North Carolina Audio Systems Contractor Agreement - Self-Employed

Description

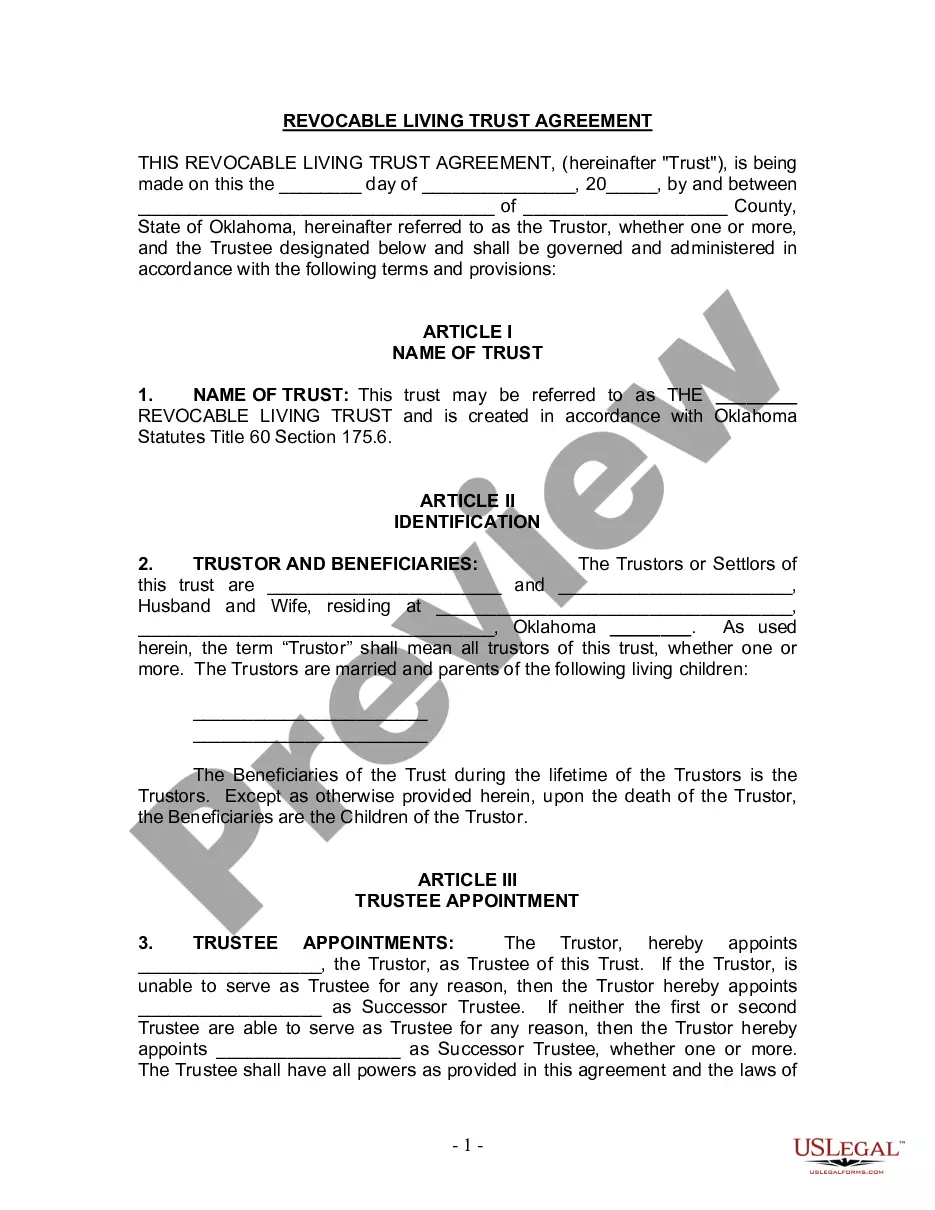

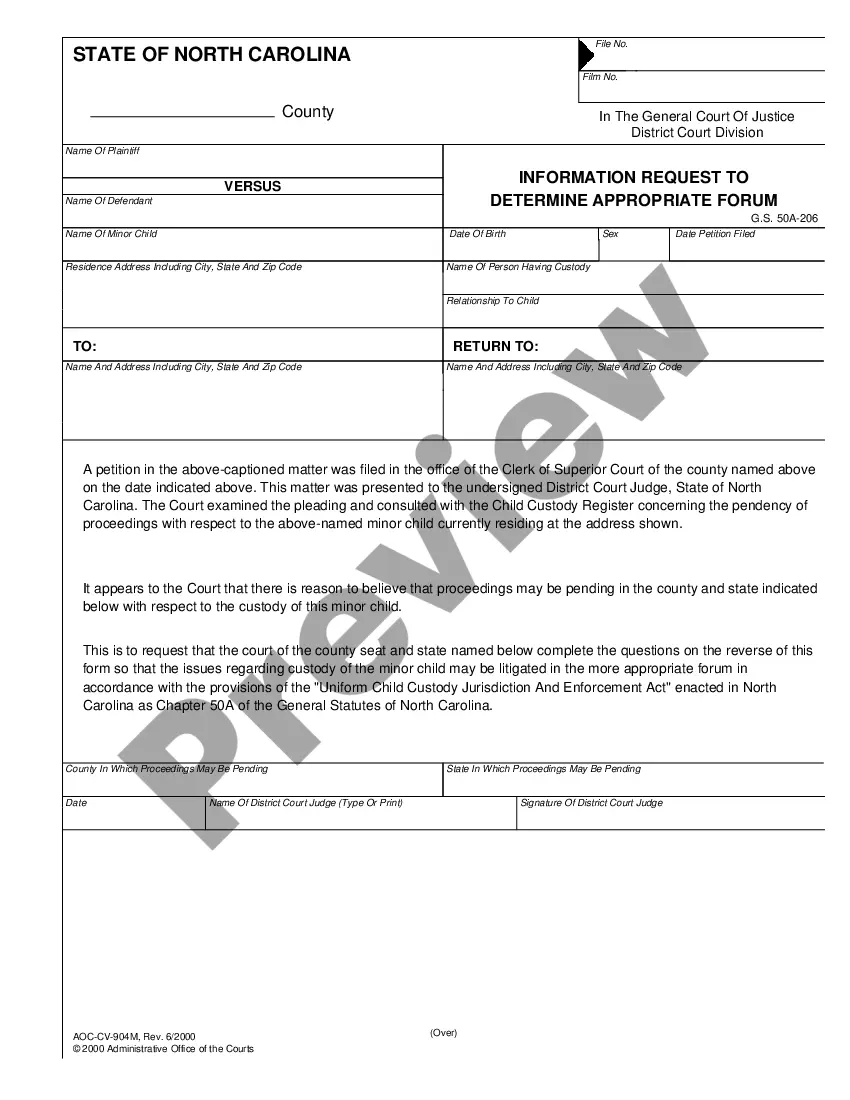

How to fill out Audio Systems Contractor Agreement - Self-Employed?

If you wish to be thorough, obtain, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site’s straightforward and convenient search function to locate the documents you require. A variety of templates for commercial and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the North Carolina Audio Systems Contractor Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the North Carolina Audio Systems Contractor Agreement - Self-Employed. You can also access forms you previously purchased within the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the steps outlined below: Step 1. Ensure you have selected the form for the appropriate city/state. Step 2. Use the Preview option to review the form's content. Remember to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template. Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account. Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the North Carolina Audio Systems Contractor Agreement - Self-Employed.

- Every legal document template you acquire is yours permanently.

- You have access to every form you obtained within your account.

- Navigate to the My documents section and choose a form to print or download again.

- Be proactive and obtain, and print the North Carolina Audio Systems Contractor Agreement - Self-Employed with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. Start by defining the scope of work, compensation, and timelines. Including terms for confidentiality and termination can also enhance the agreement's clarity. For those pursuing a North Carolina Audio Systems Contractor Agreement - Self-Employed, using online resources like uslegalforms can streamline this process, providing templates that ensure you cover all essential components.

Not all LLCs have operating agreements, but having one offers significant advantages. An operating agreement outlines the operations of the LLC and clarifies expectations for members, reducing the potential for disputes. If you’re setting up a North Carolina Audio Systems Contractor Agreement - Self-Employed, taking the time to create an operating agreement can provide peace of mind and structure for your business dealings.

If your LLC lacks an operating agreement, North Carolina's default rules will apply, which may not align with your business preferences. This can lead to ambiguity in decision-making processes, profit distribution, and management roles. To avoid such complications, crafting a detailed operating agreement is beneficial, especially in a North Carolina Audio Systems Contractor Agreement - Self-Employed context, ensuring all parties are on the same page.

