North Carolina Subscription Receipt

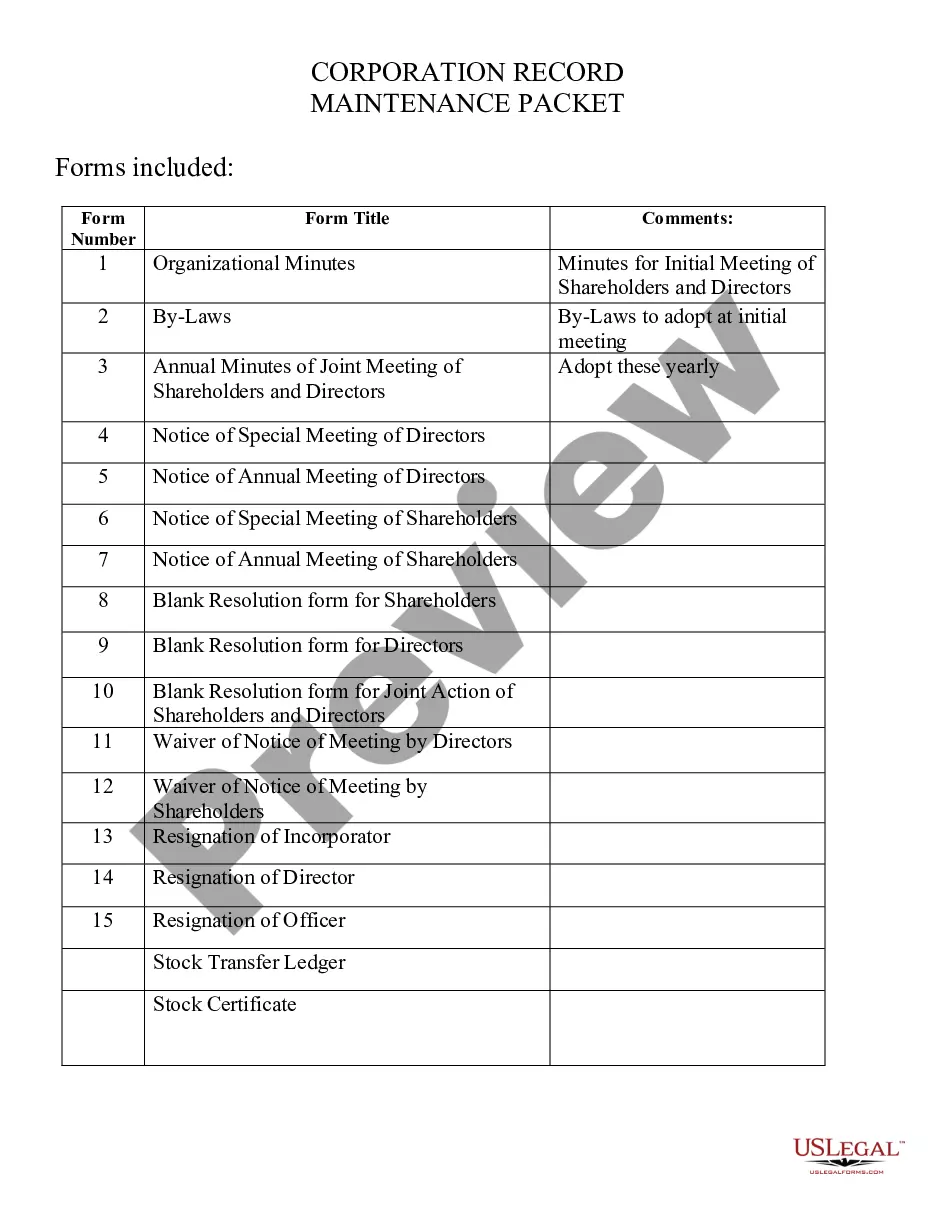

Description

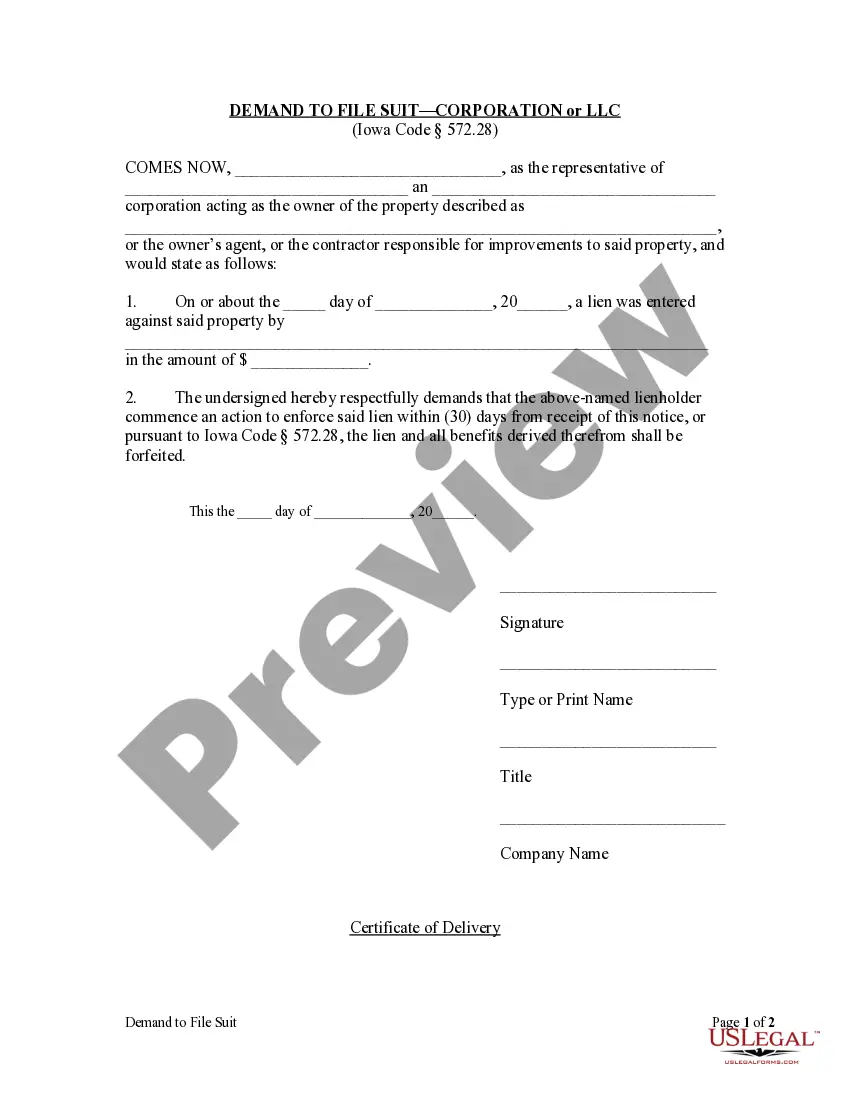

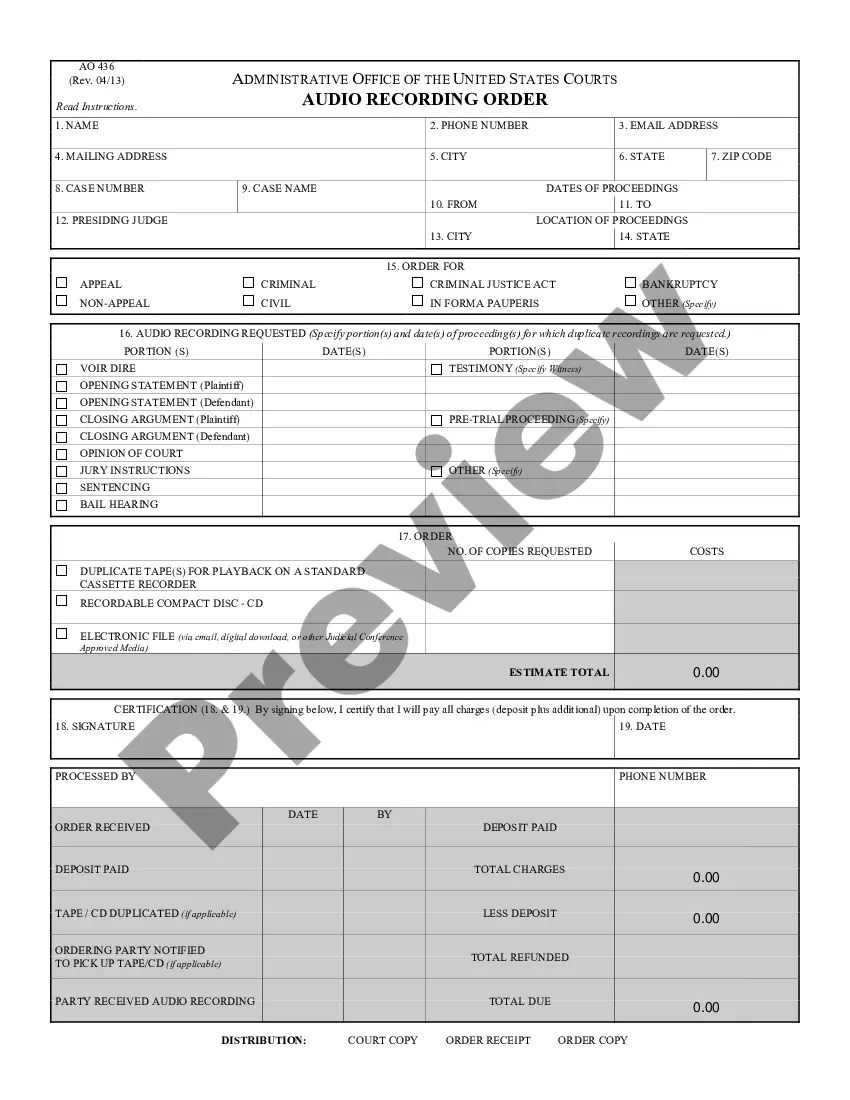

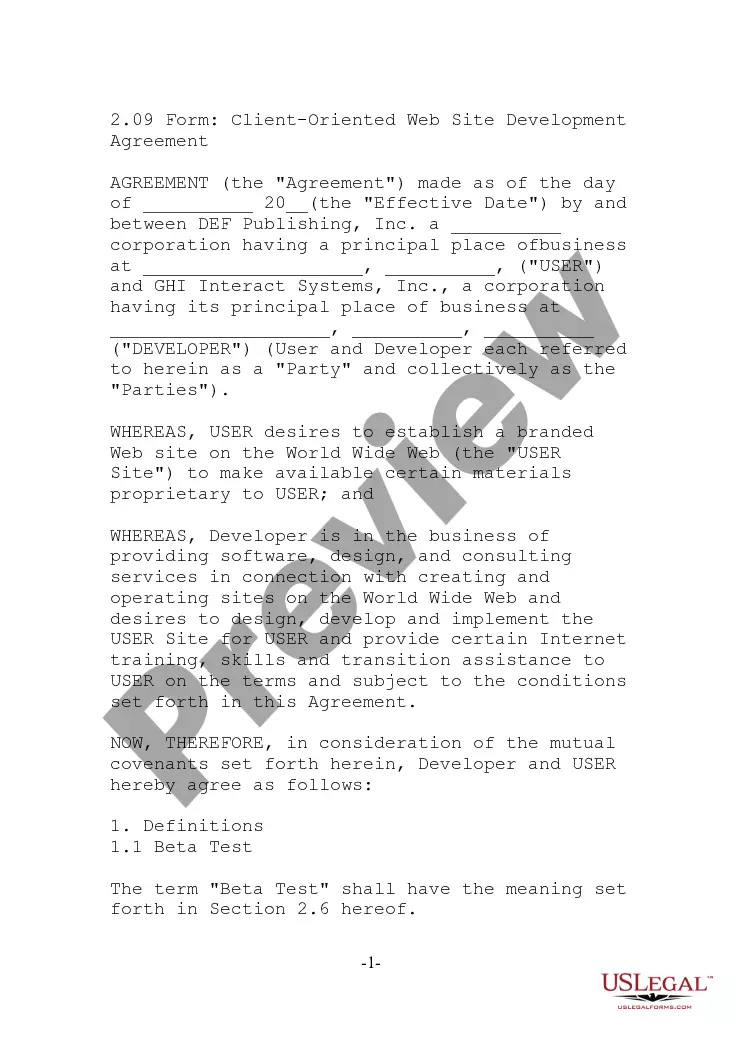

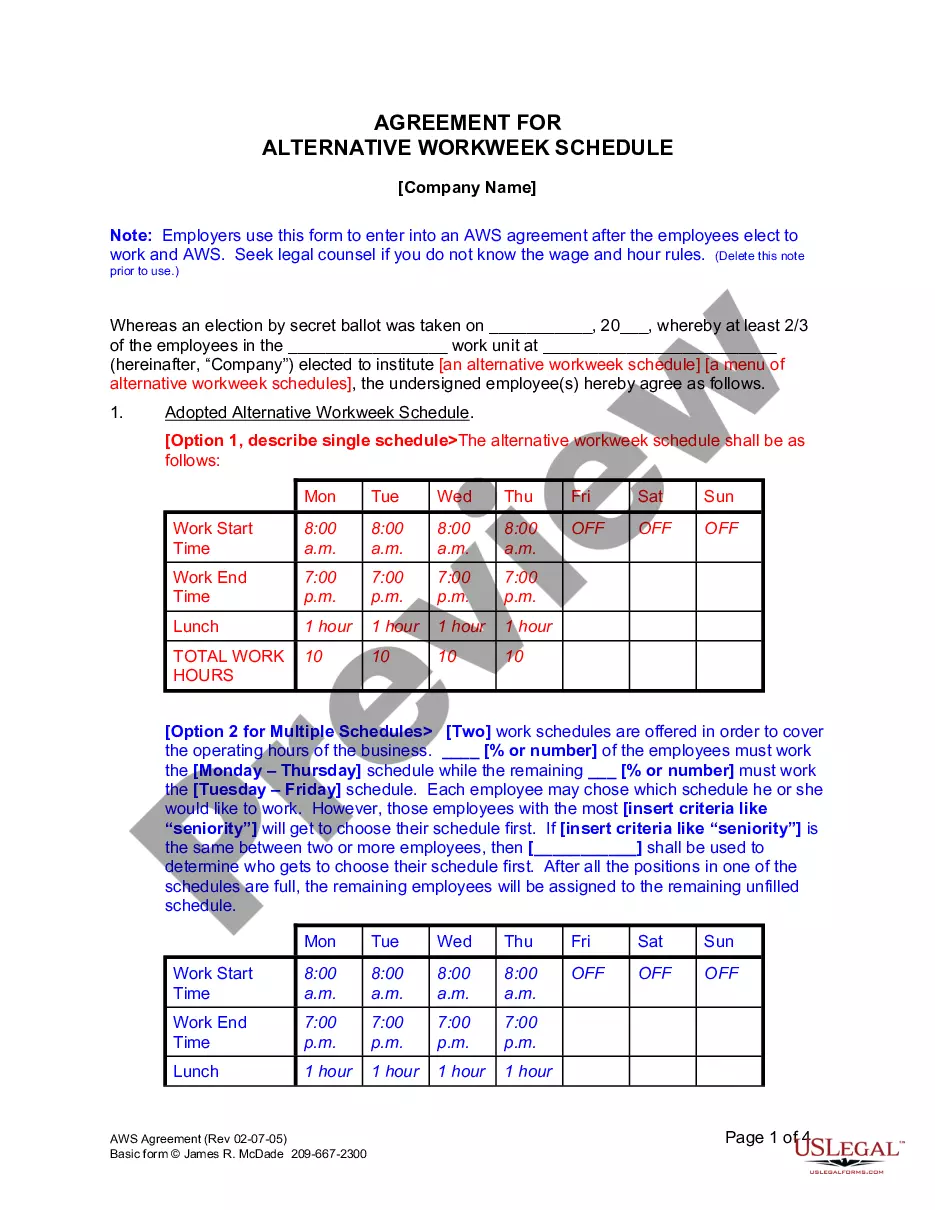

How to fill out Subscription Receipt?

Locating the correct licensed document template may be a challenge.

Of course, there are numerous designs accessible online, but how do you obtain the licensed format you need.

Utilize the US Legal Forms platform.

Firstly, make sure you have selected the correct template for your location/region.

- The service provides an extensive selection of forms, including the North Carolina Subscription Receipt, suitable for both business and personal needs.

