North Carolina LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

Are you currently in a circumstance where you need documents for either business or personal purposes regularly.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the North Carolina LLC Operating Agreement for Spouses, designed to satisfy federal and state requirements.

Once you have found the appropriate form, click Purchase now.

Select the payment plan you want, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the North Carolina LLC Operating Agreement for Spouses template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/county.

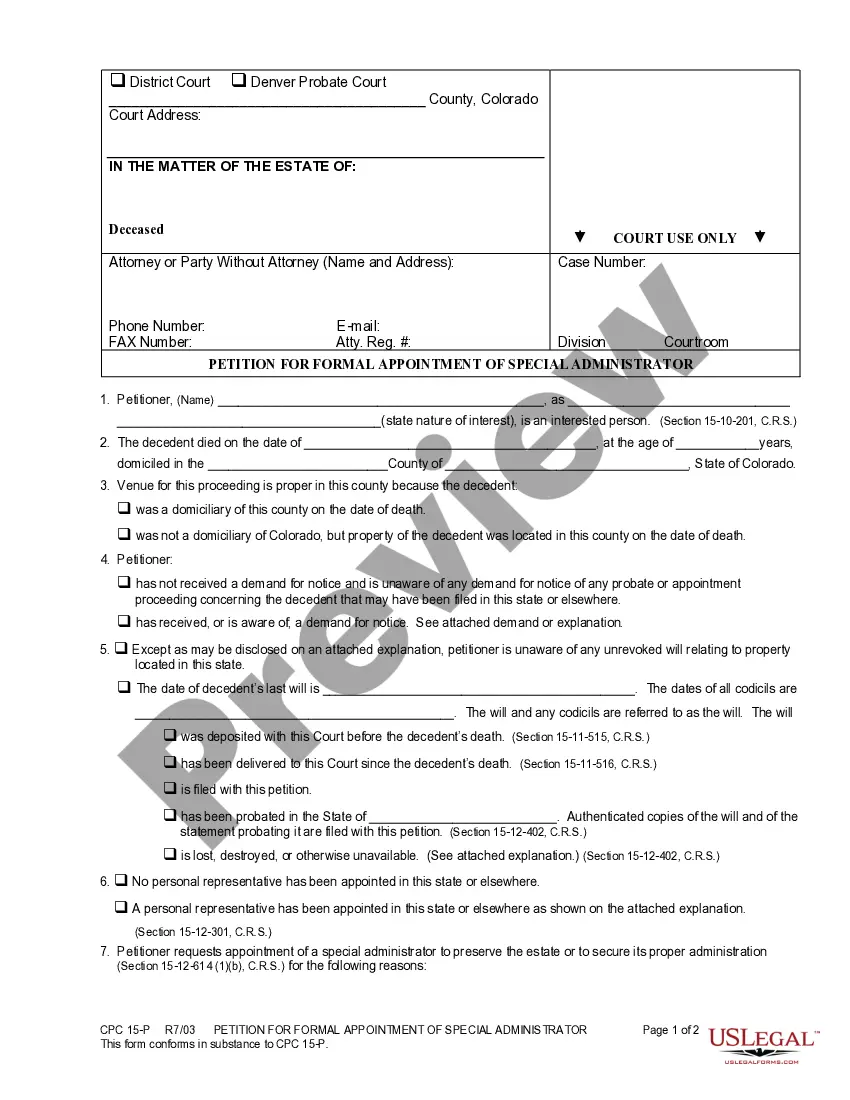

- Utilize the Preview button to review the form.

- Verify the details to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search field to find the form that matches your requirements.

Form popularity

FAQ

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business.

Every North Carolina LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Every North Carolina LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

How to Form an LLC in North Carolina (6 steps)Step 1 Appoint a Registered Agent. Each LLC must nominate a Registered Agent as required by State law.Step 2 Which LLC Type.Step 3 Complete the Application.Step 4 Filing Fee.Step 5 Operating Agreement.Step 6 Employer Identification Number (EIN)

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

Every North Carolina LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

For example, a limited liability company has Limited Life while the process of incorporation takes more time than other forms of organization. The bottom line is that North Carolina is one of the best locations to start your business and help it achieve growth.

To form an LLC in NC, you'll need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.