North Carolina Release of All Auto Accident Claims

Description

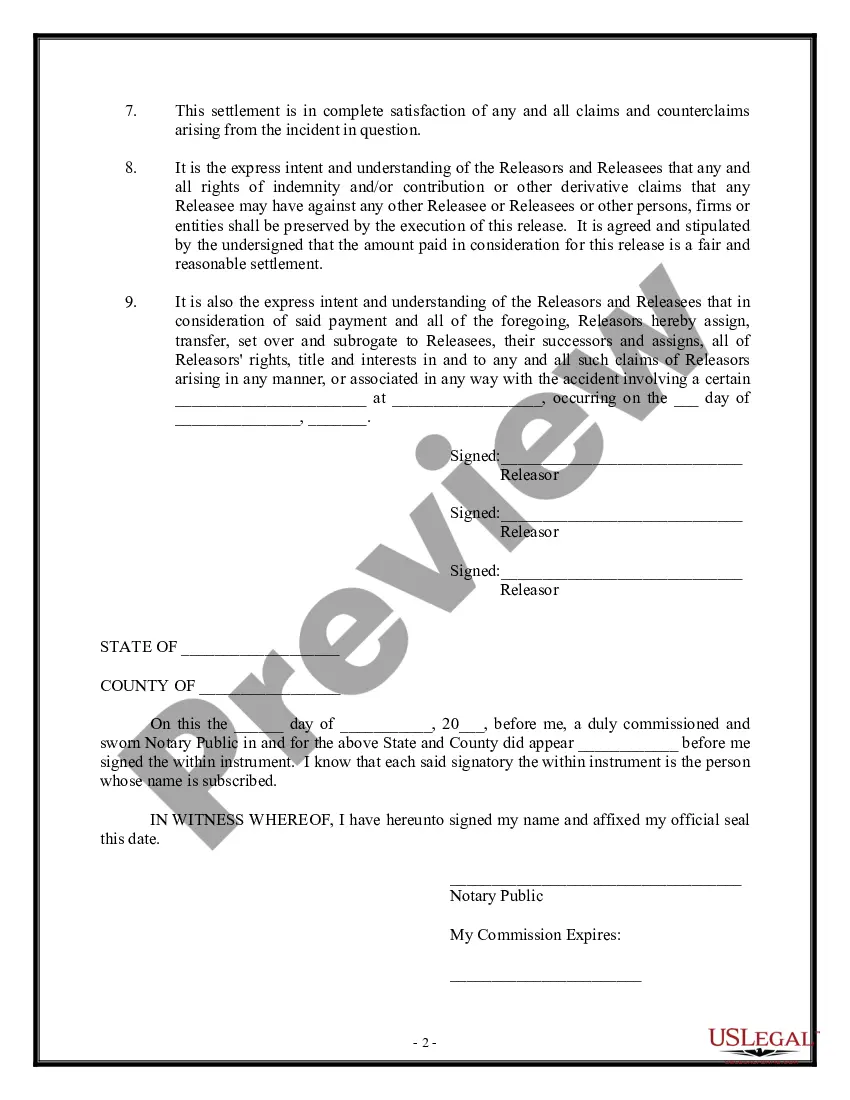

How to fill out Release Of All Auto Accident Claims?

Finding the appropriate legal document template may be challenging.

Certainly, there are many designs accessible online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. The service offers a vast array of designs, including the North Carolina Release of All Auto Accident Claims, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your area/region. You can preview the form using the Preview button and review the form details to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the North Carolina Release of All Auto Accident Claims.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

Form popularity

FAQ

Also known as a general release or release. A written contract in which one or more parties agree to give up legal causes of action against the other party in exchange for adequate consideration (that is, something of value to which the party releasing the legal claims is not already entitled).

A settlement agreement is a legally-binding document both parties sign, agreeing to end the dispute and dismiss their claims. It's also customary to sign a release in a settlement agreement.

A release of all claims form releases the responsible party (the other driver who was at fault and their insurance company) from any liability and obligation to pay you for the damages associated with the accident. Insurance companies usually ask you to sign the release form before making any payments.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).

In fact, North Carolina is an at-fault state for car accidents. That means the person deemed responsible for the accident must pay damages to another driver, passenger, or property owner if they need repairs or medical treatment.

The North Carolina Department of Insurance monitors compliance of insurance companies with laws and regulations. Based on these regulations, your insurer has a responsibility to respond to your claim within 30 days after the claim is filed.

The easiest may be to ask your existing car insurance provider for details of any claims you've made in the past. This information could include the date of any claims, the type of claims, how much was paid out, and details of any injuries. Alternatively, you could contact the Claims and Underwriting Exchange (CUE).

The release of claims is an agreement between an employer and a worker whose employment has been terminated. Employees typically sign the document in return for a severance package. The release is meant to limit potential litigation for reasons such as discrimination.

A release of all claims form is exactly what it sounds like: it is a document that absolves the parties of any liability for an accident. Once this form is signed, it is no longer possible for an injured accident victim to pursue a personal injury claim against the at-fault driver.

The simplest method of checking your car insurance claims history is to request it directly from the insurance company you were with when you made the claim. They should be able to tell you when the incident happened, what type of claim you made, and what the outcome was - including whether anyone was injured.