North Carolina Computer Repairman Services Contract - Self-Employed

Description

How to fill out Computer Repairman Services Contract - Self-Employed?

If you want to be thorough, download, or create authentic legal document templates, utilize US Legal Forms, the largest collection of legal forms available on the web.

Take advantage of the site’s straightforward and convenient search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Use US Legal Forms to obtain the North Carolina Computer Repairman Services Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to find the North Carolina Computer Repairman Services Agreement - Self-Employed.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

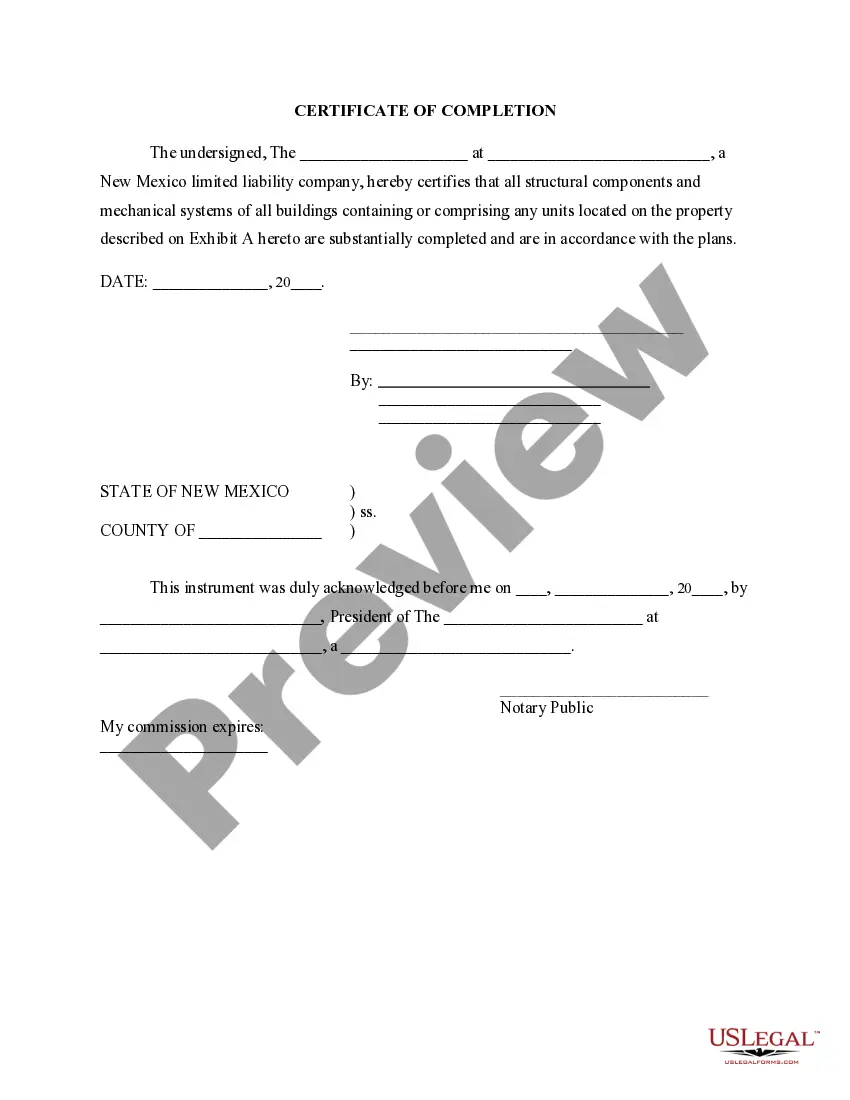

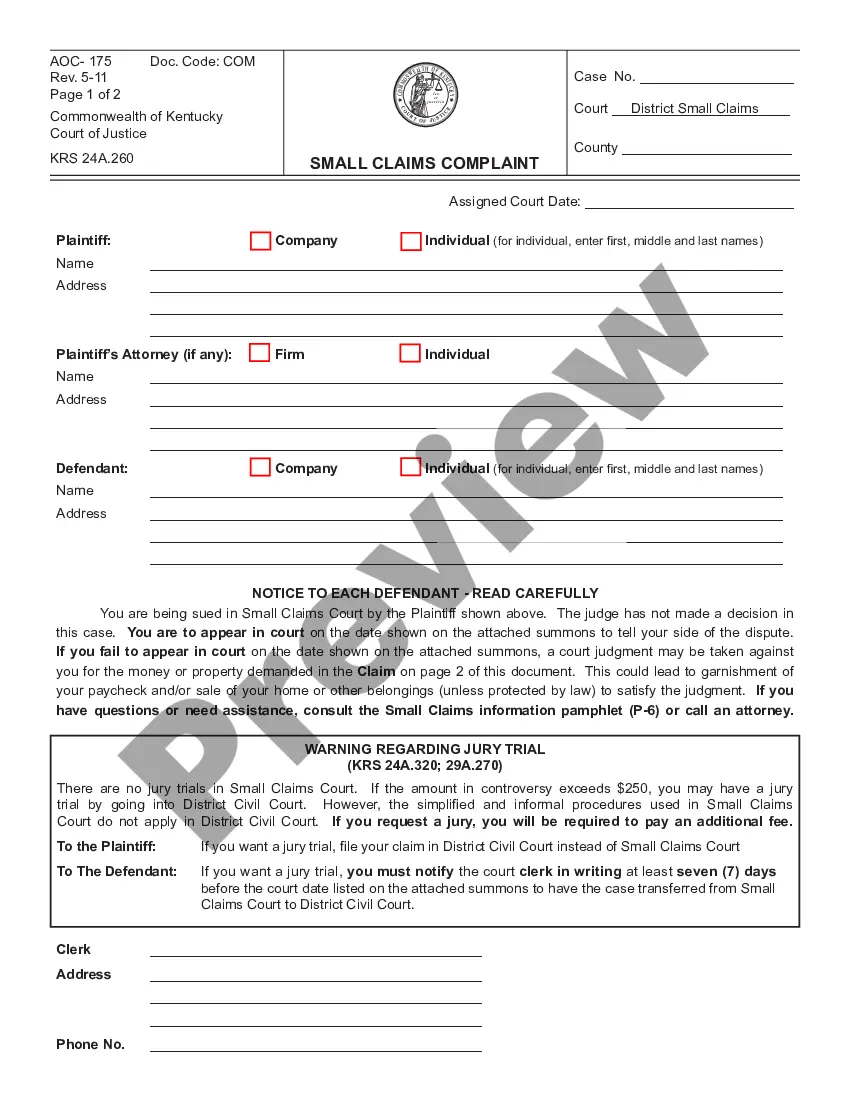

- Step 2. Utilize the Preview function to review the form’s contents. Don’t forget to check the specifics.

Form popularity

FAQ

Being classified as an independent contractor in North Carolina comes with distinctive responsibilities and benefits. It allows you flexibility in managing your work schedule, but you also have to handle your taxes and insurance. With a North Carolina Computer Repairman Services Contract - Self-Employed, you can clearly outline your work terms while making sure all legal and financial obligations are met. This clarity can help you build trust with your clients and safeguard your interests.

In North Carolina, handymen do not generally need a license for minor repairs or services. However, if you handle larger jobs or work on specific trades like electrical or plumbing, licensing is essential. Understanding the requirements is vital, especially if you are considering a North Carolina Computer Repairman Services Contract - Self-Employed. By ensuring compliance with local laws, you provide better service and protect your business.

The new federal rule introduces stricter criteria for classifying workers as independent contractors. This may affect how contractors operate across various sectors, including computer repair services in North Carolina. The rule emphasizes the degree of control a company has over its workers, which can influence your North Carolina Computer Repairman Services Contract - Self-Employed. Staying informed about these changes can help you adapt your contracts accordingly, and US Legal Forms can provide you with necessary contract templates.

To provide services as an independent contractor in the US, you typically need to register your business and obtain any necessary licenses. Each state, including North Carolina, may have different requirements, so it's essential to research local regulations. Completing a North Carolina Computer Repairman Services Contract - Self-Employed can also help clarify your role and responsibilities, ensuring you operate within the legal framework. For assistance with contracts, consider visiting US Legal Forms.

