North Carolina Notice to Employees Who Haven't Produced Identity and Employment Verification Documents

Description

How to fill out Notice To Employees Who Haven't Produced Identity And Employment Verification Documents?

Have you ever been in a location that requires documentation either for organizational purposes or particular reasons almost every workday? There are numerous authentic document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, including the North Carolina Notice to Employees Who Haven't Submitted Identity and Employment Verification Documents, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the North Carolina Notice to Employees Who Haven't Submitted Identity and Employment Verification Documents template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Carolina Notice to Employees Who Haven't Submitted Identity and Employment Verification Documents at any time if needed. Just follow the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of official forms, to save time and avoid errors. This service provides professionally crafted legal document templates that you can employ for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

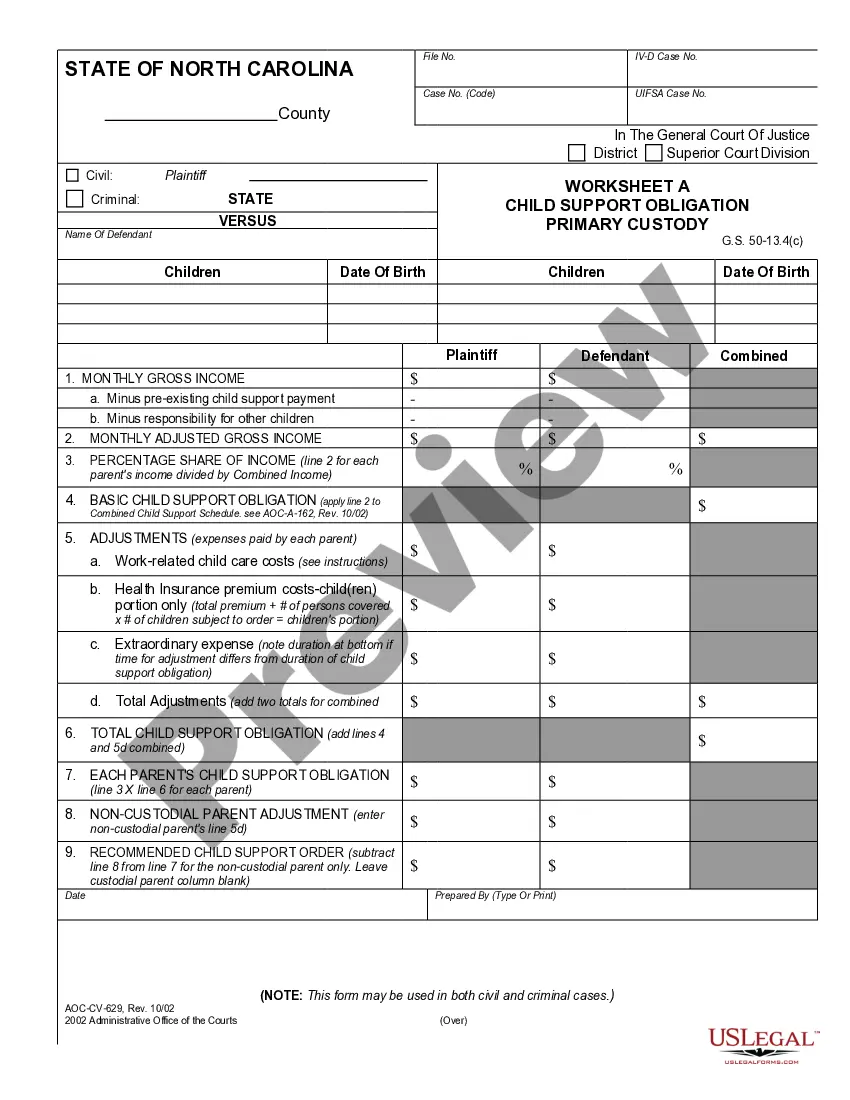

- Obtain the form you need and ensure it is for the correct city/county.

