North Carolina Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

Have you been inside a situation that you require papers for sometimes company or individual uses virtually every time? There are a variety of legal papers themes available online, but locating versions you can rely is not straightforward. US Legal Forms provides a huge number of kind themes, such as the North Carolina Proposal to Approve Adoption of Employees' Stock Option Plan, which can be published to meet state and federal demands.

When you are currently acquainted with US Legal Forms site and possess a merchant account, basically log in. Afterward, you can down load the North Carolina Proposal to Approve Adoption of Employees' Stock Option Plan template.

Unless you offer an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is to the appropriate metropolis/area.

- Take advantage of the Review switch to check the form.

- Look at the outline to actually have selected the proper kind.

- In the event the kind is not what you are looking for, make use of the Search industry to find the kind that meets your requirements and demands.

- If you obtain the appropriate kind, click Acquire now.

- Choose the prices prepare you need, fill out the required details to produce your money, and buy the order making use of your PayPal or charge card.

- Select a convenient document structure and down load your duplicate.

Locate all of the papers themes you possess bought in the My Forms food list. You can obtain a further duplicate of North Carolina Proposal to Approve Adoption of Employees' Stock Option Plan any time, if possible. Just go through the required kind to down load or print out the papers template.

Use US Legal Forms, one of the most considerable selection of legal kinds, to conserve some time and prevent mistakes. The service provides skillfully made legal papers themes that you can use for an array of uses. Make a merchant account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

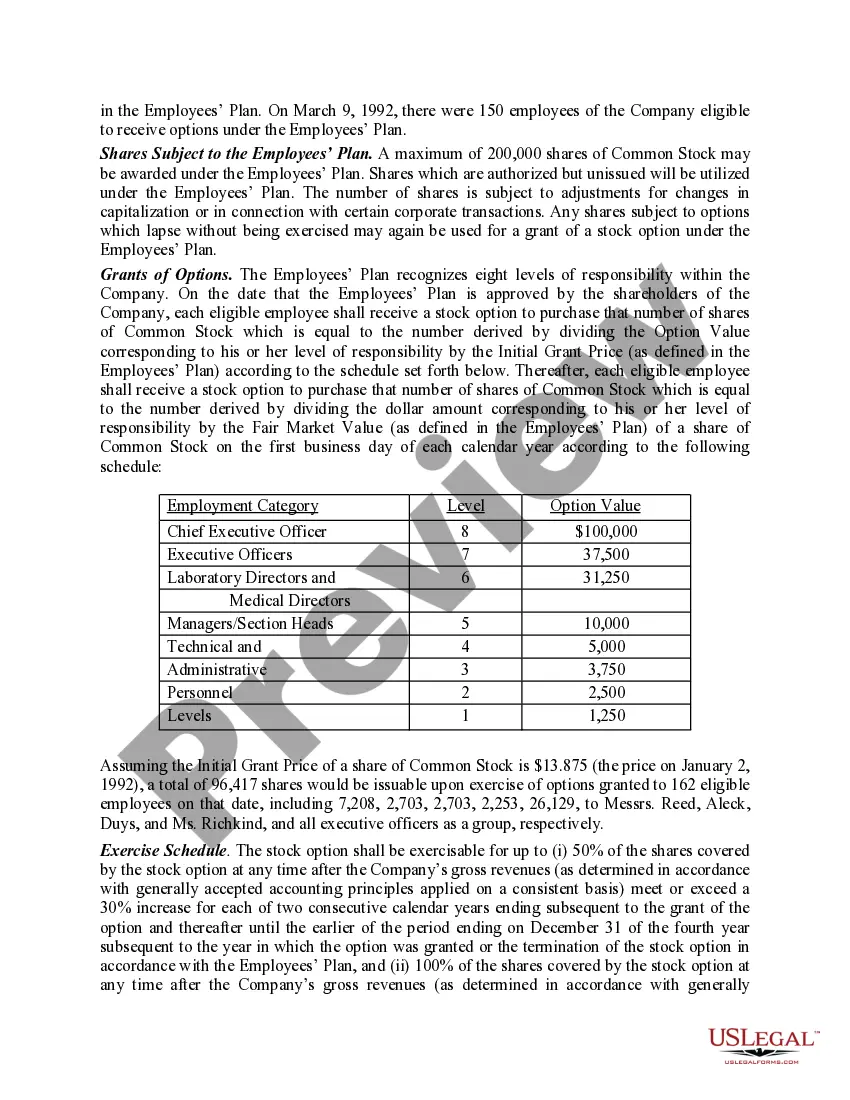

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

ESOPs are designed for prolonged, sustained growth by a business, and for a business that intends to operate for 10, 20, or more years into the future. An Equity Incentive Plan, in contrast, is geared more toward a change of control and exit from the business by service provider employees in 3-5 years (or less).

Identification. An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

A business owner can create an employee-owned trust, also called a perpetual employee trust, and fund it as a company expense. The trust then purchases some or all shares from the owner; membership is free for workers.

What is the difference between stock options and an employee stock ownership plan (ESOP)? Stock options are usually granted to company executives whereas ESOP's are provided to all employees. ESOPs provide bak advantages to employers.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

ESOPs are expensive to set up, and expensive to maintain as an appraisal is required annually to stay in compliance. If the cash flow dedicated to the ESOP will greatly limit the cash available to reinvest in the business over the long-term, an ESOP is unlikely to be a good fit.