North Carolina Franchise Registration Renewal Questionnaire

Description

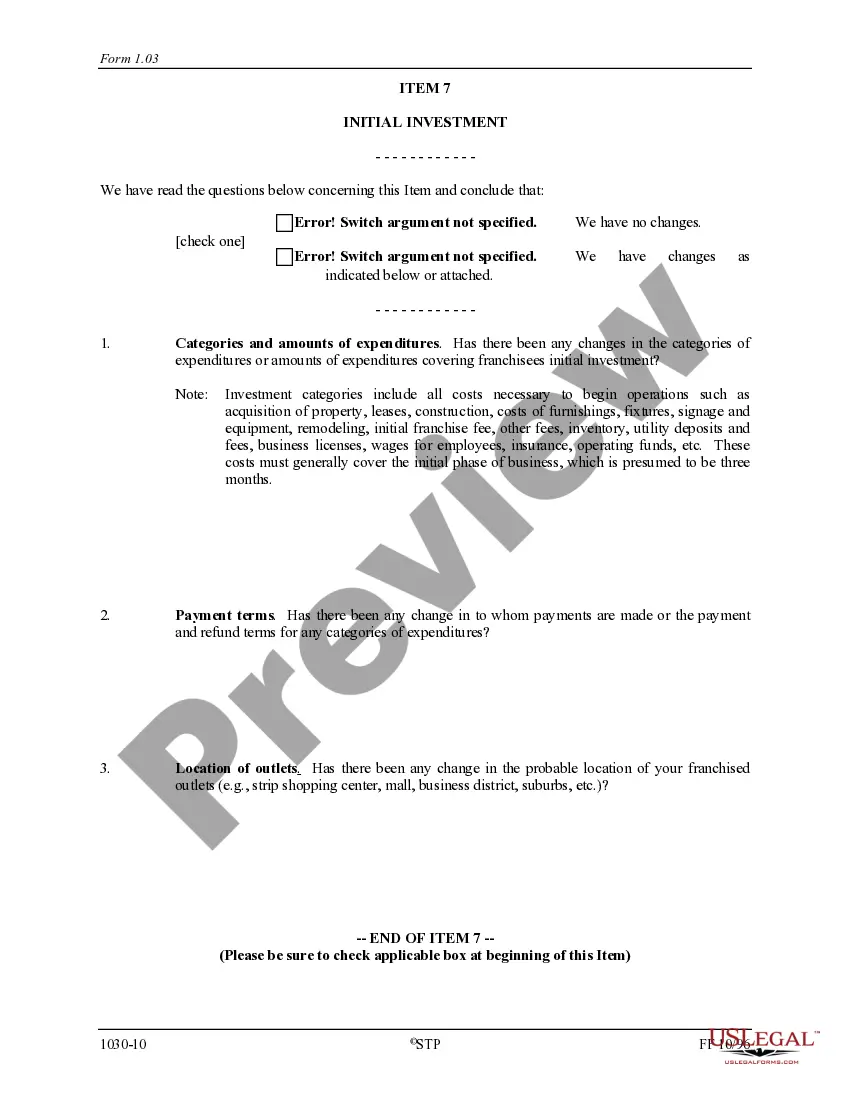

How to fill out Franchise Registration Renewal Questionnaire?

If you wish to full, obtain, or print out authorized papers templates, use US Legal Forms, the most important assortment of authorized varieties, that can be found on the Internet. Use the site`s simple and convenient look for to get the paperwork you need. Various templates for business and person functions are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to get the North Carolina Franchise Registration Renewal Questionnaire within a handful of click throughs.

In case you are presently a US Legal Forms consumer, log in for your profile and then click the Acquire button to get the North Carolina Franchise Registration Renewal Questionnaire. Also you can entry varieties you earlier saved from the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your correct town/region.

- Step 2. Make use of the Review option to check out the form`s articles. Do not overlook to see the information.

- Step 3. In case you are unhappy with the kind, utilize the Look for area towards the top of the monitor to find other types from the authorized kind design.

- Step 4. After you have identified the shape you need, click the Acquire now button. Pick the rates strategy you like and add your references to sign up on an profile.

- Step 5. Procedure the purchase. You may use your credit card or PayPal profile to perform the purchase.

- Step 6. Pick the file format from the authorized kind and obtain it on the gadget.

- Step 7. Comprehensive, modify and print out or indication the North Carolina Franchise Registration Renewal Questionnaire.

Each authorized papers design you purchase is the one you have forever. You might have acces to each and every kind you saved in your acccount. Click on the My Forms area and select a kind to print out or obtain yet again.

Remain competitive and obtain, and print out the North Carolina Franchise Registration Renewal Questionnaire with US Legal Forms. There are millions of expert and status-particular varieties you may use for the business or person needs.

