North Carolina Business Trust

Description

How to fill out Business Trust?

Are you currently in a scenario where you require documents for either business or personal needs frequently.

There are numerous legal document templates accessible online, but finding reliable versions isn't simple.

US Legal Forms offers thousands of template forms, such as the North Carolina Business Trust, designed to comply with state and federal regulations.

If you find the correct form, click on Get now.

Choose the payment plan you want, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Business Trust template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/county.

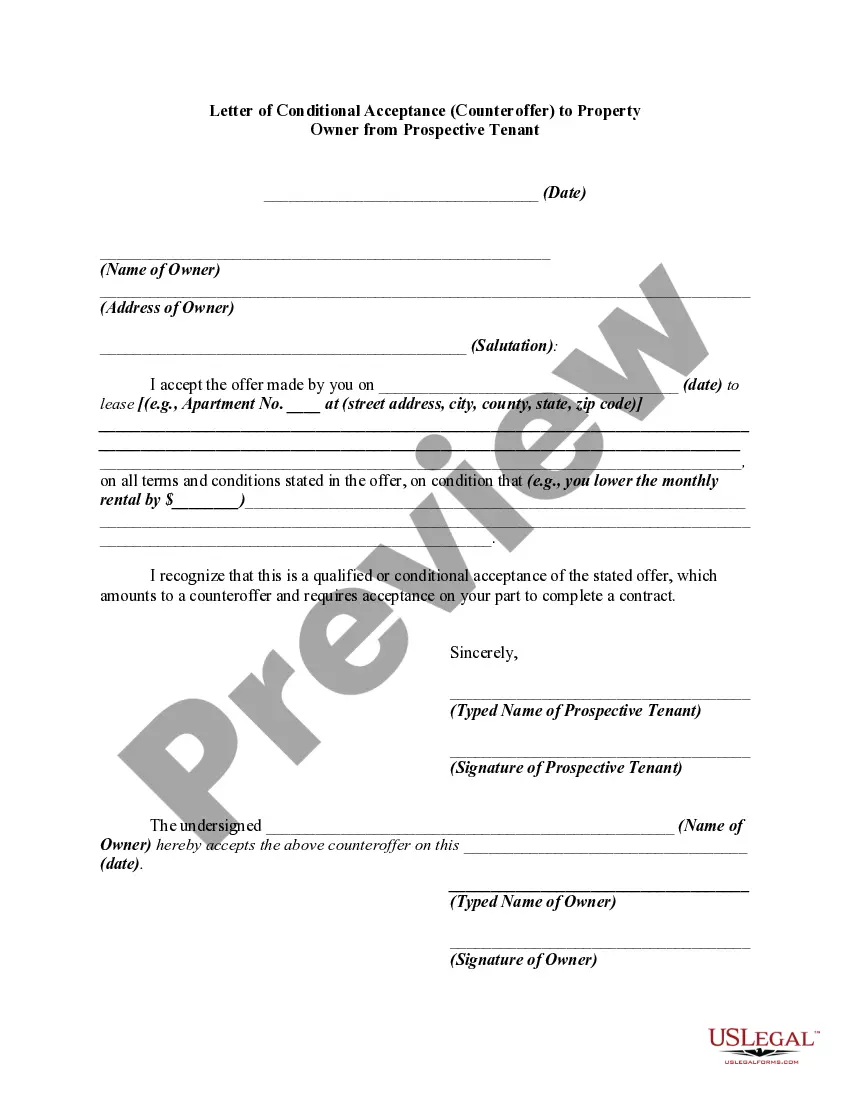

- Use the Review button to examine the form.

- Check the description to verify that you have chosen the correct form.

- If the form isn't what you are looking for, utilize the Search area to find a form that meets your needs.

Form popularity

FAQ

Functionally, a business trust is quite similar to an individual or family trust. It helps delegate control of assets to a trustee, who manages the trust and its contents on behalf of the grantor.

A will distributes assets immediately after probate ends. A trust lets you keep assets in the trust if you wish and pass them on at later dates, such as beneficiaries' significant birthdays. Your revocable living trust protects you should you become mentally incapacitated.

If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000.

Meaning of business trust in Englisha legal arrangement in which a person or organization controls property, investments, etc., for another person or business: Houses can be purchased in the name of a business trust to disguise the name of the actual owner.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay more than $1,000, and fees will be higher for couples. You can also use online software to create trust documents at a cheaper rate.

What is a Trust in North Carolina? A trust is an instrument whereby one person, the settlor, transfers property to a second person, the trustee, who holds and manages the property for the benefit of one or more third parties, the beneficiaries.

How Does a Business Trust Work? A trust is an agreement that allows one party, known as a trustee, to hold, manage, and direct assets or property on behalf of another party, called the beneficiary. In a business trust, a trustee manages a business and conducts transactions for the benefit of its beneficiaries.

To make a living trust in North Carolina, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

Advantages of a trust A trust provides asset protection and limits liability in relation to the business. Trusts separate the control of an asset from the owner of the asset and so may be useful for protecting the income or assets of a young person or a family unit. Trusts are very flexible for tax purposes.

Wills must be probated and become part of the public record when they are filed with the court. However, most states, including North Carolina, afford privacy to a living trust's creator and beneficiaries by not requiring public registration of trusts.