North Carolina Worksheet for Making a Budget

Description

How to fill out Worksheet For Making A Budget?

Are you in a circumstance where you frequently require documents for a business or particular purposes.

There are numerous legitimate document templates available online, but locating trustworthy versions is challenging.

US Legal Forms offers a vast collection of form templates, including the North Carolina Worksheet for Creating a Budget, which are crafted to meet federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain a duplicate of the North Carolina Worksheet for Creating a Budget at any time, if needed. Simply select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Carolina Worksheet for Creating a Budget template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- 1. Acquire the form you need and ensure it is for the correct city/state.

- 2. Utilize the Review button to examine the form.

- 3. Read the description to confirm you have chosen the right form.

- 4. If the form is not what you are looking for, use the Search field to find the form that fits your needs.

- 5. Once you locate the appropriate form, click on Buy now.

- 6. Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

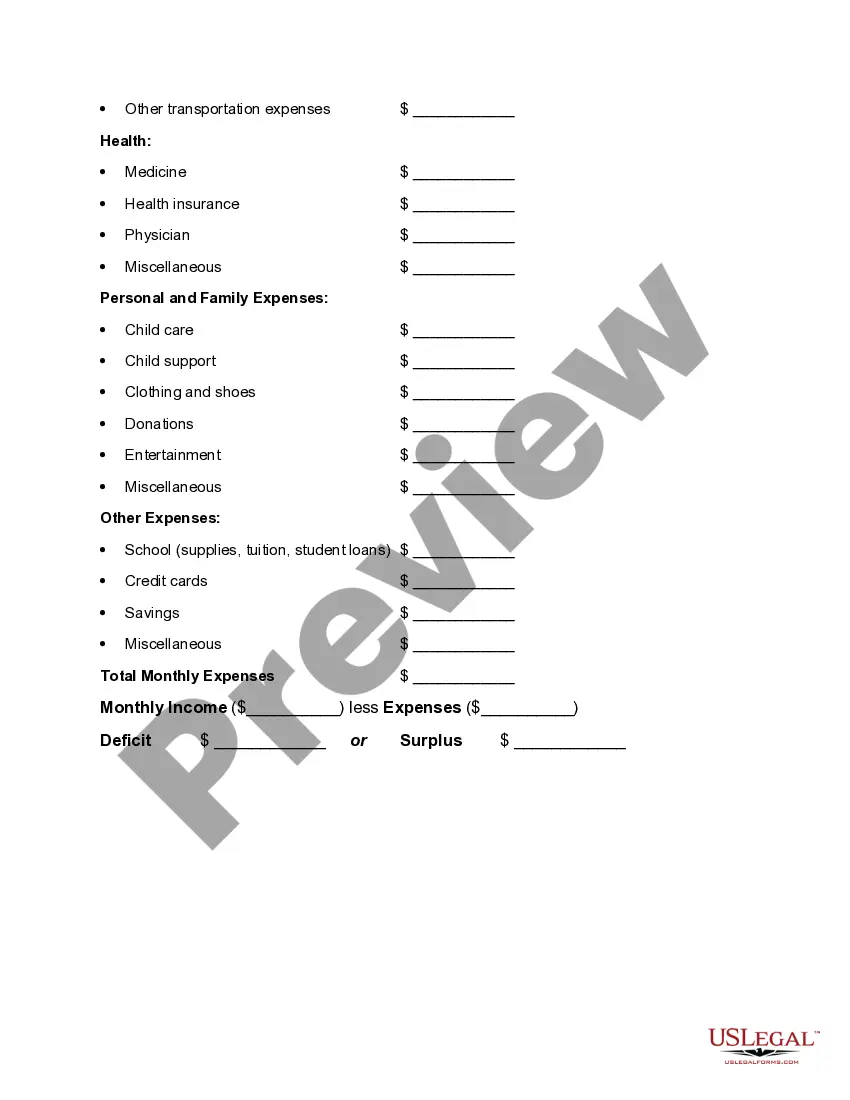

Your needs about 50% of your after-tax income should include:Groceries.Housing.Basic utilities.Transportation.Insurance.Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment category.Child care or other expenses you need so you can work.

5 Steps to Creating a BudgetDetermine how much money you make every single month. Write this amount at the top of your paper.Calculate how much money you spend every single month. List out all the things you pay for each month.Examine your spending.Develop a plan.Record your spending and track your progress.

What is a Personal Budget Spreadsheet? A personal budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending over the course of a period of usually a month or a year.

The Easy (and Free) Way to Make a Budget SpreadsheetStep 1: Pick Your Program. First, select an application that can create and edit spreadsheet files.Step 2: Select a Template.Step 3: Enter Your Own Numbers.Step 4: Check Your Results.Step 5: Keep Going or Move Up to a Specialized App.

Six steps to budgetingAssess your financial resources. The first step is to calculate how much money you have coming in each month.Determine your expenses. Next you need to determine how you spend your money by reviewing your financial records.Set goals.Create a plan.Pay yourself first.Track your progress.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

If you're looking for a quick and easy budgeting tool, the Google Sheets budget template is a great option to track your daily expenses.

The Easy (and Free) Way to Make a Budget SpreadsheetStep 1: Pick Your Program. First, select an application that can create and edit spreadsheet files.Step 2: Select a Template.Step 3: Enter Your Own Numbers.Step 4: Check Your Results.Step 5: Keep Going or Move Up to a Specialized App.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.