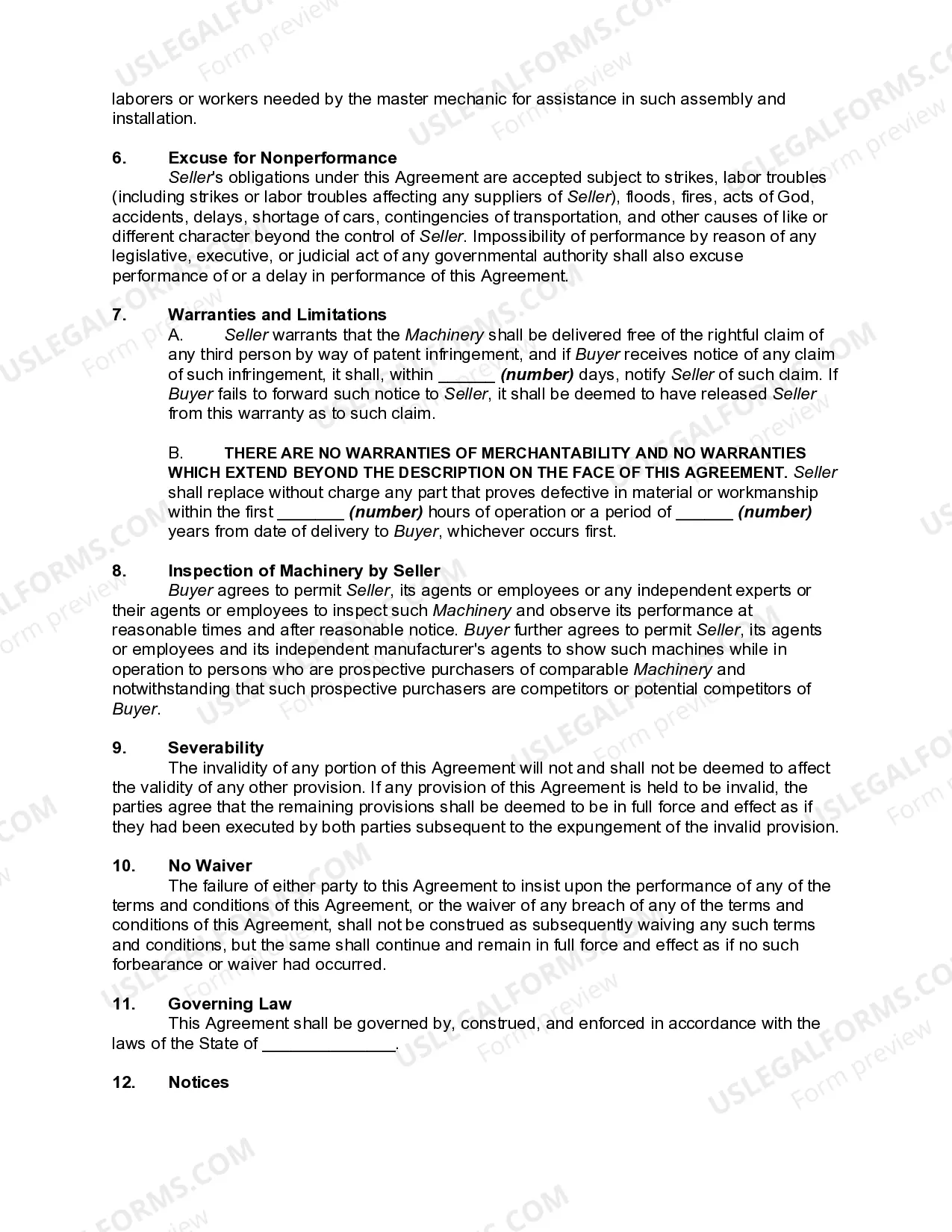

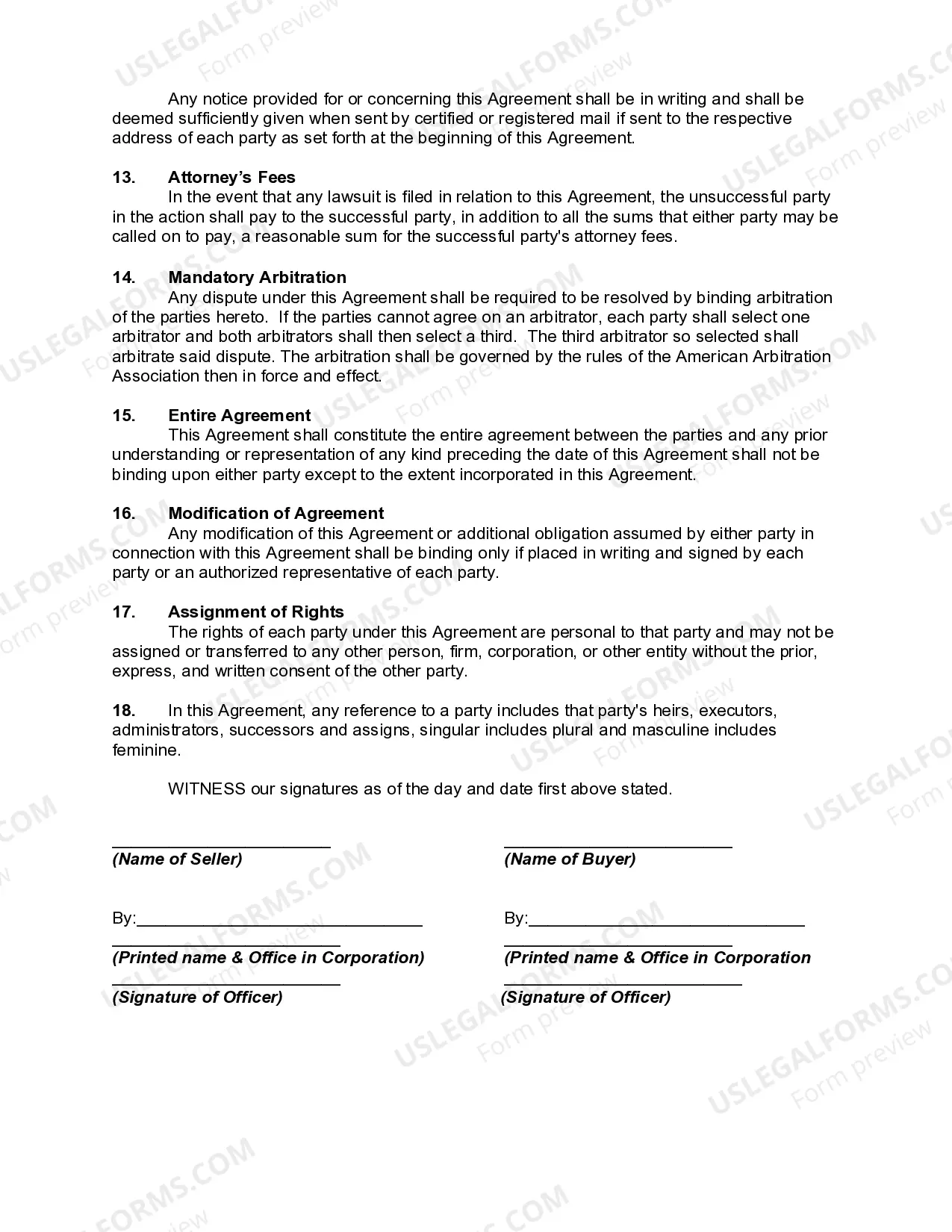

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Agreement to Manufacture, Sell and Install Machinery

Description

How to fill out Agreement To Manufacture, Sell And Install Machinery?

Have you ever found yourself in a situation where you require paperwork for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding reliable ones is quite challenging.

US Legal Forms offers a vast collection of forms, including the North Carolina Agreement to Manufacture, Sell and Install Machinery, designed to comply with both federal and state regulations.

