North Carolina Collections Coordinator Checklist

Description

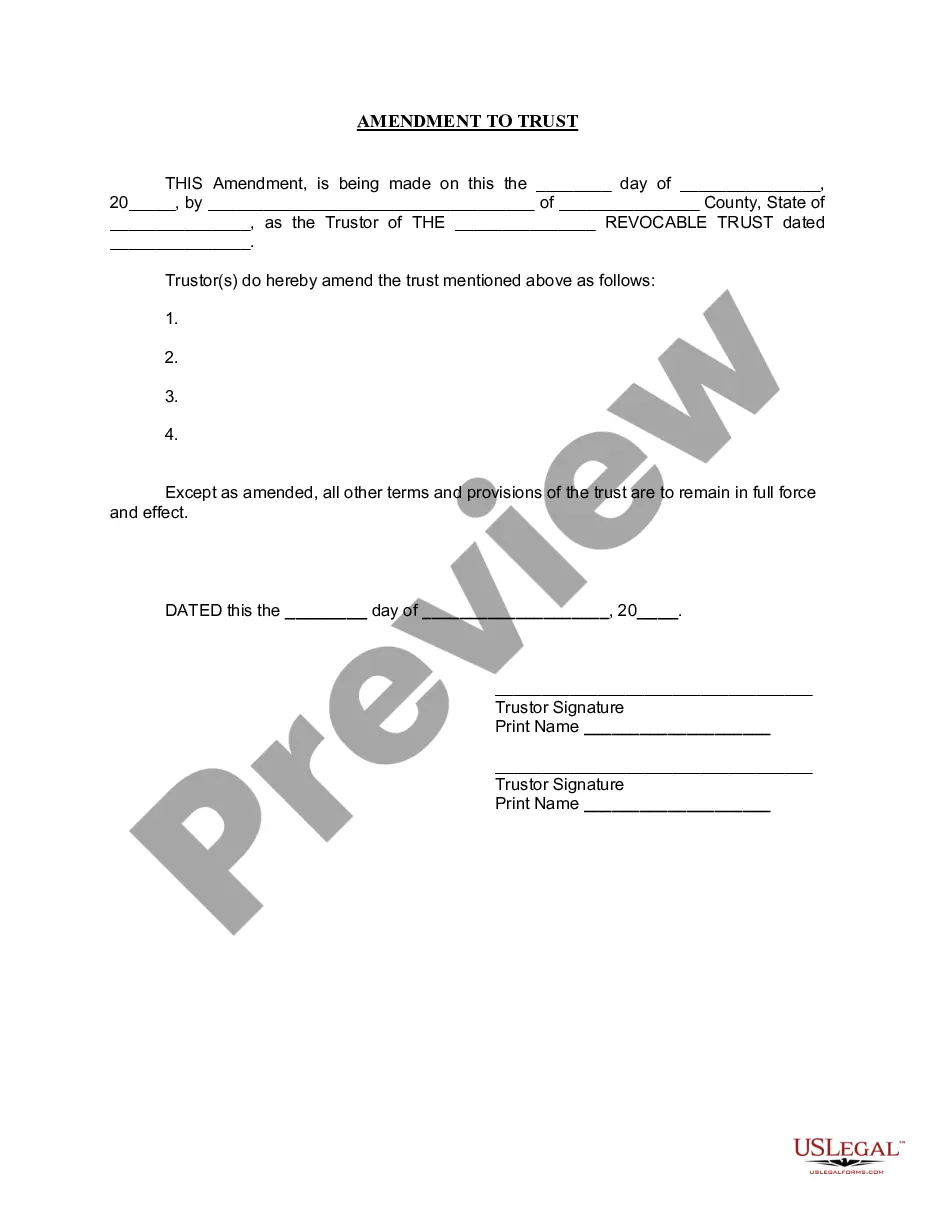

How to fill out Collections Coordinator Checklist?

It is feasible to spend numerous hours online searching for the legal document template that complies with the state and federal requirements you will require.

US Legal Forms provides a vast array of legal forms that are assessed by experts.

You can conveniently download or print the North Carolina Collections Coordinator Checklist from the service.

You can download and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the North Carolina Collections Coordinator Checklist.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/town you select.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Ask the debt collector to supply you with the details of the debt he or she is attempting to collect. Who is the original creditor? What was the original amount owed? How much of what you are attempting to collect is fees and interest accrued since he or she took possession of the debt?

North Carolina's statute of limitations on most debts is 3 years. North Carolina does not permit wage garnishment for commercial debts, though the IRS or State can garnish wages. Bank accounts are not exempt from attachment by judgment creditors.

All debt collection agencies are legally required to be regulated by the Financial Conduct Authority (FCA), which CPA are. If you go on to the Cash Protection Agency website you will see the FCA badge at the footer of the website.

In North Carolina, entities who engage in the collection agency business and/or solicit debt from more than one person must hold a Collection Agency license. Such a license is also required of debt buyers who engage in purchasing consumer loans, credit accounts, or consumer debt for collection purposes.

Most employers require a bachelor's degree to work as a debt collector. You can pursue an undergraduate degree in an area of studies such as business, finance or accounting. Some students also pursue communications because this can provide knowledge to find and contact those with debts.

You need to ensure your collectors are licensed to operate in Alberta....You will need to provide:information on your business.a criminal record check or police information check.a completed collector application form.a security.trust account information.additional information.payment for a licensing fee.

In North Carolina, debt buyers may not collect on debts where the statute of limitations has expired. This means that firms who specialize in collecting debts and who purchase debt from creditors may not pursue you after three years.

North Carolina's statute of limitations on most debts is 3 years. North Carolina does not permit wage garnishment for commercial debts, though the IRS or State can garnish wages. Bank accounts are not exempt from attachment by judgment creditors.