North Carolina Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

US Legal Forms - one of the biggest libraries of legal types in the USA - gives a wide array of legal record layouts you are able to download or produce. Making use of the internet site, you may get thousands of types for company and specific functions, sorted by categories, claims, or key phrases.You will find the most up-to-date versions of types just like the North Carolina Stock Appreciation Rights Plan of The Todd-AO Corporation within minutes.

If you already have a registration, log in and download North Carolina Stock Appreciation Rights Plan of The Todd-AO Corporation through the US Legal Forms catalogue. The Obtain switch can look on each type you perspective. You have accessibility to all in the past delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, listed here are basic recommendations to get you started out:

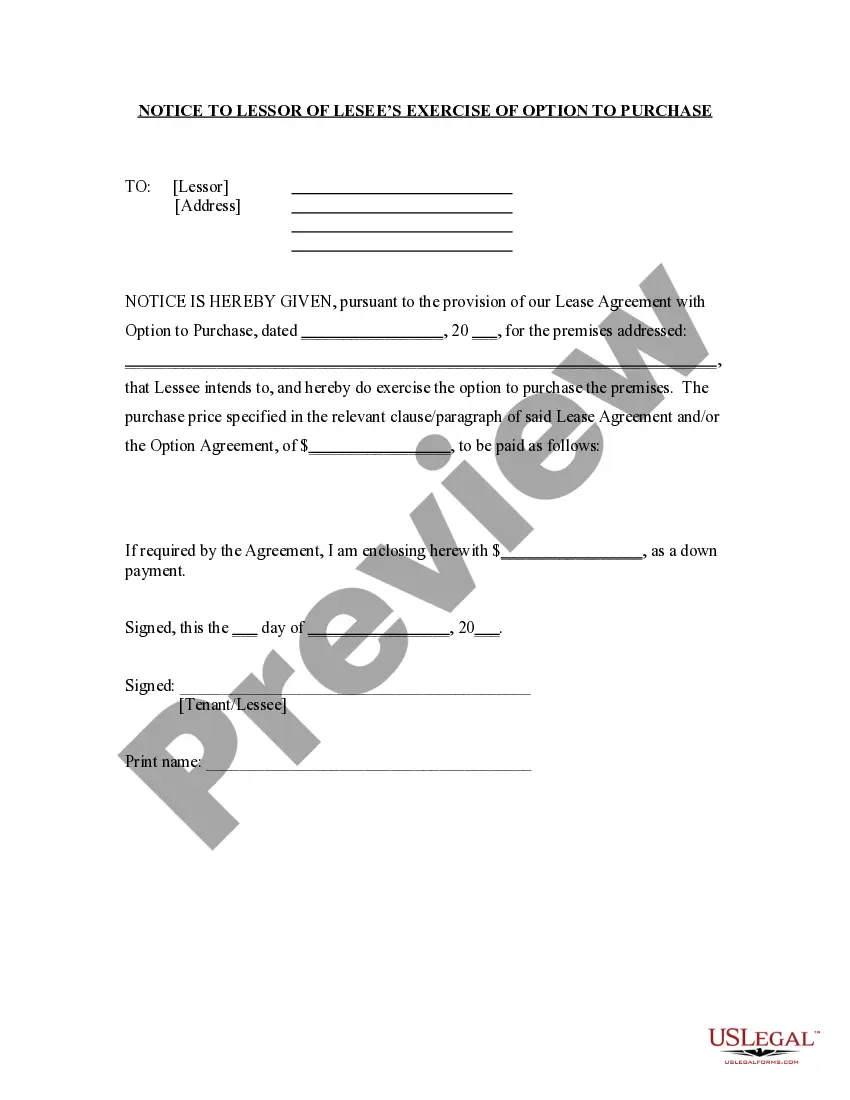

- Make sure you have selected the correct type for your personal city/region. Click on the Review switch to review the form`s content. Browse the type explanation to actually have selected the appropriate type.

- In case the type does not match your specifications, utilize the Search field at the top of the display screen to get the the one that does.

- Should you be happy with the form, validate your decision by clicking the Purchase now switch. Then, choose the prices prepare you like and provide your credentials to sign up for an account.

- Approach the purchase. Use your bank card or PayPal account to finish the purchase.

- Find the format and download the form in your device.

- Make alterations. Fill up, modify and produce and sign the delivered electronically North Carolina Stock Appreciation Rights Plan of The Todd-AO Corporation.

Each format you included in your bank account does not have an expiry date and is also yours forever. So, if you want to download or produce an additional duplicate, just visit the My Forms segment and then click about the type you need.

Gain access to the North Carolina Stock Appreciation Rights Plan of The Todd-AO Corporation with US Legal Forms, the most comprehensive catalogue of legal record layouts. Use thousands of skilled and condition-certain layouts that meet your organization or specific requires and specifications.

Form popularity

FAQ

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

Stock Appreciation Rights Are Not Securities.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Grant Date: The grant date is the date the stock appreciation right is given to you. This date also determines the exercise price. Exercise (strike) Price: The exercise price is the market price of the stock on the grant date and it's used to determine if your SARs are worth anything.

Intrinsic value is the difference between the fair value of the shares and the price that is to be paid for the shares by the counterparty.

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise. 2 Most employers will also withhold supplemental federal income tax.

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock.

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.