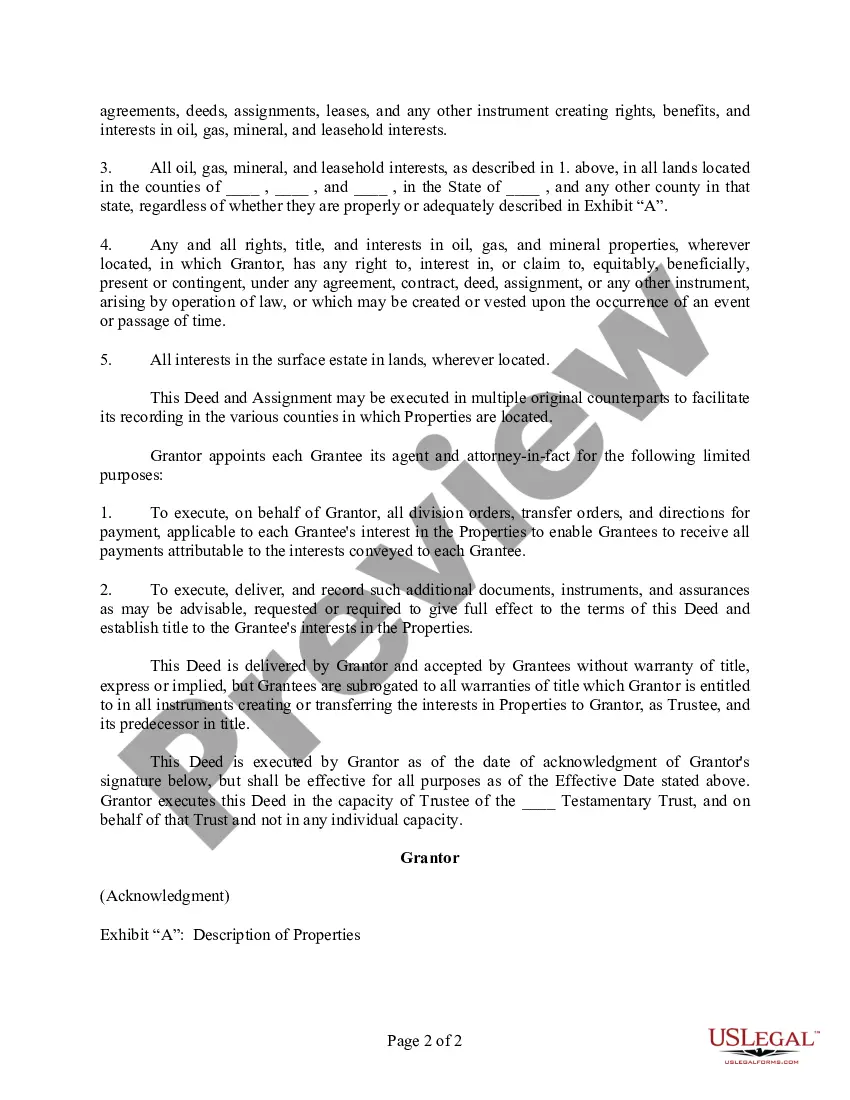

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself). Transferring assets into a living trust: Can you do it yourself? ? articles ? transferring-as... ? articles ? transferring-as...