North Carolina Notice of Unpaid Invoice

Description

How to fill out Notice Of Unpaid Invoice?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are many legal document templates available online, but locating reliable ones isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the North Carolina Notice of Unpaid Invoice, designed to comply with federal and state regulations.

Once you acquire the right form, click Purchase now.

Select the pricing plan you prefer, fill in the required details to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Notice of Unpaid Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is suited to the correct city/county.

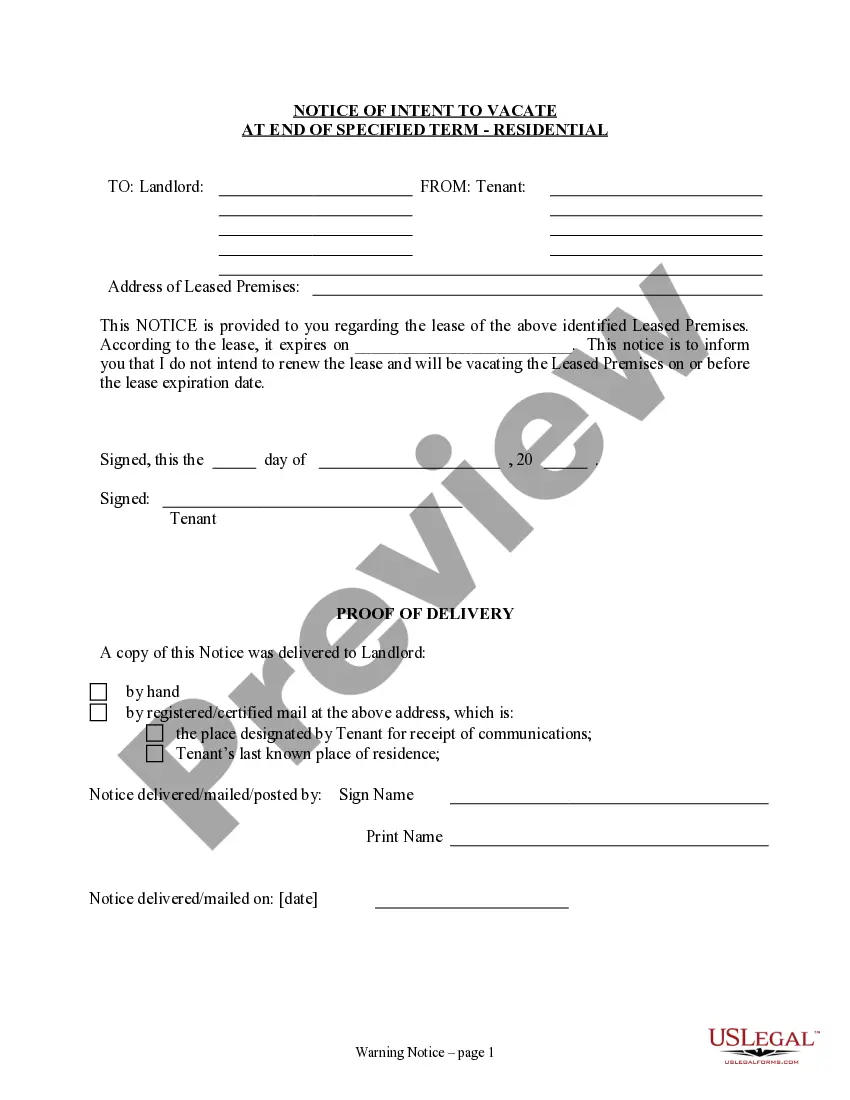

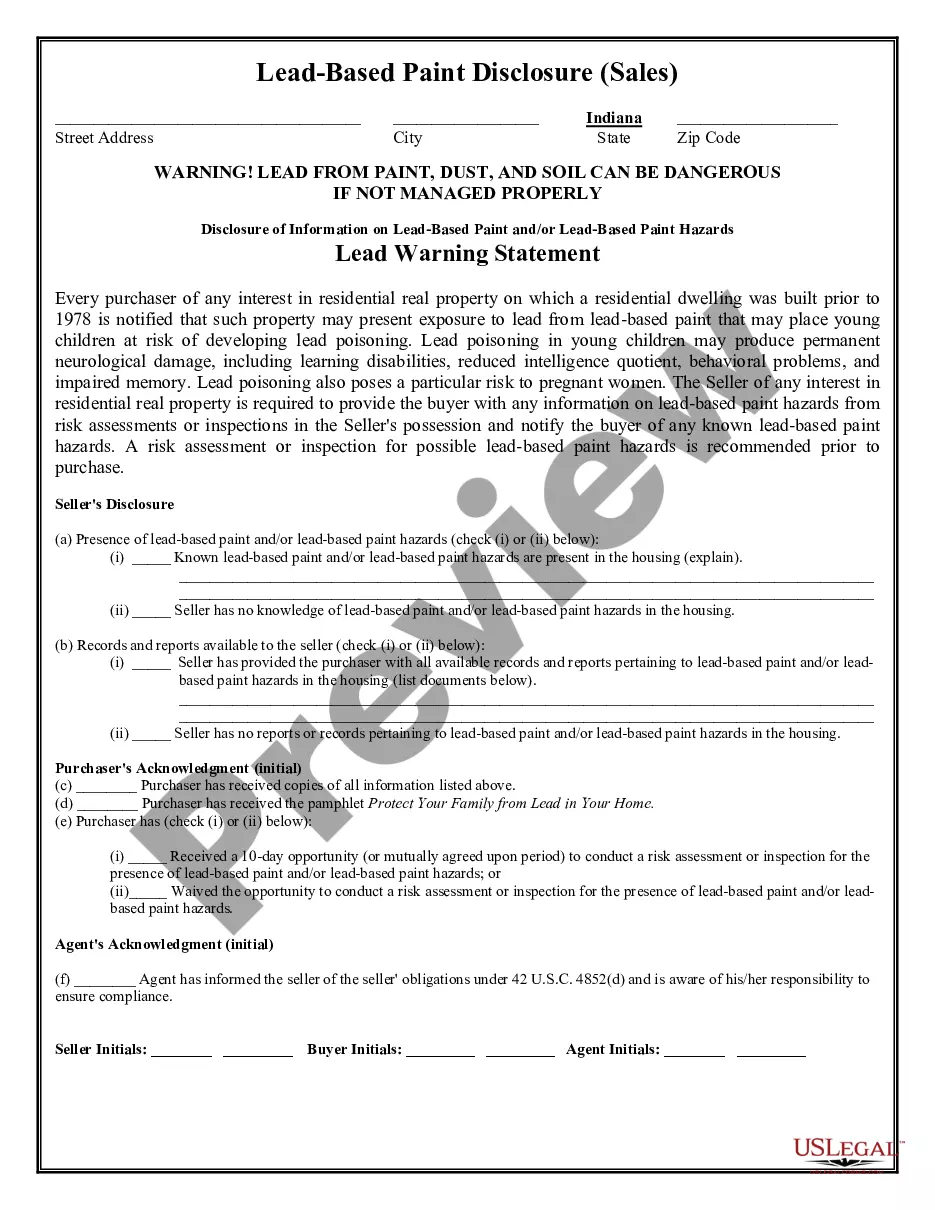

- Utilize the Preview button to review the form.

- Read the description to confirm you have chosen the appropriate form.

- If the form isn’t what you need, use the Search bar to locate a form that meets your needs and specifications.

Form popularity

FAQ

Tax warrants create liens against property to collect unpaid taxes (income or otherwise) and are filed by the Department of Revenue (DOR) in the county or counties where the taxpayer owns property.

Contact UsPhone. 877-7MY-PASS (877-769-7277)Online. Send a message.Fax. (919) 388-3279.

Can you pay someone's delinquent taxes and become the owner of the property? No. Paying someone else's taxes will not entitle you to any legal ownership to the property.

If you do not pay your initial bill in full by its due date, the unpaid toll transactions on the initial invoice will escalate on the subsequent invoice and will be subject to processing fees and civil penalties through the issuance of the subsequent succeeding invoices.

Notices are sent out when the department determines taxpayers owe taxes to the State that have not been paid for a number of reasons.

A tax warrant is a request to levy upon and sell any personal property owned by a taxpayer who has failed to pay tax, penalty, interest and fees that have been assessed by the NC Department of Revenue.

The NCDOR will not contact a taxpayer in person unless the agency has first attempted to provide the taxpayer with notification(s) via mail.

Accessed means that the IRS is going through your tax return to make sure that everything is correct. It means that your return has passed the initial screening and, at least for the moment, has been accepted.

Dial 1-877-252-4052 2. For questions surrounding your 2019 Ind. Income return, please follow the phone prompts. For questions concerning any other tax years, please see to check account status for directions.

A tax warrant is a request to levy upon and sell any personal property owned by a taxpayer who has failed to pay tax, penalty, interest and fees that have been assessed by the NC Department of Revenue.