North Carolina List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

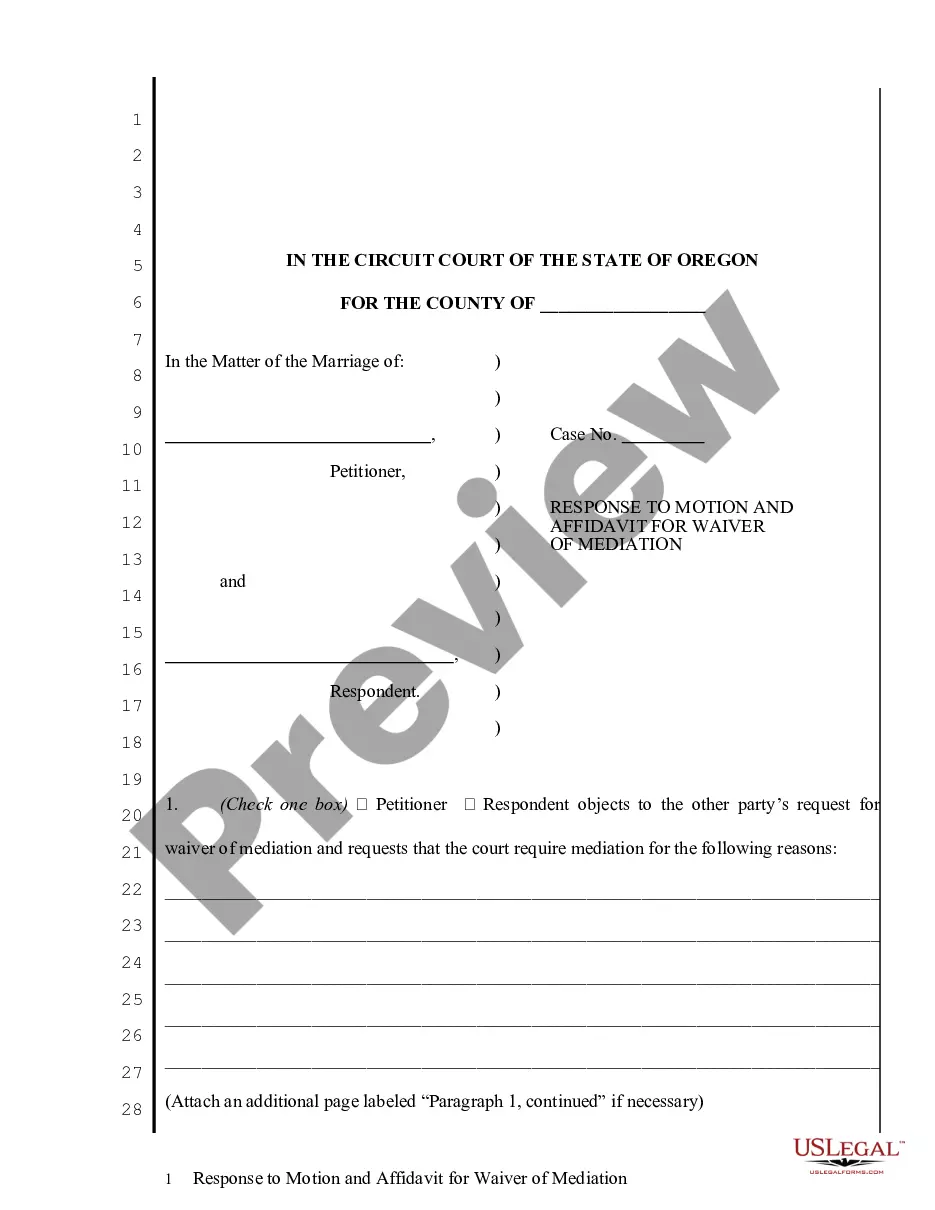

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Choosing the best authorized document template can be a have difficulties. Needless to say, there are a lot of templates available on the net, but how will you find the authorized type you want? Take advantage of the US Legal Forms site. The service provides a huge number of templates, for example the North Carolina List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, which can be used for organization and personal requirements. Each of the types are checked out by experts and meet up with federal and state requirements.

In case you are previously registered, log in to your account and click on the Down load switch to find the North Carolina List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005. Use your account to look from the authorized types you possess ordered in the past. Check out the My Forms tab of your account and acquire another version in the document you want.

In case you are a brand new customer of US Legal Forms, here are basic instructions that you should comply with:

- Initially, ensure you have chosen the appropriate type for your area/region. It is possible to look over the shape while using Preview switch and study the shape description to make certain it will be the best for you.

- If the type is not going to meet up with your preferences, utilize the Seach field to get the correct type.

- When you are positive that the shape would work, click the Get now switch to find the type.

- Opt for the rates program you need and type in the essential details. Make your account and purchase an order with your PayPal account or credit card.

- Choose the submit format and download the authorized document template to your system.

- Comprehensive, modify and print out and signal the acquired North Carolina List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

US Legal Forms will be the most significant library of authorized types in which you will find various document templates. Take advantage of the service to download skillfully-made papers that comply with express requirements.

Form popularity

FAQ

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

During compulsory and voluntary liquidation proceedings, unsecured creditors have the right to form a creditors' liquidation committee. This usually consists of between three and five members, their role being to oversee the liquidation process on behalf of unsecured creditors as a group.

On a company's insolvency creditors will rank in the following order of priority: Liquidator's fees and expenses of the winding up. Preferential debts (rent due to a landlord, wages and salaries, unpaid income tax and social security contributions). Unsecured debts. Postponed debts.

A total of 226,777 chapter 13 consumer cases were closed by dismissal or plan completion in 2020. Table 6 illustrates that 116,145 of these cases were dismissed. In 49 percent of the cases closed (110,632 cases), the debtors received a discharge after completing repayment plans, up from 43 percent in 2019.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).