North Carolina Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

You can dedicate multiple hours online seeking the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

It's easy to download or print the North Carolina Agreement to Sell Partnership Interest to Third Party from the services.

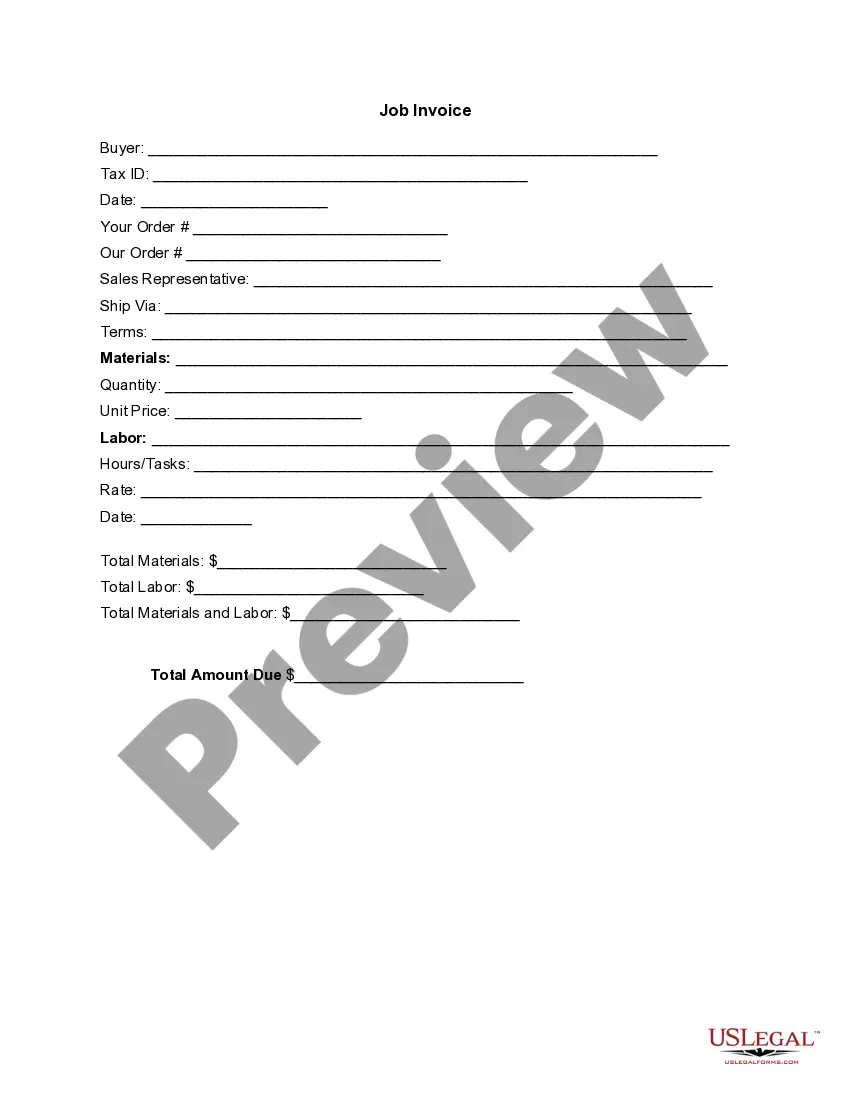

If available, use the Preview button to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can complete, modify, print, or sign the North Carolina Agreement to Sell Partnership Interest to Third Party.

- Every legal document template you obtain is yours permanently.

- To get another copy of any purchased template, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your area/city of your choice.

- Review the template information to make sure you have selected the correct type.

Form popularity

FAQ

Buyouts over time agree that the purchasing partner will pay the bought out partner a predetermined amount over time until their ownership has been fully purchased. Similarly, an earn-out pays the partner out over time but requires the partner to stay with the company during a defined transition period.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.