North Carolina Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes

Description

How to fill out Stock Option Plan - Permits Optionees To Transfer Stock Options To Family Members Or Other Persons For Estate Planning Purposes?

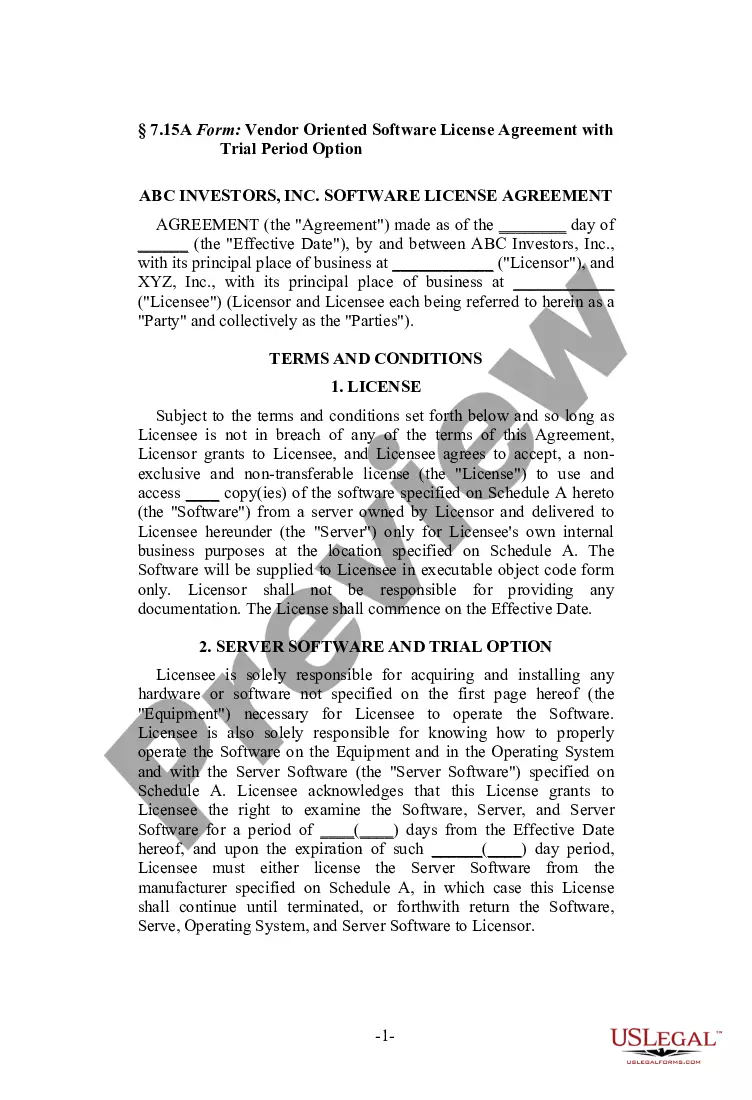

US Legal Forms - among the biggest libraries of legitimate varieties in the United States - delivers a wide range of legitimate record themes you are able to obtain or print out. Making use of the web site, you will get 1000s of varieties for organization and individual reasons, categorized by classes, says, or keywords.You will find the newest models of varieties just like the North Carolina Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes in seconds.

If you already possess a registration, log in and obtain North Carolina Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes through the US Legal Forms library. The Download option can look on each and every kind you perspective. You get access to all previously downloaded varieties in the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, listed here are simple guidelines to get you started:

- Ensure you have picked the proper kind for your area/region. Select the Preview option to examine the form`s content material. See the kind outline to actually have chosen the proper kind.

- In case the kind does not satisfy your requirements, take advantage of the Research field on top of the monitor to find the one who does.

- Should you be satisfied with the form, affirm your selection by simply clicking the Acquire now option. Then, pick the pricing plan you like and provide your accreditations to sign up for the bank account.

- Method the deal. Make use of charge card or PayPal bank account to finish the deal.

- Find the format and obtain the form on the product.

- Make changes. Complete, modify and print out and signal the downloaded North Carolina Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes.

Each web template you included in your account does not have an expiry time and is your own for a long time. So, in order to obtain or print out yet another copy, just go to the My Forms portion and click around the kind you need.

Get access to the North Carolina Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes with US Legal Forms, probably the most extensive library of legitimate record themes. Use 1000s of specialist and status-distinct themes that meet your business or individual requirements and requirements.