Yes, service contracts are generally subject to sales tax in North Carolina. When you provide services that involve repair or maintenance, you may need to collect sales tax from your clients. It is important to clearly define the terms of your North Carolina Computer Repairman Services Contract - Self-Employed to ensure compliance with state tax regulations. For more detailed guidance, you can utilize resources available on the US Legal Forms platform.

Writing an independent contractor agreement involves outlining essential components such as service descriptions, payment details, and the timeframe for completion. Mention any industry-specific requirements that pertain to your work as a North Carolina computer repairman. USLegalForms offers templates and guidance to help create a thorough North Carolina Computer Repairman Services Contract - Self-Employed, ensuring you cover all vital aspects.

When filling out an independent contractor form, start with your personal details and the client’s information. Clarify the nature of your services and payment terms. Additionally, ensure you meet the requirements for the North Carolina Computer Repairman Services Contract - Self-Employed by stating the duration of the contract and any expected outcomes. This clarity helps protect both parties.

In North Carolina, self-employed individuals can perform certain tasks without a contractor license, depending on project value. Generally, projects under $30,000 do not require a license, but this may differ based on specific local regulations. It’s essential to verify your work falls within these limits, especially when offering services as a North Carolina computer repairman. Always consult local guidelines to ensure compliance.

To fill out an independent contractor agreement, begin by entering the names and addresses of both parties. Make sure to specify the services to be performed, payment structure, and duration of the agreement. Finally, describe any specific conditions or terms that apply to the North Carolina Computer Repairman Services Contract - Self-Employed, ensuring both parties understand their obligations.

Writing a self-employed contract requires clarity and detail. Start by defining the services you will provide as a North Carolina computer repairman. Include your payment terms, project deadlines, and any legal disclaimers necessary for your protection. For comprehensive templates, consider using USLegalForms, which offers resources to create a North Carolina Computer Repairman Services Contract - Self-Employed.