This due diligence form is a workform summarizing the substance of miscellaneous agreements as well as any provisions or requirements that may apply in business transactions.

North Carolina Miscellaneous Agreement Workform

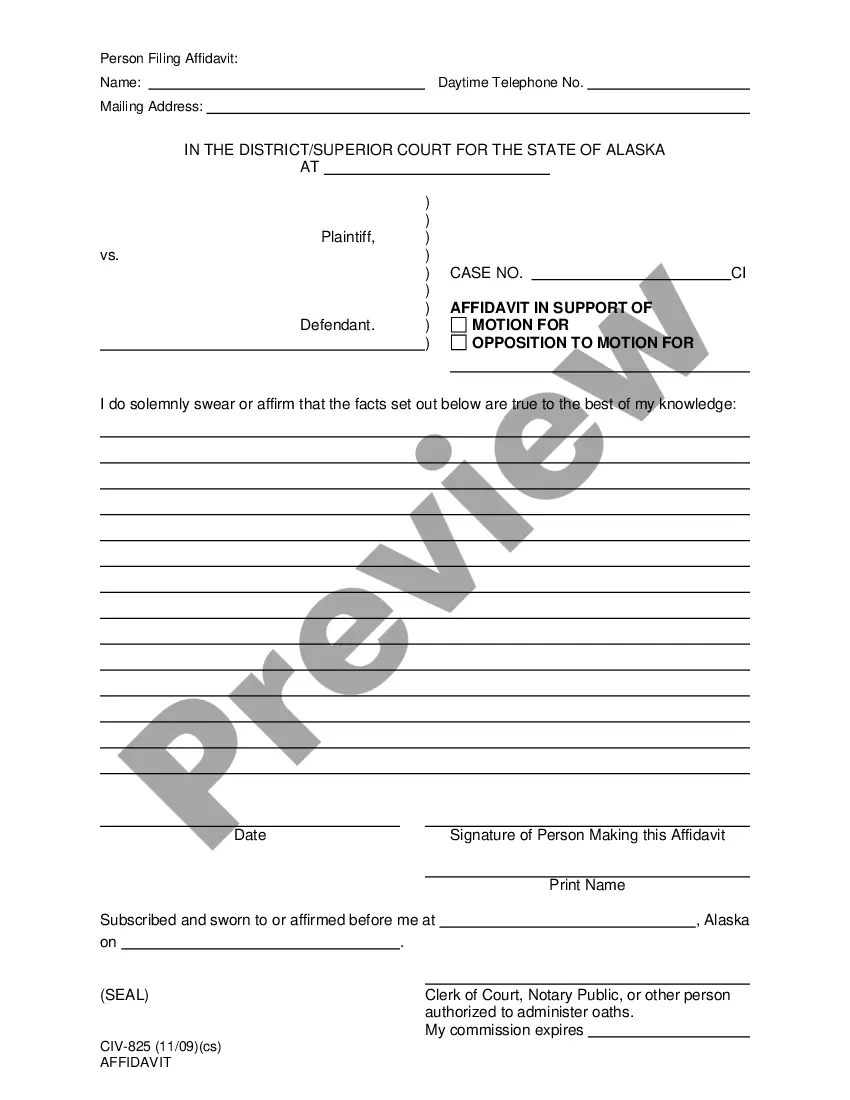

Description

How to fill out Miscellaneous Agreement Workform?

Finding the appropriate legitimate document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how can you locate the authentic form you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the North Carolina Miscellaneous Agreement Workform, which can be used for both business and personal purposes.

You can preview the form using the Preview button and read the form description to ensure it is suitable for you.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to get the North Carolina Miscellaneous Agreement Workform.

- Use your account to browse through the legitimate forms you have previously ordered.

- Go to the My documents section of your account and retrieve an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, make sure you have selected the correct form for your area/region.

Form popularity

FAQ

North Carolina does not require an operating agreement for LLC formation, but having one is strongly recommended. An effective operating agreement can clarify management decisions and procedures, which is particularly beneficial in case of disputes. Using a North Carolina Miscellaneous Agreement Workform can help construct this document, ensuring that all members are on the same page. This way, you can focus on growing your business with peace of mind.

While an operating agreement is not mandatory for your LLC in North Carolina, it is highly advisable. An operating agreement can help outline the rights and responsibilities of members, reducing the potential for conflicts. Choosing a North Carolina Miscellaneous Agreement Workform can streamline the creation of this essential document. By doing so, you ensure a smoother operation for your LLC and its members.

If your LLC lacks an operating agreement, you may face challenges regarding management and operational disputes. North Carolina law provides default rules, but they may not reflect your specific intentions or needs. Establishing clear policies through an operating agreement offers better protection and guidance. Consider using a North Carolina Miscellaneous Agreement Workform to address these matters proactively.

No, an operating agreement is not legally required for an LLC in North Carolina. However, having one is highly beneficial. An operating agreement outlines the management structure and operational procedures of your LLC, ensuring clarity among members. If you choose to create one, using a North Carolina Miscellaneous Agreement Workform can make the process straightforward and efficient.

Yes, employment contracts are legal in North Carolina. These contracts help define the relationship between the employer and employee while establishing expectations and responsibilities. Utilizing a North Carolina Miscellaneous Agreement Workform can create a clear agreement that protects both parties. This tool ensures you cover essential aspects of employment, such as duties, compensation, and termination conditions.

The NC-3 form is a payroll tax form used to report North Carolina withholding tax for employees. It consolidates information related to income taxes withheld and must be filed for each tax year. The North Carolina Miscellaneous Agreement Workform can be helpful when you need to gather the necessary information for your NC-3 filing, ensuring everything is accurate.

You can file NC withholding tax through electronic means or by submitting a paper form. Filing electronically is often faster and reduces potential mistakes. Using the North Carolina Miscellaneous Agreement Workform can guide you through this process, ensuring compliance and efficiency in your tax filings.

Filing the NC-3 form is straightforward. You can complete the form online through the North Carolina Department of Revenue’s website or the US Legal Forms platform for added convenience. The North Carolina Miscellaneous Agreement Workform simplifies this process, helping you meet all requirements easily.

If you choose to mail your NC-3 form, you should send it to the appropriate address based on your specific situation. Generally, NC-3 forms should be sent to the North Carolina Department of Revenue. However, utilizing the North Carolina Miscellaneous Agreement Workform can ensure that you have the most up-to-date address and filing instructions.

The NC-3 form can be filed electronically, which is highly recommended for convenience and accuracy. While there are options for paper filing, electronic submission reduces the risk of errors and processing delays. Utilizing the North Carolina Miscellaneous Agreement Workform can streamline your filing process further.