Form popularity

FAQ

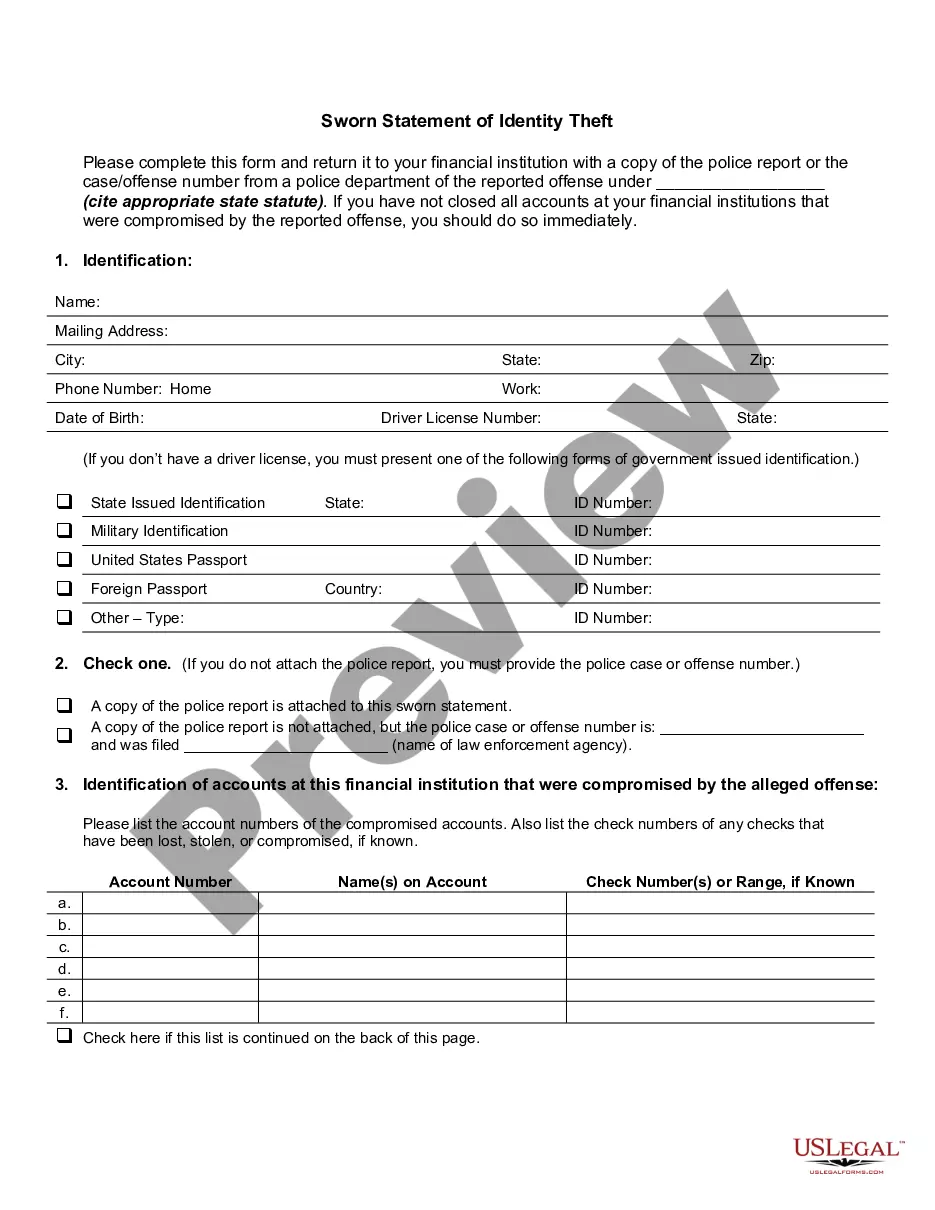

Stocks can be a great gift, and if you're wondering how to transfer stock to a family member, you can simply contact your broker. You could also fill out a stock transfer form and endorse the stock certificate. Learning how to gift stocks is the easy part ? you also have to consider the tax implications.

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

Permitted transferees usually include family members, trusts for family members or limited partnerships, or other entities owned by family members. In a simple option transfer to a family member, you transfer a vested option to a child, grandchild, or other heir.

Understanding Inherited Stock Options If you inherit stock upon the original owner's death, your first task will be to check the paperwork that comes with the options to determine whether they expired upon the original holder's death. Some options expire on the death of the holder, and others do not.

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

In most cases, the options do not lapse. After your death, your estate or beneficiary may exercise any vested options, ing to the option grant's terms and deadlines, along with any estate-planning documents (e.g. a will).

Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though.