North Carolina Framework Contractor Agreement - Self-Employed

Description

How to fill out Framework Contractor Agreement - Self-Employed?

You can spend time online attempting to locate the legal document template that meets the state and federal requirements you need. US Legal Forms offers thousands of legal templates that are reviewed by experts.

It is easy to download or print the North Carolina Framework Contractor Agreement - Self-Employed from my service.

If you have a US Legal Forms account, you can Log In and click on the Acquire button. After that, you can complete, modify, print, or sign the North Carolina Framework Contractor Agreement - Self-Employed. Every legal document template you purchase is yours for years. To get another copy of any obtained form, visit the My documents section and click on the corresponding button.

Choose the format of your document and download it to your system. Make changes to your document if possible. You can complete, modify, sign, and print the North Carolina Framework Contractor Agreement - Self-Employed. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for your county/region that you choose. Check the form details to confirm you have selected the right one.

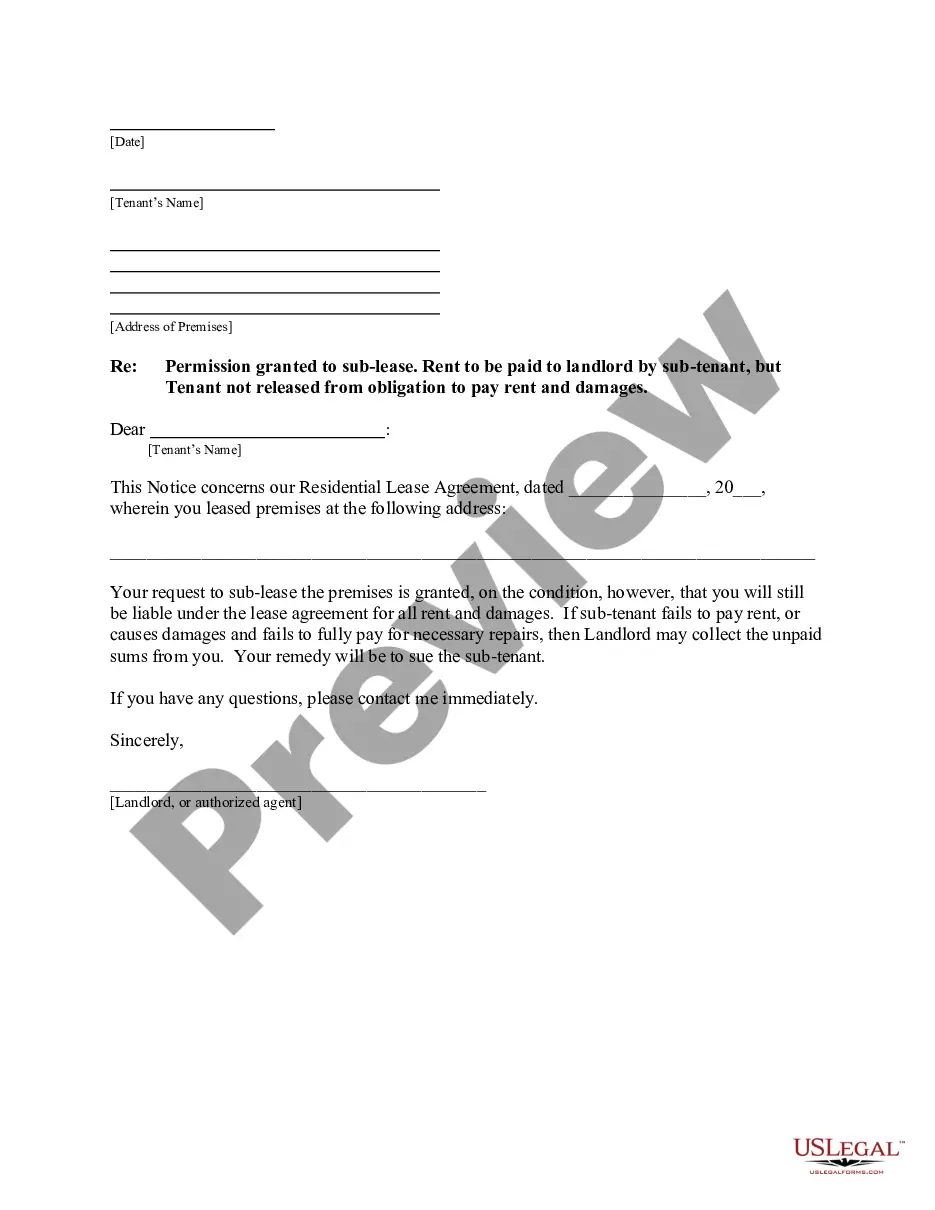

- If available, use the Preview button to review the document template as well.

- If you want to find another version of your form, use the Search field to find the template that suits your needs and requirements.

- Once you have found the template you want, just click Purchase now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

While an operating agreement is not legally required for LLCs in North Carolina, it is highly beneficial. This document outlines the management structure, ownership, and operational procedures of your LLC, which can prevent future disputes. Having a clear North Carolina Framework Contractor Agreement - Self-Employed in conjunction with an operating agreement can enhance your business’s professionalism and offer better protection. Consider using US Legal Forms to easily create these essential documents.

Creating a North Carolina Framework Contractor Agreement - Self-Employed begins with defining the scope of work. You should specify the duties and responsibilities of both parties, along with deadlines and payment terms. For added protection, include clauses regarding confidentiality and termination. Using platforms like US Legal Forms can streamline the process and provide you with excellent templates tailored for North Carolina.

When writing an independent contractor agreement, start with a clear title and date, followed by the parties' names and addresses. Outline the scope of work, payment terms, and confidentiality clauses in straightforward language. The North Carolina Framework Contractor Agreement - Self-Employed offers a solid framework to ensure you include all necessary components while protecting both parties.

Filling out an independent contractor form involves providing personal information, describing your services, and detailing payment conditions. Be specific about the job requirements and expectations to avoid confusion. The North Carolina Framework Contractor Agreement - Self-Employed can serve as an effective guideline for completing this form accurately.

To fill out an independent contractor agreement, start by clearly stating the parties involved, the project's scope, and payment terms. Include specific details about deadlines, deliverables, and confidentiality clauses. Using the North Carolina Framework Contractor Agreement - Self-Employed as a template can streamline this process and ensure you cover all essential aspects.

In North Carolina, independent contractors generally do not need workers' compensation insurance. However, if you hire subcontractors or employees, you must provide coverage. The North Carolina Framework Contractor Agreement - Self-Employed can help clarify your obligations and provide a structure for your contract terms.

Yes, independent contractors do file as self-employed individuals. This means that when you engage with a North Carolina Framework Contractor Agreement - Self-Employed, you must report your income and expenses on your tax return. It is essential to keep track of your earnings and deductible expenses throughout the year. Utilizing a clear agreement helps clarify your status and responsibilities as a self-employed contractor.