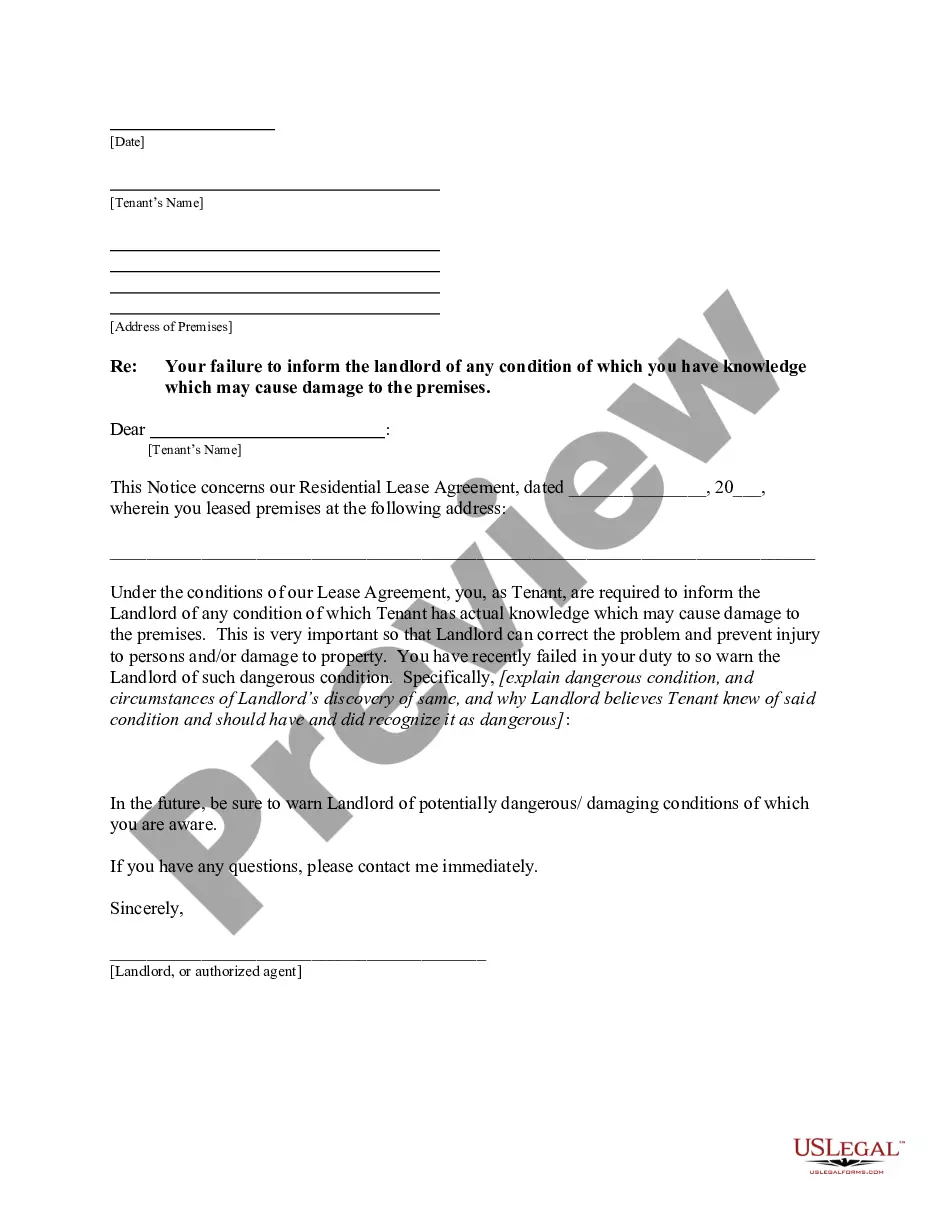

"Construction Loan Agreements and Variations" is a American Lawyer Media form. This form is to be used as a construction loan agreement.

North Carolina Construction Loan Agreements and Variations

Description

How to fill out Construction Loan Agreements And Variations?

Discovering the right legitimate file template could be a have a problem. Needless to say, there are plenty of layouts available on the net, but how do you get the legitimate type you will need? Take advantage of the US Legal Forms website. The assistance gives 1000s of layouts, for example the North Carolina Construction Loan Agreements and Variations, that you can use for company and private demands. All of the forms are checked by professionals and meet up with state and federal demands.

If you are already registered, log in in your profile and click on the Download option to find the North Carolina Construction Loan Agreements and Variations. Utilize your profile to check throughout the legitimate forms you possess acquired previously. Go to the My Forms tab of your profile and acquire one more duplicate of the file you will need.

If you are a whole new customer of US Legal Forms, listed below are basic guidelines that you should comply with:

- Very first, be sure you have selected the correct type for your town/county. You can look over the shape while using Preview option and browse the shape information to ensure this is the right one for you.

- When the type fails to meet up with your expectations, utilize the Seach industry to get the appropriate type.

- When you are sure that the shape is acceptable, select the Get now option to find the type.

- Pick the costs prepare you would like and type in the needed info. Design your profile and pay for an order making use of your PayPal profile or credit card.

- Choose the submit formatting and down load the legitimate file template in your system.

- Full, change and produce and indicator the received North Carolina Construction Loan Agreements and Variations.

US Legal Forms will be the greatest collection of legitimate forms where you can discover various file layouts. Take advantage of the company to down load expertly-made paperwork that comply with state demands.

Form popularity

FAQ

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

North Carolina's retainage limits and deadlines On private projects within the state, retainage will be governed by the terms of the contract. Retainage on such public projects is capped at 5% of each progress payment. Upon 50% completion, retainage must no longer be withheld unless the job progress is unsatisfactory.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

For contract formation, the offer and acceptance are essential terms. The offer and acceptance form the agreement between the parties. The offer must be communicated, it must be complete and the offer must be accepted in its exact terms. Mutuality of agreement is a must.

3903 North Carolina Department of Health and Human Services is charged with creating policy regarding "health care facilities", and is written primarily for hospitals. ing to the DHHS medical records of a facility must be maintained for at least 11 years after an adult patient's discharge.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

It can be classified into three main categories, namely, unsecured and secured, conventional, and open-end and closed-end loans.

Student loans: 10-year terms are most common, although they can range up to 30 years in some cases, like consolidation loans. Mortgages: 30-year mortgages are most common, but 15-year mortgages are also available.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever.

Statute of Repose Stat. §1-50(a)(5)(a). This law says homeowners have six years from the substantial completion (or the last specific act or omission of the builder) to file suit.