North Carolina Clickable Software License Notice

Description

How to fill out Clickable Software License Notice?

If you need to gather, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and convenient search feature to locate the documents you need.

Many templates for business and personal use are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every type you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, and print the North Carolina Clickable Software License Notice with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the North Carolina Clickable Software License Notice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the North Carolina Clickable Software License Notice.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

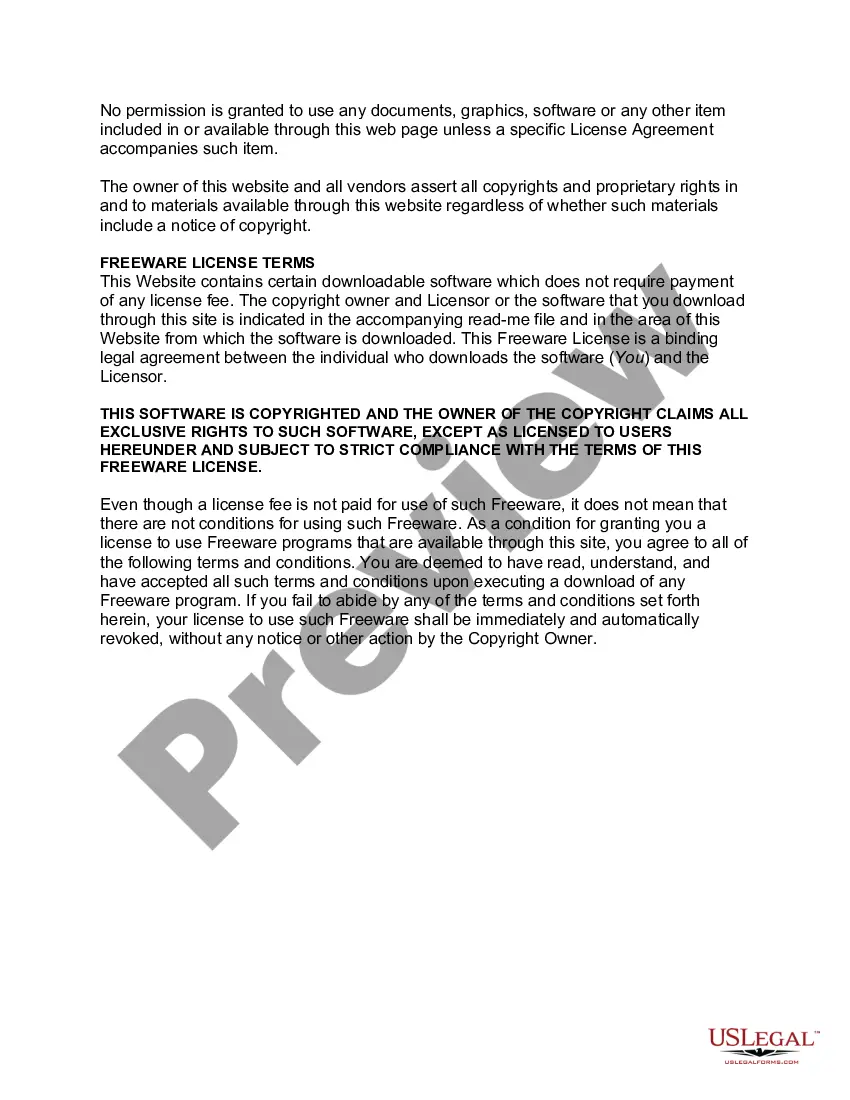

- Step 2. Use the Review option to browse through the form's content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Select your preferred pricing plan and enter your credentials to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the process.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, print, or sign the North Carolina Clickable Software License Notice.

Form popularity

FAQ

A NC file extension refers to files associated with NoteCase Pro or various tax forms in North Carolina. These formats may include specific details important for reporting software license taxes. The North Carolina Clickable Software License Notice can help clarify the data required for accurate submissions related to these file types.

Yes, taxpayers in North Carolina can file their state tax returns electronically. This includes options for businesses filing software-related taxes. Utilizing online platforms simplifies the process, which is beneficial when dealing with specific notices like the North Carolina Clickable Software License Notice.

The North Carolina Department of Revenue (NCDOR) does accept electronic signatures on various forms, making compliance easier for taxpayers. Many of their online processes are streamlined to accommodate electronic submissions. Always refer to the North Carolina Clickable Software License Notice for specific guidelines related to software licenses.

Yes, software licenses can be taxed in North Carolina, especially if they meet certain criteria outlined in state regulations. This usually involves the nature of the software and how it is acquired. The North Carolina Clickable Software License Notice can give you a clearer picture of your tax obligations.

License fees for software can be subject to sales tax in North Carolina. If the software is considered a tangible item or if it provides the right to use technology, sales tax may apply. The North Carolina Clickable Software License Notice serves as a helpful resource to understand the applicable rules.

In North Carolina, software licenses can be taxable depending on the nature of the software and how it is delivered. Generally, if a software license is transferred physically or electronically without a significant service component, it may be subject to tax. Understanding the specifics under the North Carolina Clickable Software License Notice can help clarify this.

In North Carolina, certain items are exempt from sales tax. This includes prescription medications, some food items, and certain types of software licenses. The North Carolina Clickable Software License Notice details which licenses qualify for exemptions under specific conditions.