North Carolina Independent Contractor Agreement with Church

Description

How to fill out Independent Contractor Agreement With Church?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the North Carolina Independent Contractor Agreement with Church in moments.

If you already have a subscription, sign in and retrieve the North Carolina Independent Contractor Agreement with Church from the US Legal Forms archive. The Download button will appear on every document you view. You have access to all previously acquired forms from the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

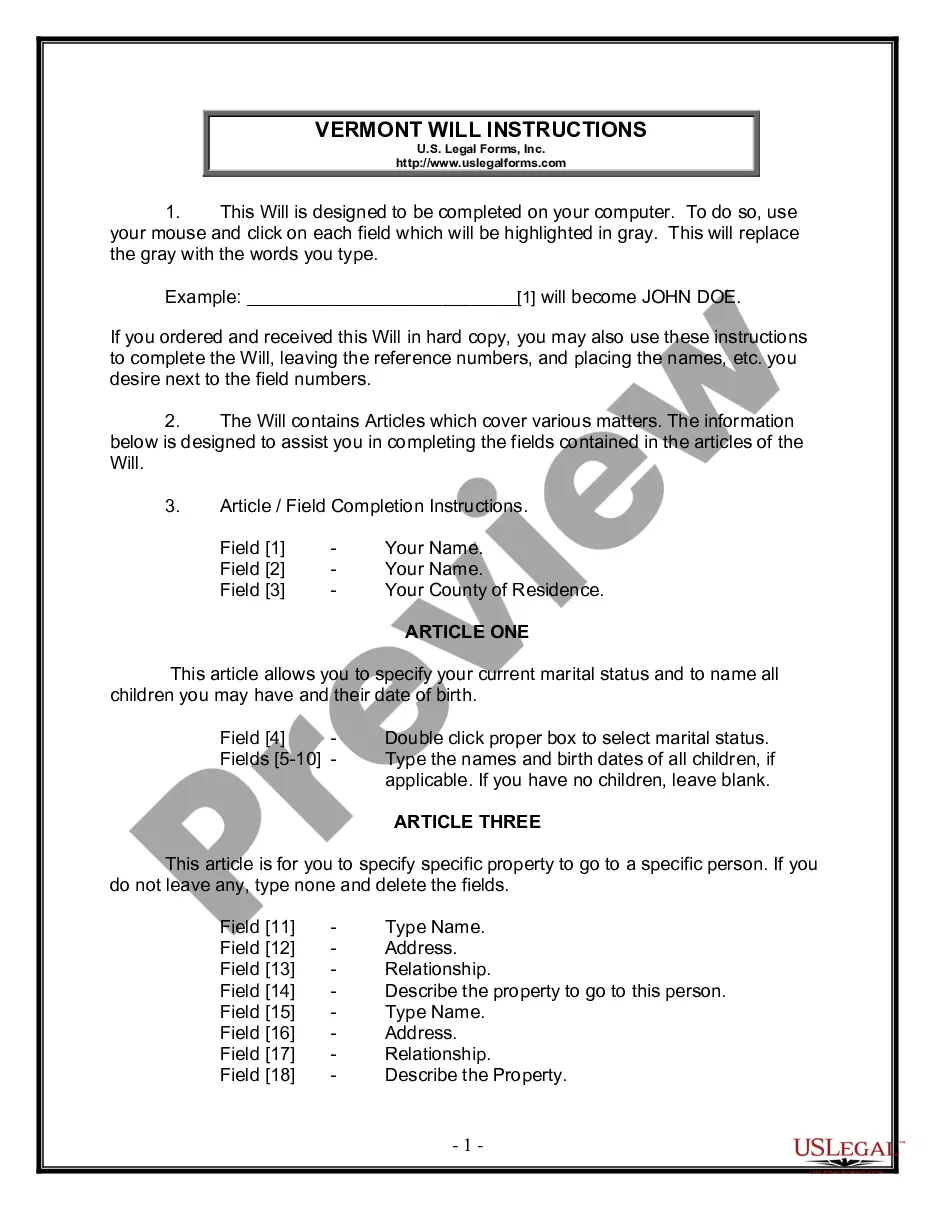

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded North Carolina Independent Contractor Agreement with Church. Each template you added to your account has no expiration date and belongs to you permanently. Thus, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the document you need. Gain access to the North Carolina Independent Contractor Agreement with Church through US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wealth of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have picked the correct form for your city/state.

- Click the Preview button to review the form's content.

- Check the form details to confirm you have selected the appropriate document.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are content with the form, affirm your choice by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Typically, the hiring party drafts the independent contractor agreement, as they outline the terms of the relationship. However, both parties can collaborate to ensure mutual understanding, especially for a North Carolina Independent Contractor Agreement with Church. It's crucial for both the contractor and the church to review and agree upon the terms to avoid any future disputes.

To create your own contract agreement, start by outlining the key components such as services, payment details, and deadlines. Utilize templates to ensure you incorporate necessary elements effectively, especially when crafting a North Carolina Independent Contractor Agreement with Church. Platforms like US Legal Forms can provide you with legally vetted templates that simplify the process.

An independent contractor agreement typically includes essential elements such as the scope of services, payment terms, and duration of the contract. In your North Carolina Independent Contractor Agreement with Church, be sure to clearly define each party's responsibilities and expectations. Additionally, include confidentiality clauses and termination conditions to protect both sides.

To become an independent contractor in North Carolina, you need to register your business. This may involve obtaining an Employer Identification Number (EIN) from the IRS. Once your business is established, you can then create a North Carolina Independent Contractor Agreement with Church to outline your working conditions and responsibilities.

Filling out an independent contractor agreement involves clearly detailing the services to be performed, the compensation method, and key terms like confidentiality and termination. It is essential to outline both parties' responsibilities to avoid misunderstandings. Using platforms like uslegalforms can simplify this process by providing templates specifically designed for a North Carolina Independent Contractor Agreement with Church.

Someone typically qualifies as an independent contractor if they provide services under their direction, offering their expertise while retaining control over how they complete their work. Key factors include having a written agreement, setting their own hours, and working with multiple clients. Using a North Carolina Independent Contractor Agreement with Church can help delineate these qualifications clearly.

A church musician can be classified as either an employee or an independent contractor, depending on the nature of their work arrangement. If the church controls the musician's schedule and how they perform, the musician may be considered an employee. Conversely, if they manage their own schedule and work under the terms of a North Carolina Independent Contractor Agreement with Church, they are likely an independent contractor.

Yes, many music artists operate as independent contractors, especially in non-traditional settings like churches and community events. This allows them the flexibility to engage with different organizations, including churches, while maintaining control over their creative work. Typically, an independent contractor agreement outlines the scope of their services.

Yes, a church musician can be an independent contractor, depending on their role and the agreement with the church. Many churches hire musicians on a contract basis for specific events or services. This arrangement is often documented in a North Carolina Independent Contractor Agreement with Church to clarify terms and responsibilities.

The IRS tends to classify church musicians as independent contractors if they meet certain criteria, such as having control over how their work is done. Therefore, it is crucial to establish a solid North Carolina Independent Contractor Agreement with Church that reflects this status. Understanding these classifications can help ensure compliance with tax obligations and protect both the church and the musicians involved.