While North Carolina law does not mandate that LLCs have an operating agreement, it is highly recommended. An operating agreement serves as a foundational document that outlines the management and financial decisions of the LLC. For a venture like a North Carolina Audio Systems Contractor Agreement - Self-Employed, such an agreement can help establish clear guidelines and protect your interests.

No, North Carolina does not legally require an operating agreement for a business to operate within the state. However, having a well-drafted operating agreement can clarify the management structure and roles. This is particularly important for those establishing a North Carolina Audio Systems Contractor Agreement - Self-Employed, as it helps prevent misunderstandings among partners and ensures smooth operations.

While North Carolina law does not require LLCs to have an operating agreement, it is highly advisable to create one. An operating agreement outlines the management structure and operational guidelines for your LLC, helping you avoid disputes among members. Furthermore, having a clear North Carolina Audio Systems Contractor Agreement - Self-Employed can enhance your credibility in the eyes of clients and partners. Using platforms like USLegalForms can simplify the process of drafting this essential document, ensuring you cover all necessary provisions.

employed contract should detail the work arrangement clearly and include essential components like the scope of services, payment terms, and deadlines. Additionally, outline any responsibilities, rights, and termination clauses. For those using the North Carolina Audio Systems Contractor Agreement SelfEmployed, these elements ensure a mutual understanding and help safeguard your agreements.

An operating agreement is not legally required for an LLC in North Carolina, but it is highly recommended. This document outlines the ownership structure and operating procedures. Having a well-crafted operating agreement can provide clarity and protect your interests, especially when using a North Carolina Audio Systems Contractor Agreement - Self-Employed in your business.

Writing an independent contractor agreement involves outlining the key elements of the work relationship. Start with your details and the client's information. Include sections on the services provided, payment terms, and any applicable laws. Utilizing a template for the North Carolina Audio Systems Contractor Agreement - Self-Employed can streamline this process and ensure you cover all essential aspects.

To fill out an independent contractor agreement, first review the terms carefully. Include your contact information, scope of work, payment details, and completion dates. Be precise about responsibilities and deliverables, which is crucial in a North Carolina Audio Systems Contractor Agreement - Self-Employed. Clear agreements help prevent misunderstandings later.