Once you locate the correct form, click Download now.

Choose the pricing plan you prefer, fill in the required details to create your account, and process the payment using PayPal or a credit card.

Select a convenient document format and download your copy.

You can find all the document templates you have acquired in the My documents section.

You can always obtain another copy of the North Carolina Agreement to Manufacture, Sell and Install Machinery if needed.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the North Carolina Agreement to Manufacture, Sell and Install Machinery template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and make sure it corresponds to the correct jurisdiction/location.

- Use the Preview button to review the form.

- Check the description to verify that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find a form that meets your needs.

Just click on the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors.

The service provides professionally crafted legal document templates that can be used for various purposes.

Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

A seller might prefer an exclusive listing because it provides a committed agent who focuses their efforts on marketing the property effectively. This type of listing can lead to increased exposure and potentially a faster sale. Additionally, with an exclusive agreement, a seller benefits from streamlined communication and coordinated marketing strategies, which can be solidified using a North Carolina Agreement to Manufacture, Sell and Install Machinery.

The key factor of an exclusive right to sell listing is that it grants one agent exclusive rights to represent the seller, ensuring focused marketing and negotiation efforts. This arrangement motivates agents to invest time and resources into selling the property, as they are guaranteed a commission if the property sells. By utilizing a North Carolina Agreement to Manufacture, Sell and Install Machinery, sellers can ensure they’re binding their rights effectively.

Breaking an exclusive right to sell agreement usually requires mutual consent between the seller and the agent, or a breach of contract. It’s essential to read the specific terms outlined in the contract, as they dictate the process for cancellation. Additionally, consider consulting a legal expert or using the North Carolina Agreement to Manufacture, Sell and Install Machinery to navigate this issue effectively.

To fill out an exclusive right to sell agreement, start by clearly identifying the seller and the exclusive agent. Next, include the property details and specify the terms of the agreement, like the duration and commission rate. Additionally, ensure that the responsibilities of both parties are outlined effectively. Using a North Carolina Agreement to Manufacture, Sell and Install Machinery template can help streamline this process.

North Carolina imposes taxes on various services, primarily those related to tangible personal property. Services that involve repairs, renovations, and improvements, particularly in relation to machinery, may be taxable if they are not linked to a North Carolina Agreement to Manufacture, Sell and Install Machinery. Staying informed about which services are taxable can help businesses plan effectively and avoid unexpected tax liabilities.

The Machinery Act in North Carolina governs property tax assessments for machinery and equipment. This act provides guidelines for valuing and taxing machinery used in manufacturing, which is significant for businesses under a North Carolina Agreement to Manufacture, Sell and Install Machinery. Familiarity with the Machinery Act helps companies optimize their tax strategies and ensure accurate reporting.

In North Carolina, the taxability of installation labor depends on the nature of the service. Generally, installation labor may not be taxable when included as part of a North Carolina Agreement to Manufacture, Sell and Install Machinery. However, if the installation is separately charged, it could be subject to sales tax. Understanding the details of the tax regulations is vital to ensure compliance.

The Machinery Act in North Carolina governs the property tax assessment for machinery used in manufacturing. This Act aligns closely with the North Carolina Agreement to Manufacture, Sell and Install Machinery, setting guidelines for proper assessments and evaluations. Understanding the Machinery Act helps businesses manage their tax liabilities effectively while operating in the state.

Manufacturing supplies in North Carolina are generally taxable unless they qualify for an exemption. It’s important to link these supplies to a North Carolina Agreement to Manufacture, Sell and Install Machinery to understand potential tax responsibilities. For clarity in these matters, businesses can consult resources or professionals who specialize in these regulations.

Yes, manufacturing equipment can be subject to sales tax in North Carolina unless it meets criteria for exemption. The relationship to the North Carolina Agreement to Manufacture, Sell and Install Machinery can influence tax status. For businesses, keeping abreast of these regulations is essential for compliance and financial planning.