North Carolina Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent

Description

How to fill out Sample Letter For Initiate Probate Proceedings For Estate - Request To Execute Waiver And Consent?

You may devote time online looking for the lawful record format that meets the state and federal demands you require. US Legal Forms supplies a large number of lawful forms that happen to be reviewed by pros. It is simple to down load or printing the North Carolina Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent from the services.

If you already have a US Legal Forms bank account, you may log in and click the Obtain option. Next, you may comprehensive, revise, printing, or sign the North Carolina Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent. Each and every lawful record format you get is your own property for a long time. To acquire yet another version of any acquired kind, go to the My Forms tab and click the corresponding option.

If you use the US Legal Forms site the very first time, follow the straightforward guidelines under:

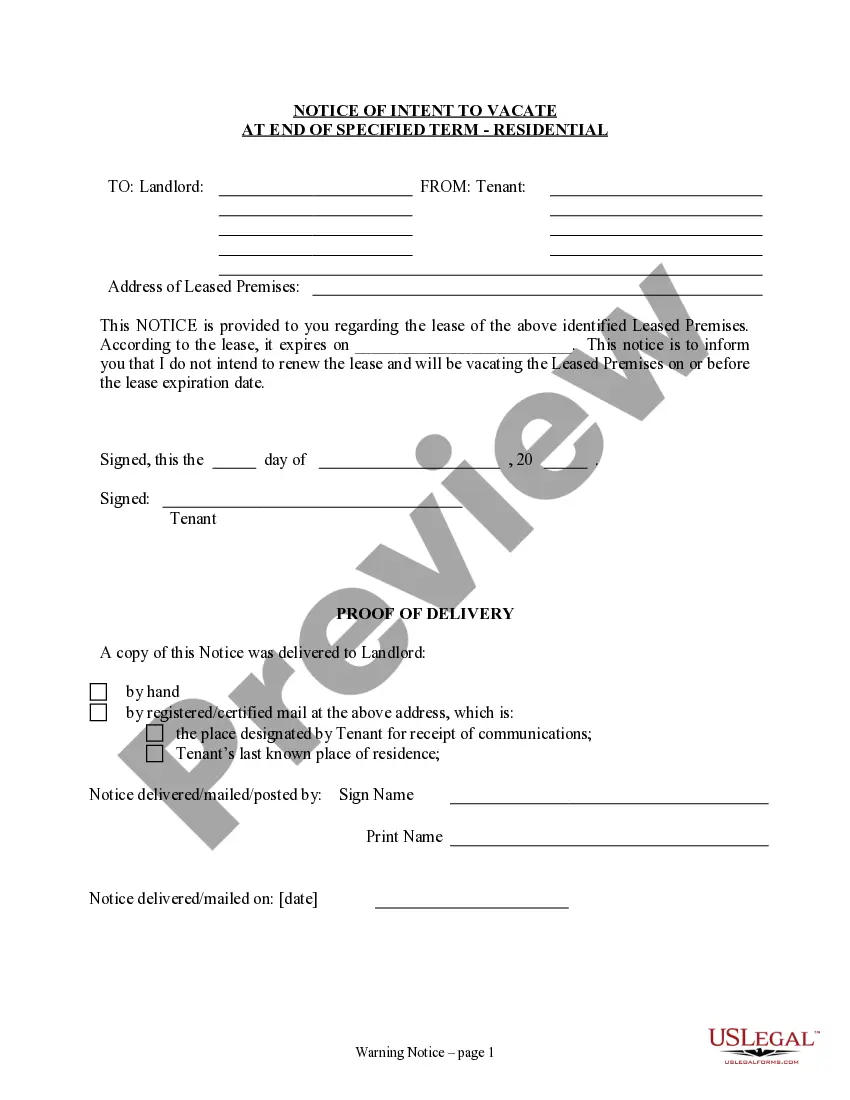

- Initial, be sure that you have chosen the correct record format for your county/metropolis of your liking. Look at the kind outline to make sure you have picked the appropriate kind. If readily available, take advantage of the Review option to look throughout the record format at the same time.

- If you want to locate yet another version of the kind, take advantage of the Search field to get the format that fits your needs and demands.

- When you have found the format you would like, click on Purchase now to carry on.

- Choose the costs plan you would like, key in your references, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal bank account to cover the lawful kind.

- Choose the formatting of the record and down load it in your product.

- Make alterations in your record if needed. You may comprehensive, revise and sign and printing North Carolina Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent.

Obtain and printing a large number of record web templates utilizing the US Legal Forms site, that provides the largest assortment of lawful forms. Use professional and status-distinct web templates to handle your organization or individual needs.

Form popularity

FAQ

The Estate Settlement Timeline: While there is no strict deadline for this in North Carolina law, it's typically advisable to do so within a month to avoid unnecessary delays in the probate process.

It depends on the nature of the Estate. Many assets pass outside of Probate and Estate Administration. For example, assets with Beneficiary designations such as retirement accounts and life insurance may pass outside of Probate. Many individuals opt to use Trusts to keep assets out of Probate.

This Form (AOC-E-201) is used to start the process of settling a person's estate after they die (Probate). It's a request to make the Will and appointment of the Executor official and should be filled out by the Personal Representative.

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding. If the surviving spouse inherits the whole estate, however, the estate's value can't exceed $30,000 if probate is to be avoided.

The most useful tool we use to avoid probate is a revocable ?living? trust. A trust is an entity that holds property for the use of individuals known as beneficiaries. The property in the trust is managed by a trustee, but the trustee does not get to use the property for their own benefit.

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding. If the surviving spouse inherits the whole estate, however, the estate's value can't exceed $30,000 if probate is to be avoided.

The application must be submitted along with the will (if there is one), a preliminary inventory of the estate and a certified copy of the deceased's death certificate. The fee to open an estate is $120. Both executors and administrators are known as ?personal representative? of the estate.

The Probate Process in North Carolina A probate proceeding begins when the court appoints someone to handle the administration of estate, i.e. a personal representative. Often, the decedent will already have named the personal representative in his or her will.