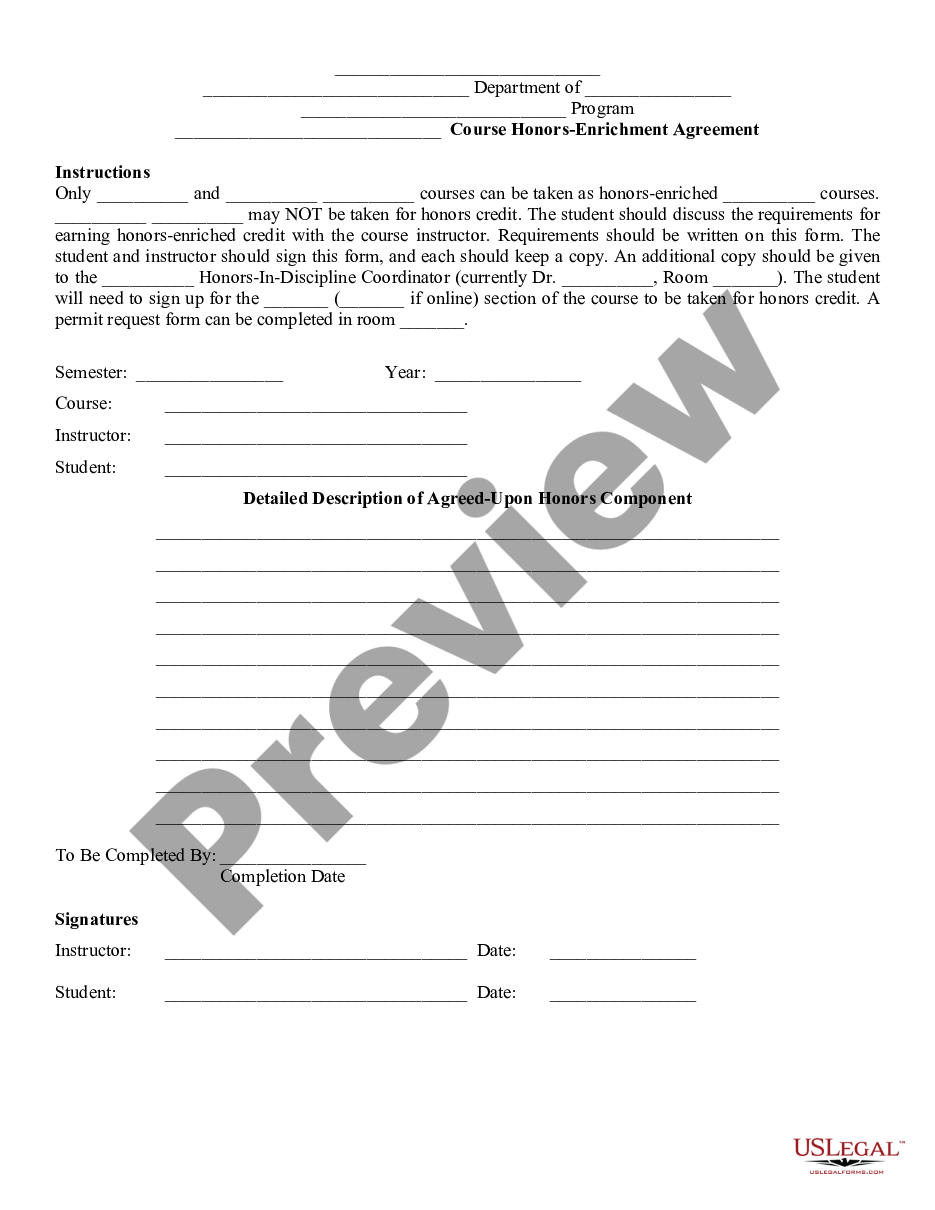

- Use the Preview feature to examine the form.

- Review the details to confirm that you have selected the right form.

- If the form isn’t what you need, make use of the Search field to find the form that meets your criteria and requirements.

- Once you have the correct form, click Order now.

- Choose the payment plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

Failure to comply with I-9 verification and document retention requirements could result in a penalty. Most recently, the minimum penalty for a first offense is $252 per I-9; the maximum penalty is $2,507 per I-9 for a first offense.

If you suspect the background check has been unable to verify dates of employment for a certain employer, contact the background check company and ask what you can do to facilitate the process. They may ask for additional information, ask you to contact the employer directly, or request copies of your W-2s.

What can be done to verify current employment without having to contact the current employer? The employer can request pay stubs from the employee that will show what wage they are currently earning, their current position, and employment dates.

A. If an employee is unable to present the required document or documents within 3 business days of the date employment begins, the employee must produce a receipt showing that he or she has applied for the document. In addition, the employee must present the actual document to you within 90 days of the hire.

Check credentials To check your credentials, a prospective employer calls your previous employers directly to verify the accuracy of jobs and dates of employment in your application. A prospective employer may also ask them about your skills and how well you performed tasks.

California. Passed in 2016, Assembly Bill 622 forbids employers to unlawfully use the E-Verify program with penalties per violation set at $10,000.

How to Request the LetterAsk your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

This e-verification can be done at the time of filing return or even after return filing. Penalty under Section 234F is not applicable if ITR is filed before due date but verification is done after the due date.

EVC refers to Electronic Verification Code. It is a 10-digit alphanumeric code, unique to every PAN. It is required for e-verification of ITR. Please note that ITR must be verified within 120 days of ITR filing.

If you fail to submit your ITR-V within 120 days of filing your Income Tax Return, then your Income Tax Return will be considered as null and void or invalid. It means, the Income Tax Department will consider, that you have not yet filed your IT return.