- All templates are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and then click the Obtain option to access the North Carolina Subscription Receipt.

- Use your account to search through the legal documents you may have previously acquired.

- Visit the My documents tab of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

Form popularity

FAQ

North Carolina Excludes Sales of Certain Digital Goods from Sales and Use Taxes. On June 5, 2020, Governor Cooper signed HB 1079, which will exclude sales of certain digital audio and visual works from the state's sales and use tax, and make other tax changes.

Subscription products are an indirect transaction. The customer pays a subscription fee that covers the cost of goods. The thing to be mindful of is that the products are subject to sales tax. So you have to tax the goods through the monthly subscription fee.

The North Carolina Department of Revenue issued a private letter ruling, concluding that subscription fees for a Software as a Service (SaaS) product are non-taxable. The taxpayer licenses a cloud-based SaaS platform for customer engagement and marketing, which customers access via the Internet.

In North Carolina at the Local Government level, Gross Receipts Tax is applied very much like the Sales & Use tax and often on the same specific products / services: Room Occupancy Tax. Prepared Food and Beverage Tax. Short Term Motor Vehicle Rental. Heavy Equipment Rental.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.) (Source: California BOE Publication 109 Non Taxable Sales).

North Carolina law applies sales taxes to any product delivered electronically that would be taxable if delivered in tangible form, specifically including digital products as defined.

In the state of North Carolina, magazines sold by subscription and delivered by the mail are considered to be exempt.

The North Carolina Department of Revenue issued a private letter ruling, concluding that subscription fees for a Software as a Service (SaaS) product are non-taxable. The taxpayer licenses a cloud-based SaaS platform for customer engagement and marketing, which customers access via the Internet.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.