North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization

Description

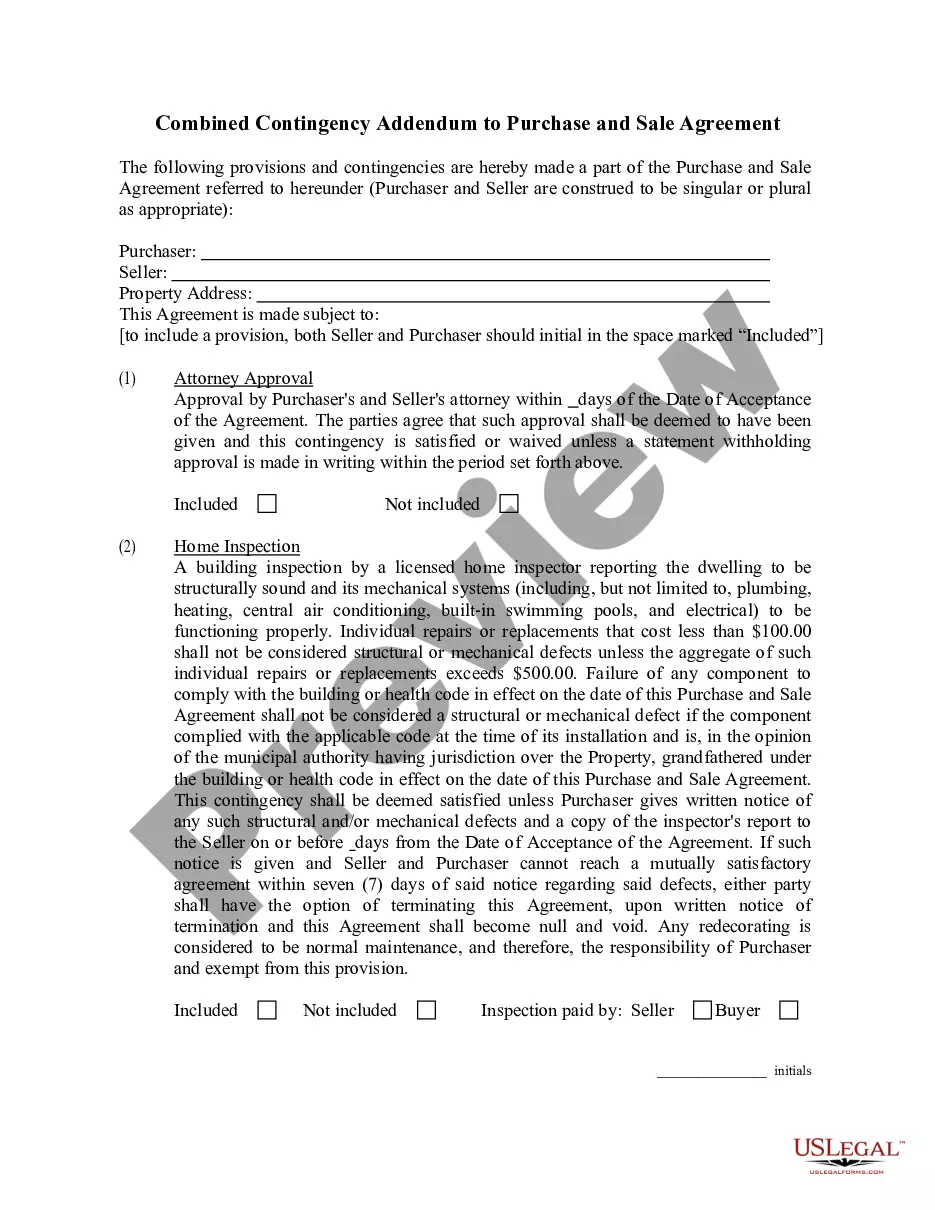

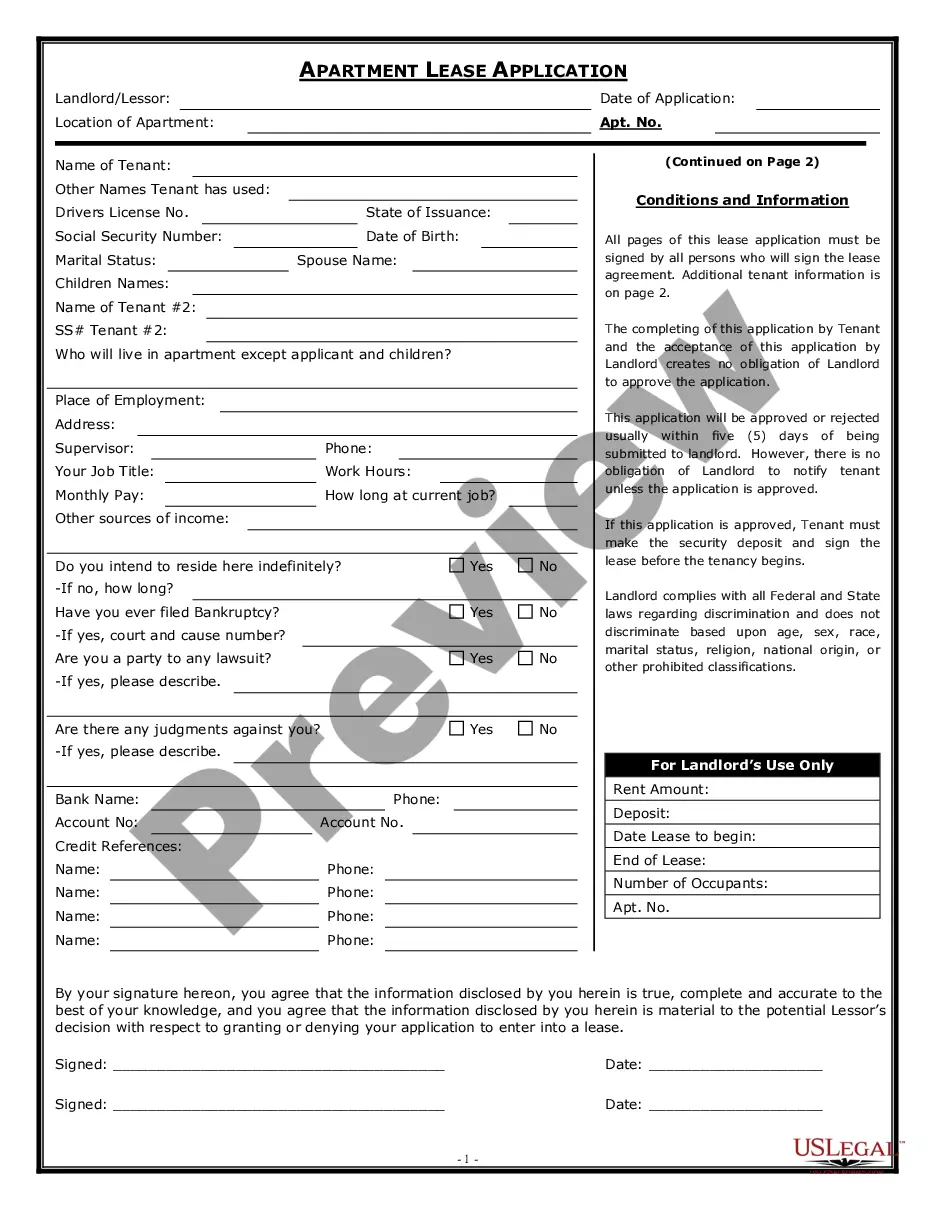

How to fill out Resolution Of Meeting Of LLC Members To Amend The Articles Of Organization?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can locate thousands of forms for business and personal purposes, categorized by type, state, or keyword. You can quickly find the newest forms like the North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization.

If you have a monthly subscription, Log In to download the North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization from the US Legal Forms database. The Download button will be visible on each document you view. You can access all previously downloaded forms in the My documents section of your account.

Make changes. Fill out, edit, print, and sign the downloaded North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization.

Each template you added to your account does not expire and is yours permanently. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization with US Legal Forms, the most comprehensive library of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you select the correct form for your city/state. Click the Preview button to review the content of the form. Read the description of the form to verify that you have chosen the correct one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your pricing plan and provide your information to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

To remove a member from an LLC in North Carolina, you typically need to follow the procedures outlined in your operating agreement. If your agreement does not specify a process, you will likely need to hold a meeting and pass a resolution, adhering to the guidelines set by the North Carolina Resolution of Meeting of LLC Members to Amend the Articles of Organization. Utilizing services like uslegalforms can provide templates and guidance to simplify this process for you.

To amend your North Carolina articles of incorporation, you just need to submit form B-02, Articles of Amendment, Business Corporation to the North Carolina Secretary of State, Corporations Division (SOS) by mail, in person, or online. A Coversheet for Corporate Filings is required for over the counter filings.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To amend a North Carolina LLCs articles of organization, you file form L-17, Limited Liability Company Amendment of Articles of Organization with the North Carolina Secretary of State, Corporations Division SOS. You can submit the amendment by mail, in person, or online.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Every North Carolina LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Percentages of Ownership Members usually receive ownership percentages in proportion to their contributions of capital, but LLC members are free to divide up ownership in any way they wish. These contributions and percentage interests are an important part of your operating agreement.

Depending on your state, you will probably do this through:Filing Articles of Amendment with your state's business registration agency.Filing a Statement of Information: with your state's business registration agency.Providing a notice of ownership change as part of your annual reporting requirements.

LLC ownership percentage is usually determined by how much equity each owner has contributed. The ownership interest given to each owner can depend on the need of the limited liability company and the rules of the state where the LLC has been formed.