Form popularity

FAQ

Franchise Tax Rate for General Business Corporations The franchise tax rate is one dollar and fifty cents ($1.50) per one thousand dollars ($1,000) and is applied as set forth in the law.

Every corporation doing business in North Carolina and every inactive corporation chartered or domesticated here must file an annual franchise and income tax return using the name reflected on the corporate charter if incorporated in this State, or on the certificate of authority if incorporated outside this State.

The franchise tax can be no less than $200 with no maximum except for a qualified holding company." Per the NC C-Corporation Instructions: "Franchise tax is computed by applying the rate of $1.50 per $1,000.00, and can be no less than $200." ?Note: No franchise tax is calculated on a final return.

If an LLC is taxed as a corporation for federal tax purposes and a corporate member has activities in this State in addition to its ownership interest in the LLC, the corporate member(s) is required to file a corporate income and franchise tax return.

The franchise tax rate is $1.50 per $1,000.00 of the corporation's net worth or other alternative tax schedule.

North Carolina has a flat income tax rate of 4.99%, meaning all taxpayers pay this rate regardless of their taxable income or filing status. This can make filing state taxes in the state relatively simple, as even if your salary changes, you'll be paying the same rate.

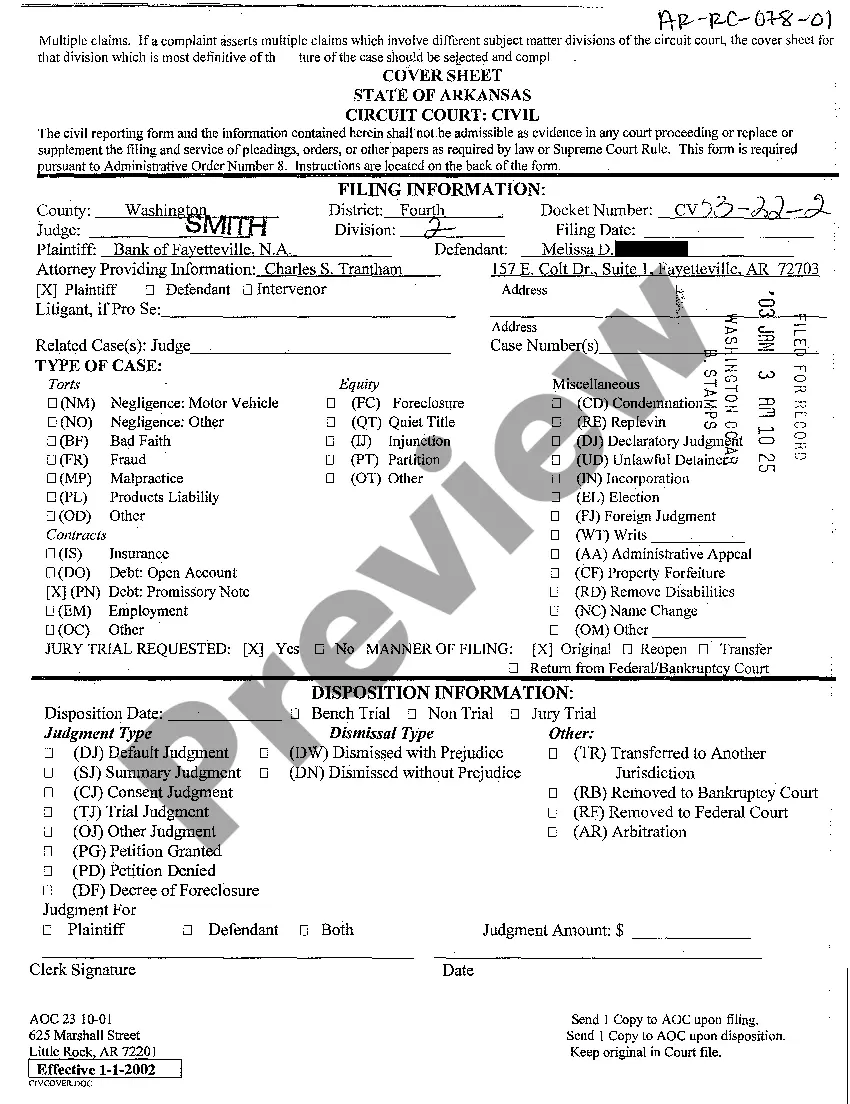

North Carolina Franchise Law The State of North Carolina is a franchise filing state. This means that before offering and selling a franchise in the State of North Carolina a franchisor must first ensure that its Franchise Disclosure Document is current and filed with the North Carolina Secretary of State.

There is no limitation on the amount of franchise tax payable where the tax produced by the investment in tangible property or appraised value of property exceed the tax produced by the net worth tax base (formally the capital stock, surplus, and undivided profits tax base).