North Carolina Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Annual Disbursements To Members Of The Company?

Have you ever found yourself in a situation where you require documents for both professional and personal matters nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template options, such as the North Carolina Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company, which are designed to comply with federal and state regulations.

Once you find the correct template, click Purchase now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the North Carolina Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you require and ensure it is appropriate for your specific city or county.

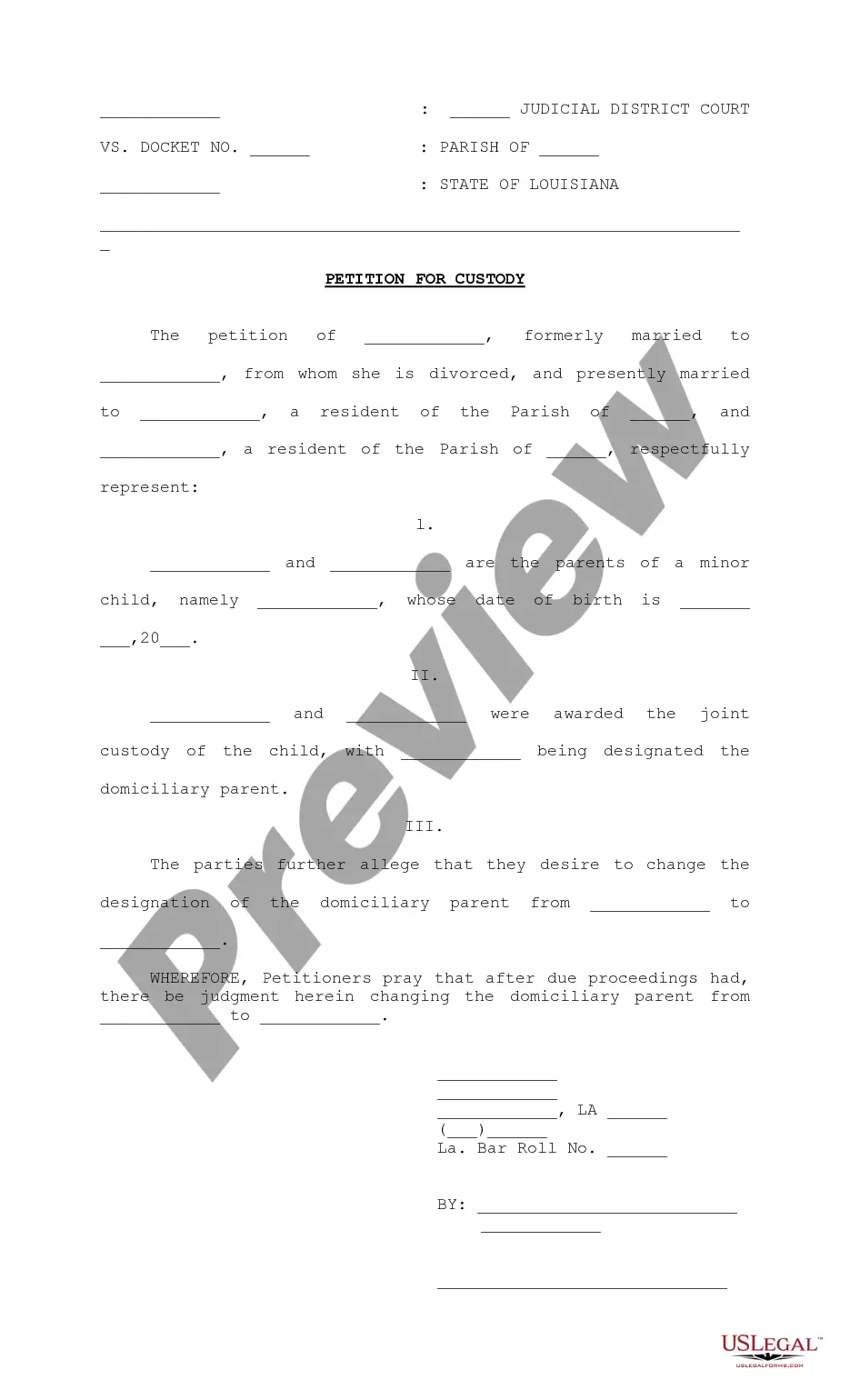

- Utilize the Review button to examine the form.

- Check the description to make sure you have selected the correct template.

- If the template isn’t what you need, use the Search feature to find the form that meets your needs and requirements.

Form popularity

FAQ

Professional limited liability companies (PLLC), professional corporations (PCs), and limited partnerships (LPs) are not required to file annual reports with the state.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.

North Carolina Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

Each domestic and foreign Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership, other than professional entities formed under Chapter 55B of the N.C. General Statutes, is required to deliver an annual report to the Secretary of State.

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

North Carolina Annual Reports are filed with the Annual Report. In most states, you will need to look up your business entity in public records. Be sure to find the corporations filing authority in your state and conduct a North Carolina Secretary of State - Business Registration Division business search.

In North Carolina, an annual report is a regular filing that your LLC must complete every year to update your business information, including: Company address. Registered agent name and address. Names and addresses of LLC members or managers.

An Annual report is a filing that details a company's activities throughout the prior year. Annual reports are intended to give state governing authorities information regarding the names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address.